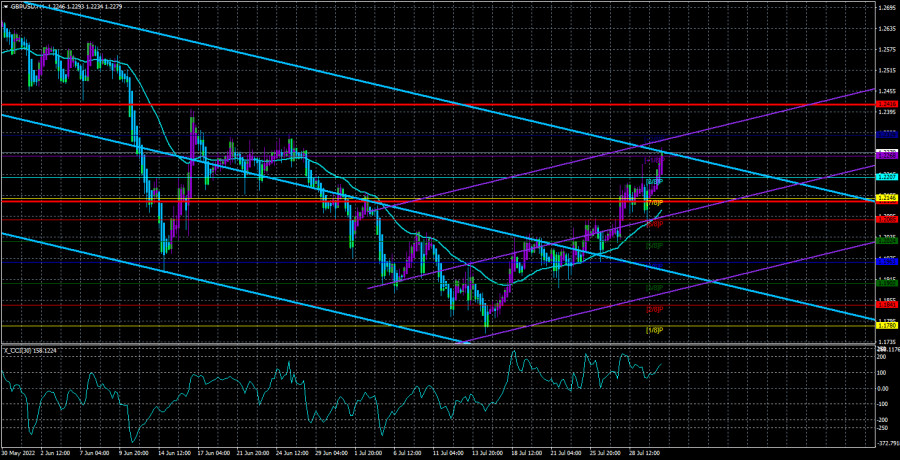

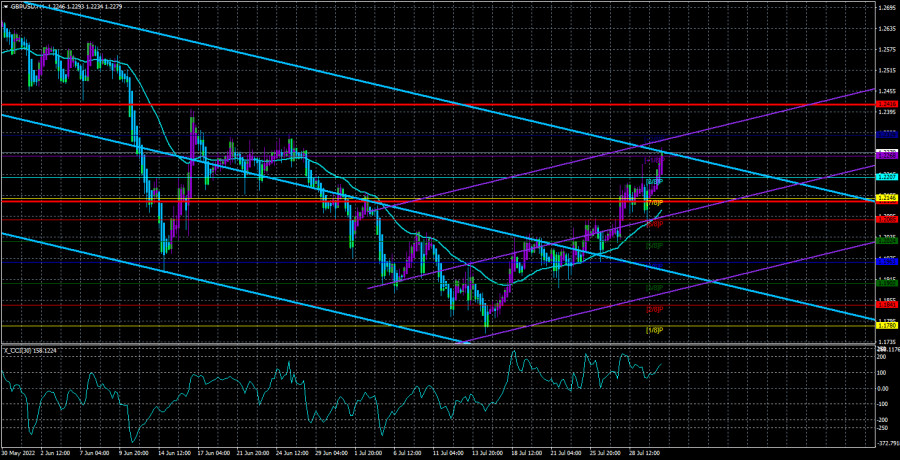

On Monday, the GBP/USD currency pair continued to rise steadily. And this occurred on a day when no important data was released. Despite the absence of significant data in the United Kingdom last week, the pound continues to rise with great confidence. The index of business activity in the manufacturing sector was released early in the morning yesterday. However, this was July's second and final result, and it was virtually identical to predictions. Even if we consider the smallest deviation, we cannot conclude that the pound jumped in response to this information since the actual value was worse than anticipated. Therefore, we are now almost certain that just two factors contributed to the increase of the British pound. The first is pretty apparent - technical. Periodically, the pair should rebalance, and the pound is still less susceptible to sliding versus the dollar than the euro. The second is critical. This Thursday, the Bank of England will reveal the outcomes of its meeting and will likely vote to hike the key rate by 0.5%, which has not occurred since 1995. Thus, it appears that the pound has grounds for development, but it should be noted that the geopolitical situation in the world remains extremely difficult on multiple fronts. And complex geopolitics is always a reason for the US dollar, the world's reserve currency, to expand, regardless of what anyone says. It should also be noted that no matter how hard the Bank of England tries to boost its interest rates, it remains well behind the Federal Reserve. Therefore, the US dollar has the required factors to continue gaining over the medium term.

Will BA shock the marketplace?

As previously stated, the Bank of England will increase the rate to 1.75 percent. And we feel that this is a big reason why the pound/dollar pair is currently rising, whereas the euro/dollar pair has been trading flat for several weeks. It seems doubtful that the pound is rising because a new Prime Minister is being elected in the United Kingdom, or Scotland will hold a vote on independence in 2023 and has already filed a lawsuit against London. However, this situation raises various questions. First, what is the future relationship between the pound and the euro? How long will the price of the pound continue to rise?

From our perspective, the response to the first question is fairly obvious. We predict that as soon as the market stops speculating on the unannounced results of the Bank of England meeting, the pound will continue its long-term downward trend. The answer to the second issue is much the same, as when the decision to raise the interest rate is disclosed, the pound will no longer have grounds for further growth, as this component will have been recaptured beforehand. Therefore, we are inclined to predict that the British pound's decline will resume on Thursday with a new report of two-year lows.

Remember that any fundamental assumption requires technical verification. In other words, selling the pound is unnecessary until the price falls below the moving average line. Why take chances if you can wait for the return of the downward trend? The market has often demonstrated that responding to significant events can be irrational. Remember that the market consists of individuals who are free to trade as they see fit. The underlying background only serves as a foundation for participants to trade in a particular way. However, this does not imply that everyone should hurry to purchase dollars if the Fed raises interest rates. In addition, after the Fed raised rates last week, the US dollar did not increase. And there is further evidence that Thursday's reaction is so unpredictable that it is futile to attempt to predict it.

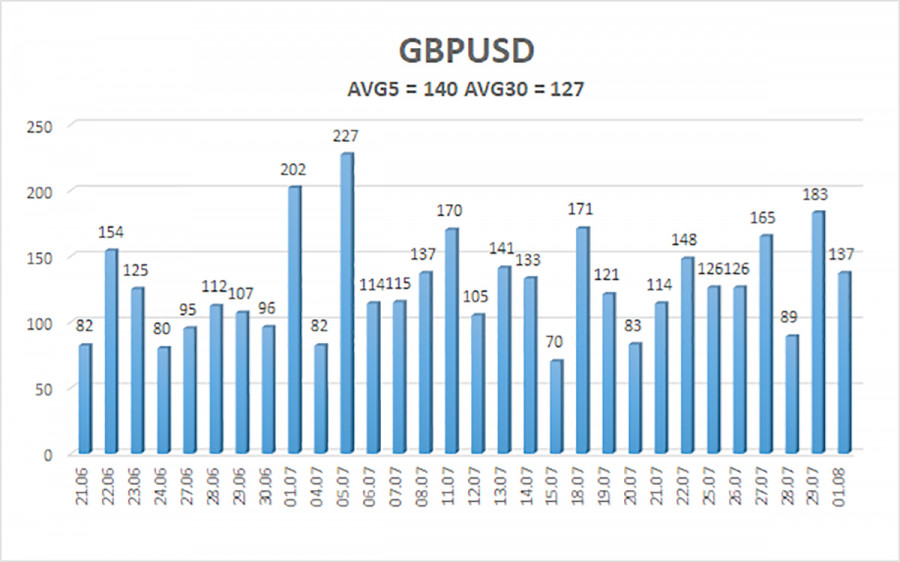

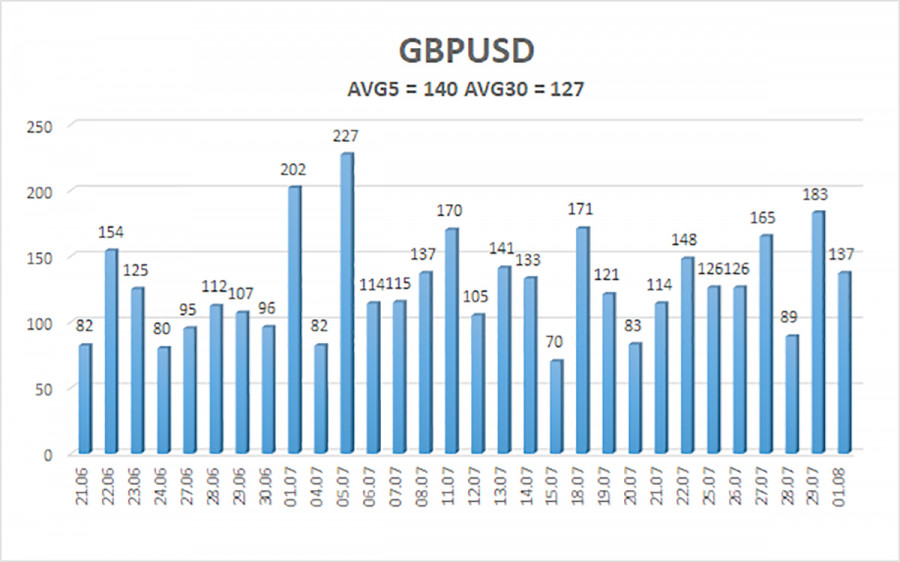

During the last five trading days, the average volatility of the GBP/USD pair was 140 points. This value for the pound/dollar combination is "high." Therefore, on Tuesday, August 2, we anticipate movement inside the channel, constrained by the levels of 1.2138 and 1.2416. The downward reversion of the Heiken Ashi signalizes a round of corrective movement.

Nearest support levels:

S1 – 1.2268

S2 – 1.2207

S3 – 1.2146

Nearest resistance levels:

R1 – 1.2329

Trading Recommendations:

On the 4-hour timeframe, the GBP/USD pair remains above the moving average. Therefore, until the Heiken Ashi signal becomes negative, you should maintain purchase orders with targets of 1.2329 and 1.2416. When the price is anchored below the moving average line, sell orders should be placed with targets at 1.2024 and 1.1964.

Explanations for the figures:

Channels of linear regression – aid in determining the present trend. If both are moving in the same direction, the trend is now strong.

Moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the expected price channel that the pair will trade within over the next trading day, based on the current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.