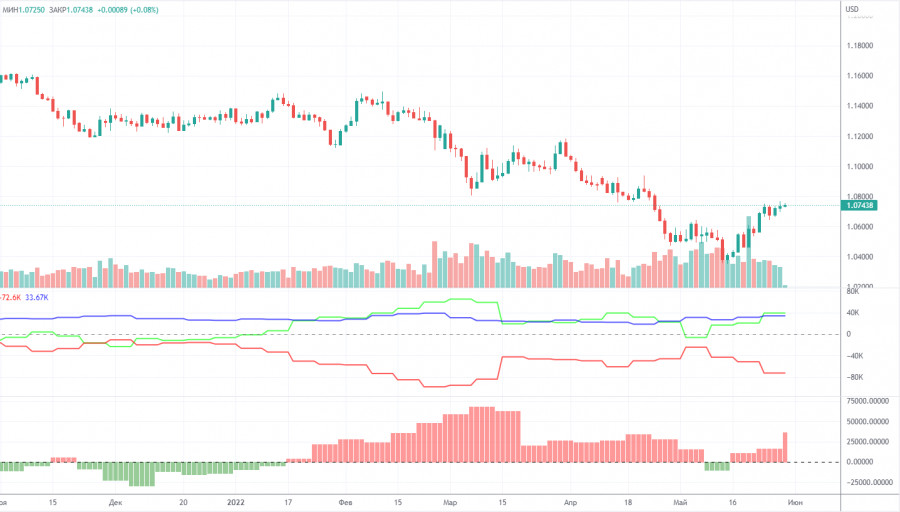

EUR/USD 5M

Yesterday, the EUR/USD pair started an upward movement in the morning, which continued throughout the day. No important events were published in the European Union on Thursday, so the strengthening of the euro in the morning raises questions, from a macroeconomic or fundamental point of view. However, the pair has been trading very strangely in recent days. Its movements are very difficult to predict, and the direction in the medium term is even more difficult to outline now, as the euro retains good growth prospects due to the technical factor, but fundamental and geopolitical factors may contribute to its fall against the dollar. However, on Thursday, the pair rose to the critical line and now the bulls need to confidently overcome it in order to count on the resumption of the short-term upward trend that has been forming in the last three weeks. It should be noted that the ADP report was published in the United States, which turned out to be significantly worse than forecasts, however, at the time of its release, the dollar was already falling, and after that it only continued to fall. The pair's volatility on Thursday amounted to about 90 points, which is again quite a lot.

There was another problem with trading signals on Thursday. Only one trading signal was formed during the day, moreover, when all the upward movement had already ended. Therefore, it was clearly not worth working out this signal near the critical line. Formally, a signal for long positions near the extreme level of 1.0637 was formed a day earlier in the evening, but on the morning of June 2, the price had already moved quite far from this level, so it was not possible to open a long position "retroactively".

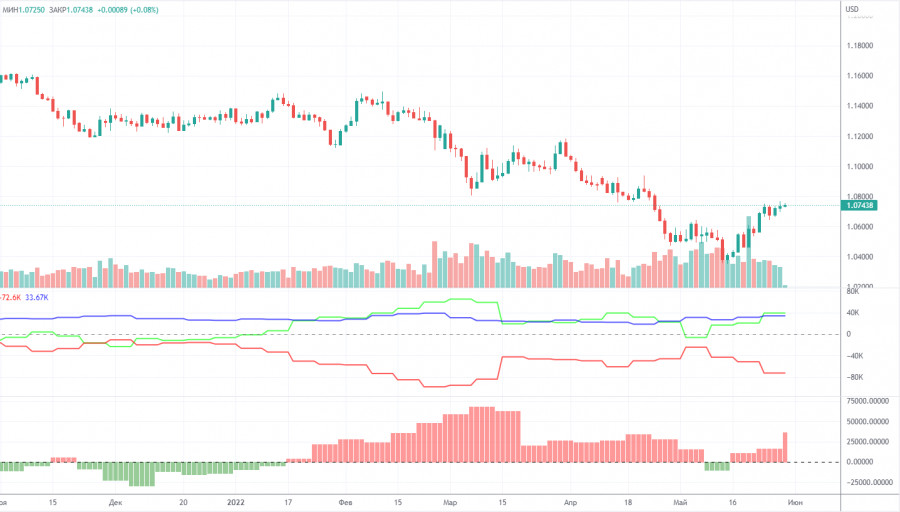

COT report:

The latest Commitment of Traders (COT) reports on the euro raised a lot of questions. Recall that in the past few months, they showed a blatant bullish mood of professional players, but the euro fell all the time. Now the situation has begun to change, but not at the expense of the market players themselves, but due to the fact that the euro has begun to grow. That is, the mood of traders remains bullish (according to COT reports), and the euro began to grow due to the fact that it needs to be corrected from time to time. During the reporting week, the number of long positions increased by 6,300, while the number of shorts in the non-commercial group decreased by 12,200. Thus, the net position grew by 18,500 contracts per week. The number of long positions exceeds the number of short positions for non-commercial traders by 40,000 already. From our point of view, this happens because the demand for the US dollar remains much higher than the demand for the euro. Now a certain "respite" has begun for the euro, but this does not mean that tomorrow the global downward trend will not resume, and the data from COT reports will not continue to contradict the real state of things on the market. We therefore believe that such reporting data still cannot be relied upon for forecasting. At this time, both on the 4-hour timeframe and on the hourly there are clear trends, trend lines, and channels that indicate where the pair will move next. It is better to rely on them when making trading decisions.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. June 3. The ADP report is weak, traders are again targeting 20-year lows.

Overview of the GBP/USD pair. June 3. Orban is blackmailing the European Union, Erdogan is blackmailing NATO. There is not a split of opinions in both blocs, but a lack of one voice.

Forecast and trading signals for GBP/USD on June 3. Detailed analysis of the movement of the pair and trading transactions.

EUR/USD 1H

The pair is currently trying to restore the upward trend on the hourly timeframe. If the price manages to settle above the critical line, this will be a strong step forward for the bulls. But the situation still remains incomprehensible now, since the technique is opposed to the "foundation" and we don't know who will win. Today we highlight the following levels for trading - 1.0459, 1.0579, 1.0637, 1.0748, 1.0806, as well as Senkou Span B (1.0622) and Kijun-sen (1.0706). Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. There are also secondary support and resistance levels, but no signals are formed near them. Signals can be "rebounds" and "breakthrough" extreme levels and lines. Do not forget about placing a Stop Loss order at breakeven if the price has gone in the right direction for 15 points. This will protect you against possible losses if the signal turns out to be false. The European Union is set to publish reports on business activity in the service sector and retail sales. Not the most significant data, especially considering that the US will release reports on unemployment, NonFarm Payrolls and average wages in the afternoon. Naturally, the main attention of the market will shift to the NonFarm Payrolls report. It is expected that their number will be 320-325,000 in May.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.