On Wednesday, the EUR/USD currency pair continued to trade near its 20-year lows. In essence, it does not even make much sense to celebrate the next update of these very minimums or the absence of it. It is evident to everyone that, given the current conditions, only a miracle can help the European currency. The market does not buy euros even when there seem to be causes and reasons for this. We understand that in the first half of the year, the euro currency fell due to the following: (1) geopolitical conflict in Ukraine; (2) EU sanctions against Russia, which are hitting the EU economy too; (3) the strengthening of the "hawkish" attitude of the Fed; (4) a strong increase in the Fed rate. All these considerations were solid reasons to get rid of the euro and buy the dollar. But in the last few months, the geopolitical struggle in Ukraine has steadily evolved into a passive one. Neither the APU nor the Russian army have a major advantage. Both are pleased with local successes. If this fight continued for ten years, would the euro currency sink all this time? Unlikely

The Fed has been raising rates and will continue to raise them. This is evident, but the ECB is finally starting to battle inflation, has started raising the rate, and is also doing it at the fastest possible speed. Therefore, why is the European currency not strengthening today, at least a little? It should be mentioned that technical analysis also has a big influence on the movement of the pair. After all, if traders detect a severe and long-term downturn, why would they buy a pair? Consequently, geopolitics and the foundation may be beginning to stabilize the European currency, but it cannot profit from this.

The euro has every opportunity to update its 20-year lows multiple times.

As soon as the two primary causes of the euro's depreciation in 2022 began to stabilize, many other reasons emerged that could lead to a further depreciation of the European currency. First, there is an energy shortage. The European Union is more dependent on foreign oil and gas supplies than the United States. They will be significantly less affected by the increase in energy prices. Additionally, they may earn. If the European Union abandons Russian hydrocarbons entirely (or if Moscow bans shipments), Europe will have to purchase oil and gas from somewhere else. Why not in the United States? Considering the issue from this vantage point, the American dollar emerges as the superior option.

The dollar is the world's reserve currency, implying that traders choose to purchase dollars rather than the euro, pound, yuan, or lira at times of high risk and uncertainty. In addition, both the yuan and the lira have recently depreciated, reinforcing our thesis on the dollar's cosmopolitan standing and high demand.

Third, the European economic downturn will be heavily influenced by the energy issue, which cannot be averted. No one can predict how much gas and oil prices will increase if the European Union can fully compensate for the loss of hydrocarbons from Russia or how much Europe's industrial production will decline. Once more, there is uncertainty. The market anticipates a significant decline, and in the United States, everything appears reasonably obvious. The economy is slowing down due to the Fed's rate hike and QT program. In the near future, the Fed will stop raising interest rates, causing the situation to improve. If in the United States we are discussing a recession that may finish by the end of next year (i.e., the terms are evident), then it is impossible to predict its depth and duration in the European Union. So it turns out that the geopolitical foundation has not changed, but traders can also consider a few additional aspects that have been introduced. And none of these characteristics are favorable to the EU currency. It has already fallen below parity with the dollar and cannot even adjust. Therefore, we believe that the drop will continue for a while, potentially for several months. The euro requires robust support, not a single ECB rate hike in the current environment.

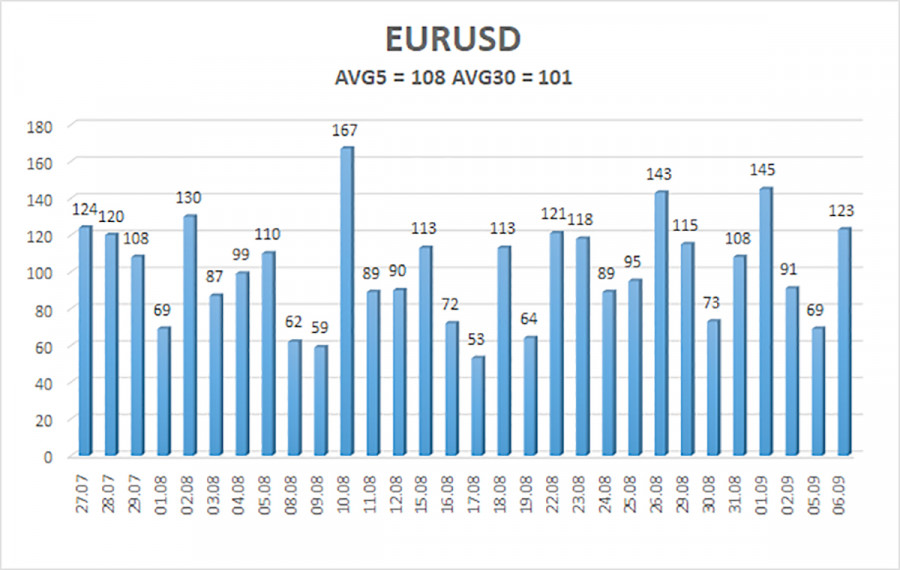

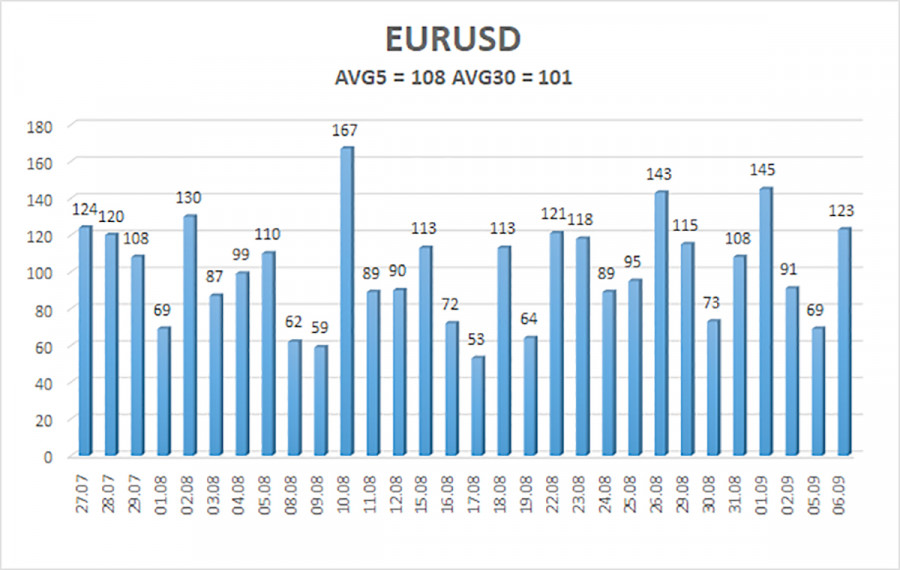

As of September 8, the average volatility of the euro/dollar currency pair over the previous five trading days was 108 points, considered "high." Thus, we anticipate the pair to trade between 0.9800 and 1.0016 today. The Heiken Ashi indicator's upward reversal will suggest a new round of upward movement.

Nearest support levels:

S1 – 0.9888

S2 – 0.9827

S3 – 0.9766

Resistance levels closest:

R1 – 0.9949

R2 – 1.0010

R3 – 1.0071

Recommendations for Traders:

The EUR/USD pair continues to trade in a flat or "swing" pattern, despite the recent appearance of a bearish tendency. Thus, it is now possible to trade on Heiken Ashi indicator reversals until the price exits the 0.9900-1.0072 range. Formally, she continues to hold this position.

Explanations for the figures:

Channels of linear regression – aid in determining the present trend. If both are moving in the same direction, the trend is now strong.

Moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the expected price channel the pair will trade within over the next trading day, based on the current volatility indicators.

The CCI indicator — its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.