The GBP/USD currency pair saw much more activity on Monday than anticipated. The pair made adjustments throughout the day after plunging last Friday, and by the end of the day, it had nearly entirely recovered all of its losses and was trading close to the moving average line. If you don't look at the image, it would appear that the pound's positions are not that awful because all losses have been recovered, but in reality, the situation for the British pound is still very difficult, if not as bad as it is for the euro. The price of the pound is presently close to its two-year low. These are not 20-year lows, but remember that the pound faces more fictitious issues than the euro. In the case of the euro, we are referring to the currency of the entire bloc, which should exhibit more stability and resistance in situations of geopolitical turmoil. A hypothetical trade war with same Great Britain would, of course, have a much bigger impact on the UK than on the EU, and the EU does not risk losing its territories. Therefore, despite the European Union being significantly closer to the Ukrainian conflict, we think the pound will likely decline more over the coming several years.

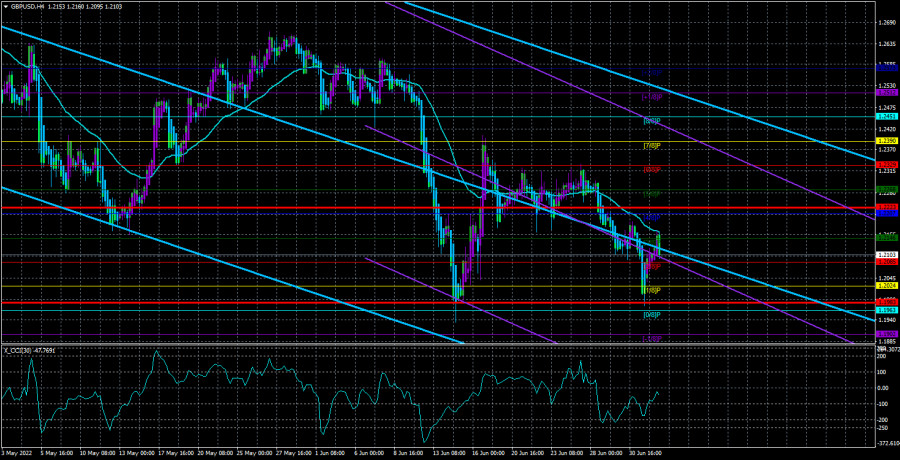

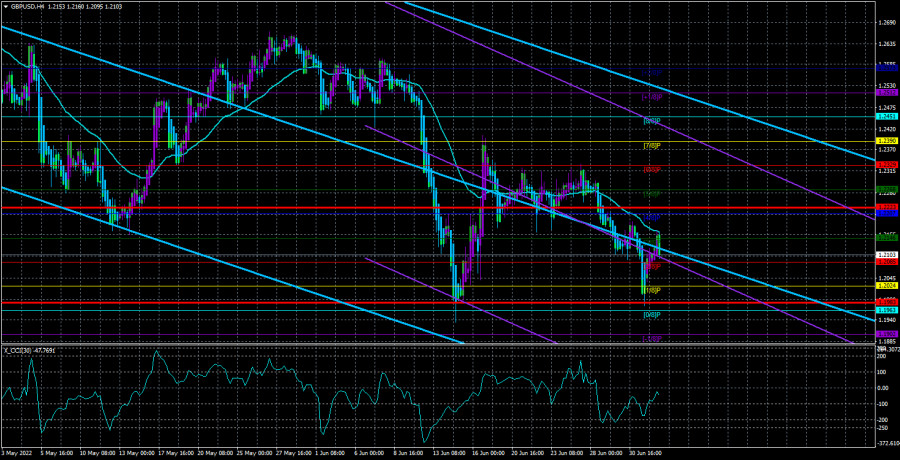

The current technical picture is incredibly straightforward and uninteresting because all signs are now pointing downward. The pound's value fluctuates from time to time, but these adjustments are so tiny in comparison to the overall downward trend - which started over two years ago - that nobody questions whether the decline will resume following another upward pullback. All of the Bank of England's efforts "pass by the cash register" since inflation has been rising steadily while the pound's value has been declining. We anticipate a greater decline, just as we did with the euro.

What about geopolitics, though?

While we would like to say that "geopolitics has greatly improved recently," this is not the reality. The absence of bad news does not indicate that geopolitics has advanced. Fighting is still intense in the East and Southeast of Ukraine, where it is still being rocketed. With that, everything now appears to have tactical value for the conflicts. The armed forces of Russia and Ukraine are evenly matched. The Russian army has made some progress in the Luhansk region, while in the Kherson region, the AFU still forces the Russian military back.

Furthermore, the infamous Lend-Lease has not yet started its operation. Therefore, there is no doubt that more fierce conflicts will start when Western weaponry floods Ukraine with renewed zeal. There is no way to guarantee that the situation won't get worse regarding large-scale military operations.

The geopolitical situation on a worldwide scale is equally poor. For instance, it was revealed last week that Turkey had approved the membership of Finland and Sweden in NATO. As anticipated, President Erdogan adopted a pro-country stance, which gave him the leverage to negotiate certain advantages for himself. Thus, the Finns and Swedes will join NATO in a few months (as anticipated), and there is no question that the Kremlin's answer will come after that (or earlier). Lithuania's blockade of the Kaliningrad region, which forbade sanctioned commodities and goods to flow through its territory, is still up in the air. How Turkey's "special operation" in Syria, where Russia too has a stake, will turn out is utterly unknown. The situation only worsens, and possibly new "hotbeds of ignition" may arise every week, if not every day. Since no one knows how it will finish or where the world and each country will be in a few months, it is thus similar to a pandemic and even worse. Well, riskier currencies' likelihood of growth decreases with increasing geopolitical complexity. The states' economies face little harm because they are removed from conflicts. As a result, the dollar continues to appear to be the safest currency.

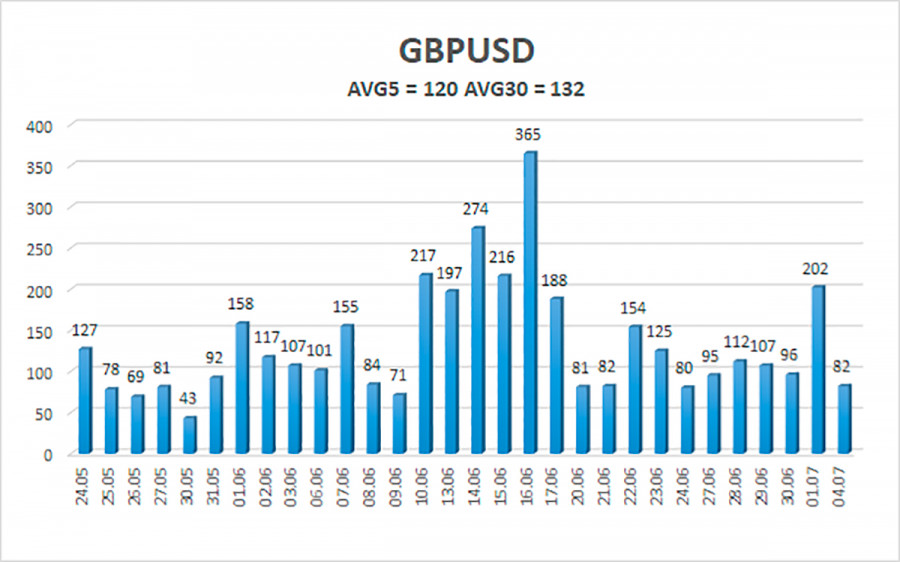

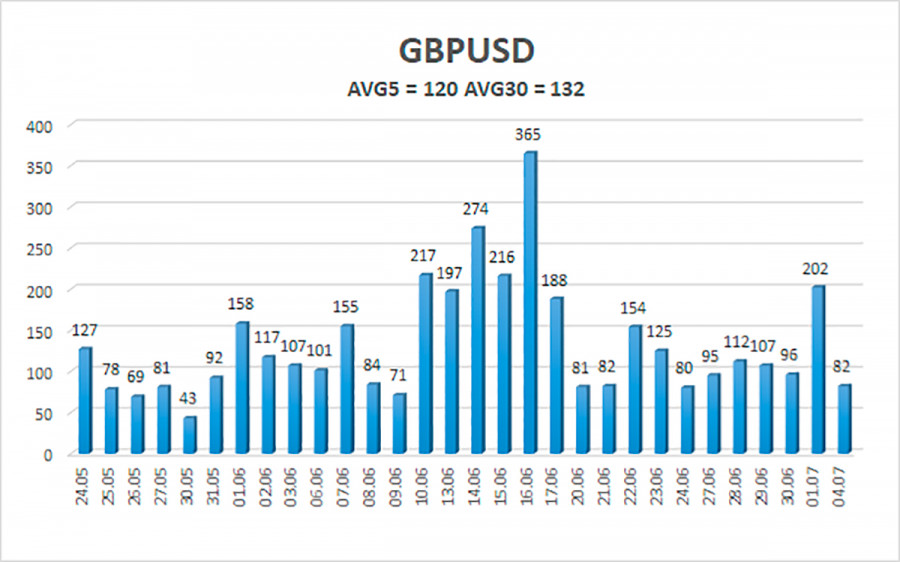

Over the previous five trading days, the GBP/USD pair has averaged 120 points of volatility. This figure is "high" for the dollar/pound exchange rate. As a result, on Tuesday, July 5, we anticipate movement constrained by the levels of 1.1983 and 1.2223. The Heiken Ashi indicator's downward turn indicates that the downward momentum has resumed.

Nearest support levels:

S1 - 1.2085

S2 - 1.2024

S3 - 1.1963

Nearest resistance levels:

R1 - 1.2146

R2 - 1.2207

R3 - 1.2268

Trading recommendations:

In the 4-hour period, the GBP/USD pair finished the "swing" pattern and started moving lower again. As a result, at this time, short positions with 1.2024 and 1.1983 as targets should be taken into account when the Heiken Ashi indicator goes downward. When fixed above the moving average, buy orders should be placed with targets of 1.2223 and 1.2268.

Explanations of the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they both move in the same direction.

Moving average line (settings 20.0, smoothed): this indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.