On Tuesday, the EUR/USD currency pair re-adjusted to the moving average line and started declining again. Everything is pointing toward the European currency updating its 20-year lows once more and continuing to do so for some time in the future. We've already mentioned that long-term trends typically do not end with a slow, obtrusive retreat. They conclude with a powerful countertrend movement that is dramatic and unexpected at this time, even in theory. As a result, we anticipate another decline in the euro.

Regarding the causes, it is pointless to discuss technical ones since all technical indications in all periods indicate downward. As it has been since the start of this year, the geopolitical landscape is the same. In light of this, if the euro was affected in the past, it undoubtedly will be in the future. Although the trend will undoubtedly stop sooner or later, and possibly without drastically altering the geopolitical backdrop, there are no indications that the market's mood has changed. Even the COT reports, which indicate that there are still more sellers than buyers, attest to this.

In today's world, geopolitics is less significant than its effects. After all, very few people deny that geopolitics may be the exact source of the energy problem in the European Union. Due to the start of a military confrontation in Ukraine and the imposition of sanctions against Russia by the European Union, their relationship has drastically worsened. Moscow currently has access to all available pressure points in the energy sector and actively employs them. Should I have had other expectations? It would be naive to believe that Moscow will not respond, given the severe blow done to its economy. Thus, Ukraine's conflict directly impacts the energy problem, which hasn't started yet. And the more it continues, the worse the effects will be for many nations worldwide.

The energy issue is not as bad as people make it out to be.

We might claim that the basic context has changed somewhat in favor of the euro. After all, it appears that the ECB will increase the rate on September 8, this time very significantly. There are currently reports that the rate could increase instantly by 0.75%. Do you perceive a rise in the euro price against these messages? Since the ECB increased rates much later than expected, the market is utterly unconcerned with the change. The discrepancy is still noticeable because the ECB rate may only increase to 1.25%, while the Fed rate may increase to 3% at the following meeting (also in September). Consequently, even if the ECB dares to raise rates by 0.75%, the "foundation" will still be on the side of the dollar.

As we've already stated, the energy emergency hasn't begun this time. The second is that the European Commission will take all reasonable measures to improve the lot of European households. Third, several EU nations' storage facilities are already 70–80% full. Yes, we must make savings. Yes, the cost of heating and electricity will increase. A recession could indeed start. But is all of this terrifying for a successful European Union? How much can wintertime industrial production decline? By 1-2%? This is a tiny amount. Recession? Two digits are unlikely to be present. Will energy costs increase? Europeans are not among the world's poorest people and will save and survive. No one disputes that the European economy will suffer a new setback, but it is also not worth "creating a mountain out of a molehill."

Although gas prices have recently fallen two times in a short time, they are still expensive today. Gas, then, is not gold, which has a generally constant value. Prices are growing as a result of Nord Stream's current inefficiency. The announcement that supplies have begun will be made tomorrow, and prices will immediately drop. The prices will drop when it is revealed tomorrow that the European Union will purchase gas in other nations in the quantities it requires. Keep in mind that prices for fuel and energy are growing worldwide. The US is experiencing significant inflation, and they are both expanding. In the United States, the recession has already started, yet at the same time, the dollar is soaring. In our opinion, the European economy's prospects are not as dire as those of the American economy, preventing the euro from further decline. But this is what is taking place right now.

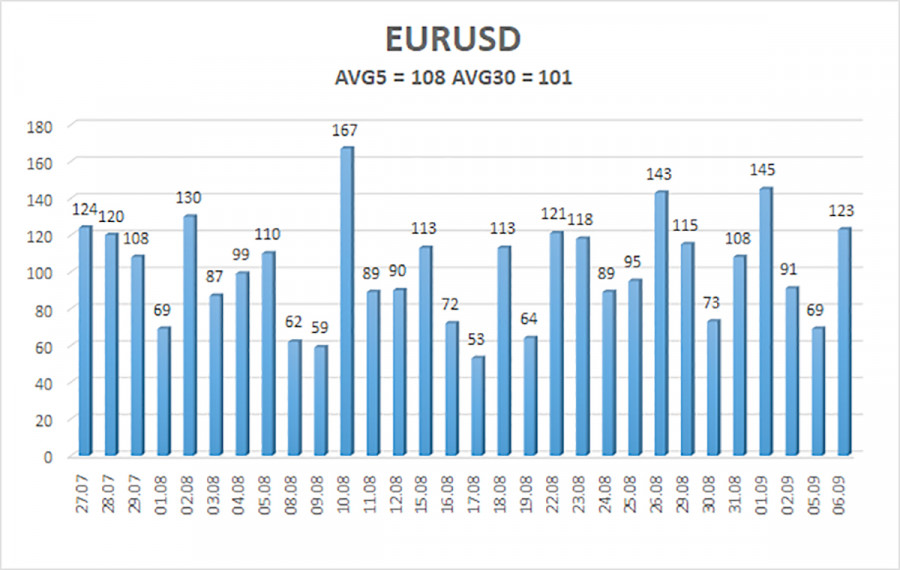

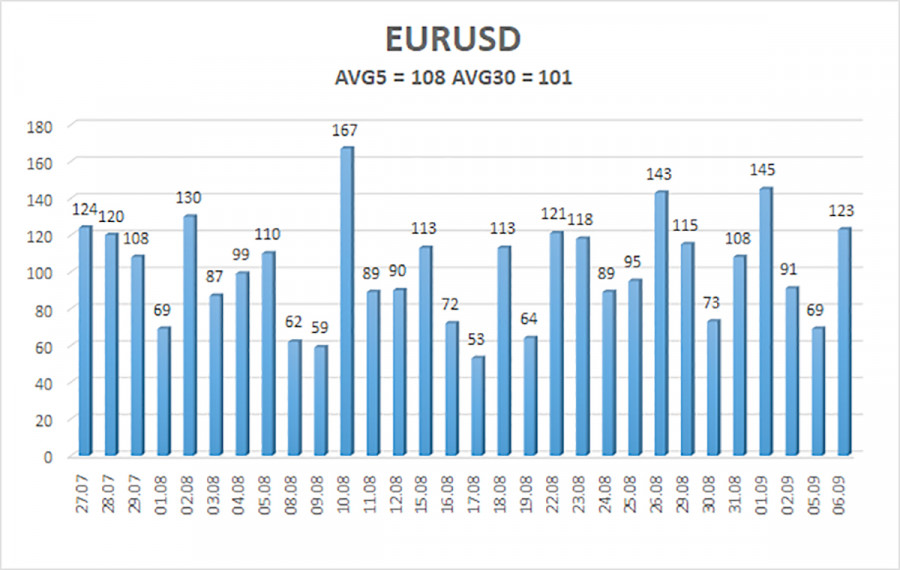

As of September 7, the euro/dollar currency pair's average volatility over the previous five trading days was 108 points, which is considered "high." As a result, we anticipate that the pair will fluctuate today between 0.9800 and 1.0016. A new round of upward movement will be indicated by the Heiken Ashi indicator turning upward.

Nearest support levels:

S1 - 0.9888

S2 - 0.9827

S3 - 0.9766

Nearest resistance levels:

R1 - 0.9949

R2 - 1.0010

R3 - 1.0071

Trading Suggestions:

Despite a recent negative inclination, the EUR/USD pair continues to trade in a flat or "swing" pattern. As a result, it is now viable to trade on the Heiken Ashi indicator's reversals until the price breaks out of the 0.9900–.0072 zone. It still holds a formal position inside it.

Explanations for the examples:

Channels for linear regression allow us to identify the present trend. The trend is now strong if they both move in the same direction.

The moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.