The EUR/USD currency pair reached the historical level of 1.0000 during the first half of Tuesday's trading session before falling to the Murray level of "2/8." Thus, the decline in euro quotes began on Monday night and continued throughout Monday and Tuesday. Yesterday, there was a feeble attempt to complete the fall, but it was so pitiful that it didn't even pull back. Consequently, the European currency continues to plummet into the abyss, and it remains unclear what can halt this decline. We have already enumerated all the causes of the decline of the euro/dollar pair. In addition, we have stated a million times that neither the fundamental nor the geopolitical contexts have changed in recent years. On what basis should the growth of the euro currency be anticipated? We believe the euro can only rely on corrective growth, as before. When will the course correction start? Unfortunately, it is nearly impossible to respond to this question. Because the pair is near its 20-year lows, there are virtually no significant levels in the current region from which the price could rebound and initiate a strong correction. This level could be considered 1.0000, which is not only historical but also psychological. Nonetheless, as we can see, the correction did not begin, although it had been calculated. Everything continues to be extremely negative for the euro currency.

In this case, the technical picture is even worse. Typically, "technique" provides countertrend signals. For instance, the CCI indicator warns of a possible reversal when entering oversold or overbought territory. After the most recent entry into the oversold region, no upward pullback occurred. This leads us to conclude that the European currency is falling almost by inertia, disregarding all other factors already working against it. Such a decline can be prolonged.

The US inflation report will have no effect.

As stated in previous articles, one of the most significant events of this week will be the release of the US inflation report today. We did not anticipate Wednesday to begin near the 1.000 level. This level should have been determined just after releasing new, significant statistics or closer to the end-of-the-month Fed meeting. But the market disagreed and continued to sell the euro currency for no apparent reason. Therefore, the importance of today's inflation report in determining the future of the euro/dollar pair has diminished. If it turns out, for example, that inflation accelerated even more in June, then the likelihood of a 0.75% Fed rate hike on July 26-27 will also increase. Or perhaps there will be a sudden increase of 1.00%, which has not occurred in several decades. And what will it mean for the dollar if it continues to increase? If it turns out that inflation has begun to decelerate, will a single report be sufficient to reverse the nearly two-year downward trend?

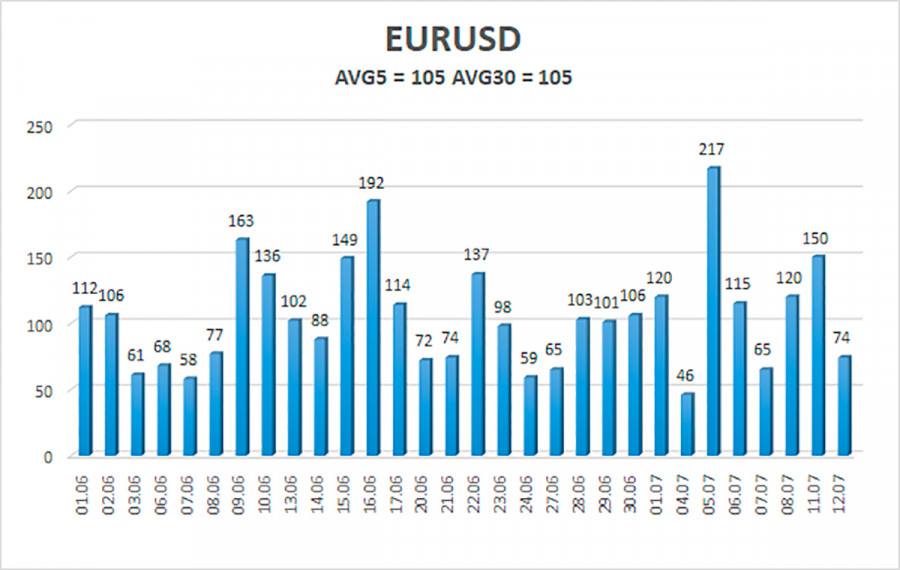

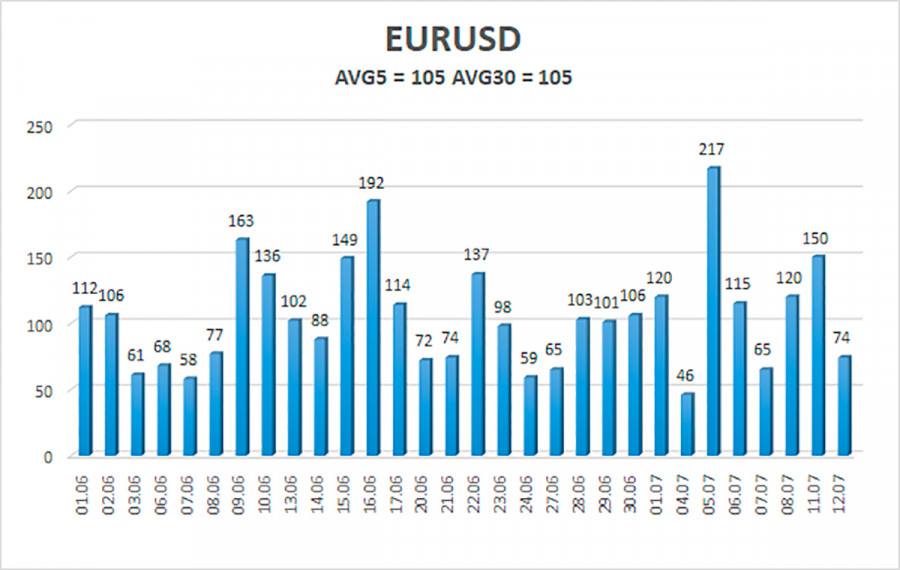

Eventually, the downward trend will end, and we strongly suspect it will end as unexpectedly as possible for most traders. Despite all the geopolitical threats to the European economy and the complete passivity of the ECB, it is already assumed that the euro currency is grossly oversold. Let's be honest: the current situation in Europe is not so dire that the euro will lose nearly 10 cents within a few weeks. Consequently, as long as the trend remains intact and all technical indicators signal down, you must continue selling the pair. However, you should be cautious: the southward migration could end abruptly and unexpectedly. We do not even anticipate an increase in volatility due to the American inflation report, as it is already unprecedented. Observe the graph below; the average volatility over the last 30 trading days exceeds 100 points. We cannot recall the last time this occurred.

As of July 13, the average volatility of the euro/dollar currency pair over the previous five trading days was 105 points, which is considered "high." Thus, we anticipate that the pair will trade between 0.9958 and 1.0168 today. The downward reversal of the Heiken Ashi indicator signifies the continuation of the decline.

Nearest support levels:

S1 – 1.0010

S2 – 0.9888

S3 – 0.9766

Nearest resistance levels:

R1 – 1.0132

R2 – 1.0254

R3 – 1.0376

Trading Recommendations:

The EUR/USD pair is attempting to readjust. Consequently, we should now consider new short positions with targets of 1.0010 and 0.9858 if the Heiken Ashi indicator reverses to the downside. When the pair is fixed above the moving average with targets of 1.0254 and 1.0376, purchases become relevant.

Explanations for the figures:

Channels of linear regression – aid in determining the current trend. If both are moving in the same direction, the trend is currently strong.

Moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the likely price channel that the pair will trade within for the next trading day, based on the current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.