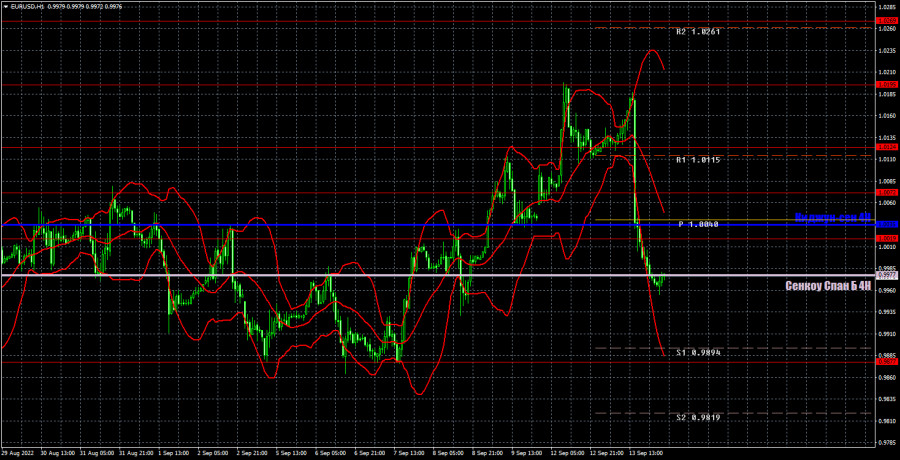

EUR/USD 5M

The EUR/USD pair showed extreme movements on Tuesday. The whole day can be safely divided into "before" and "after" the release of the US inflation report. The US currency rose by 180 points after this report was released, although in the first half of the day it was trading with an increase. What was so special about this report that we saw a reaction comparable to the reaction to the Federal Reserve meeting? Really nothing special. The consumer price index amounted to 8.3% in August, which is 0.2% lower than the previous month and 0.2% more than the forecast. Thus, it is absolutely impossible to call an adequate reaction of the market to this event. We would not be surprised if the pair went up or down 100 points, after all, the report is important, but more than 180 is too much. Moreover, the report showed nothing shocking. Inflation continued to decline, but not at the rate expected by the market. Since the pace slowed down, the market probably decided that now the Fed's rate hike of 0.75% is guaranteed and rushed to buy the dollar. The explanation can only be this.

In regards to Tuesday's trading signals, everything was complicated. The first buy signal was excellent in terms of accuracy and after it the pair went up about 50 points. In any case, the long position should have been closed manually in profit, since it clearly should not have been left open before the release of an important report. Traders either did not have time to work out all subsequent signals, or there was no point in trying to work them out. A collapse of 180 points happened literally in half an hour and, of course, it was not worth trying to enter the market in the middle of such a "storm".

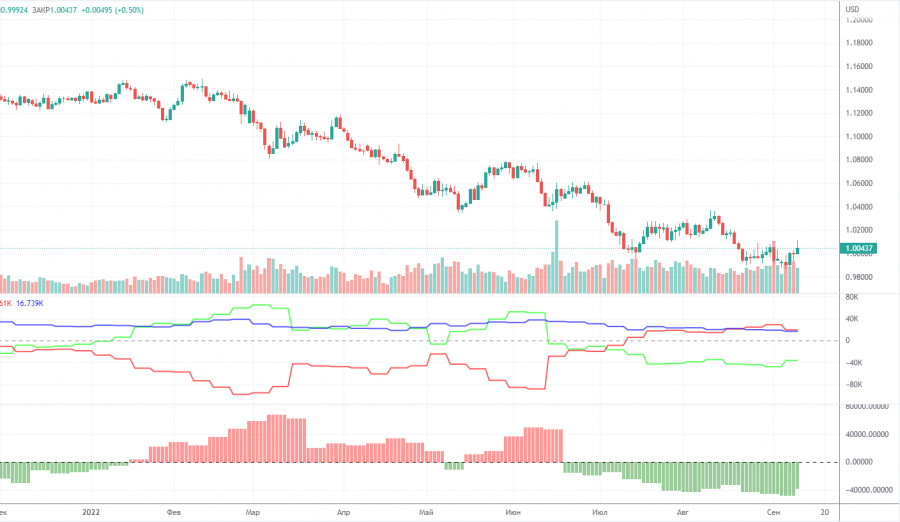

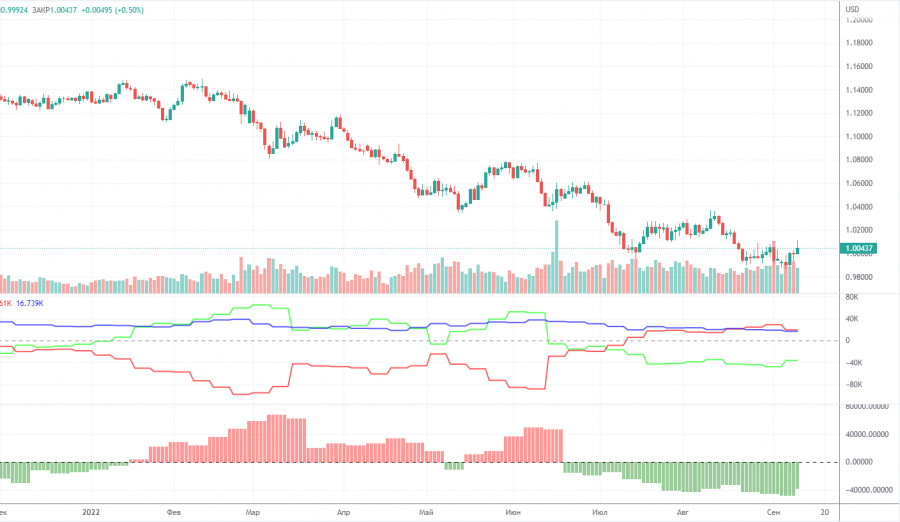

COT report:

The Commitment of Traders (COT) reports on the euro in the last few months clearly reflect what is happening in the euro/dollar pair. For half of 2022, they showed a blatant bullish mood of commercial players, but at the same time, the euro fell steadily. At this time, the situation is different, but it is NOT in favor of the euro. If earlier the mood was bullish, and the euro was falling, now the mood is bearish and... the euro is also falling. Therefore, for the time being, we do not see any grounds for the euro's growth, because the vast majority of factors remain against it. During the reporting week, the number of long positions for the non-commercial group increased by 3,000, while the number of shorts decreased by 8,300. Accordingly, the net position grew by about 12,000 contracts. This is not very much, but it is still a weakening of the bearish mood among the major players. However, this fact is not of particular importance, since the mood still remains bearish, and the euro remains "at the bottom". At this time, commercial traders still do not believe in the euro. The number of longs is lower than the number of shorts for non-commercial traders by 36,000. Therefore, we can state that not only does the demand for the US dollar remain high, but that the demand for the euro is also quite low. The fact that major players are in no hurry to buy the euro may lead to a new depreciation of this currency. Over the past six months or a year, the euro has not been able to show even a tangible correction.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. September 14. Joachim Nagel provokes the strengthening of the European currency.

Overview of the GBP/USD pair. September 14. Market skepticism towards the pound has not gone away, but now is a good time for a global trend reversal.

Forecast and trading signals for GBP/USD on September 14. Detailed analysis of the movement of the pair and trading transactions.

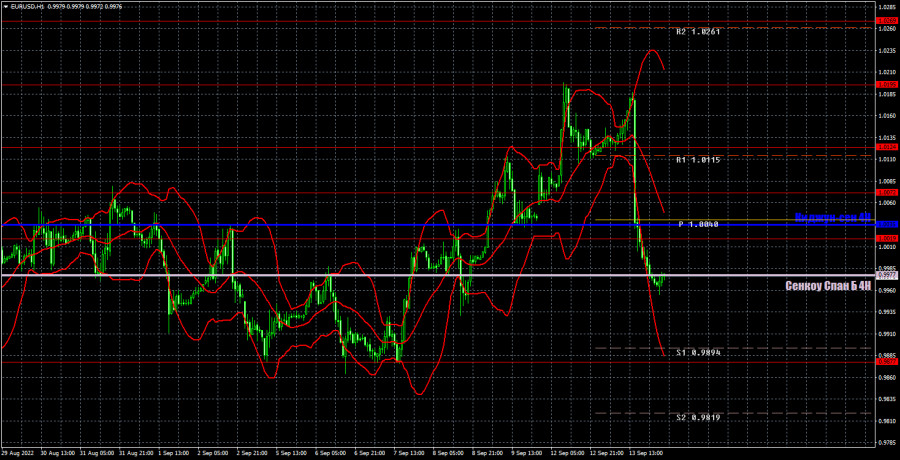

EUR/USD 1H

On the hourly timeframe, the pair showed on Monday how fragile any rise in the euro can be. In fact, a single report led to a huge drop that broke the emerging upward trend. So far, the pair remains above the important Senkou Span B line, but it may well overcome it tomorrow. In this case, the global downward trend will resume. We highlight the following levels for trading on Wednesday - 0.9877, 1.0019, 1.0072, 1.0124, 1.0195, 1.0269, as well as Senkou Span B (0.9977) and Kijun-sen (1.0035). Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. There are also secondary support and resistance levels, but no signals are formed near them. Signals can be "rebounds" and "breakthrough" extreme levels and lines. Do not forget about placing a Stop Loss order at breakeven if the price has gone in the right direction for 15 points. This will protect you against possible losses if the signal turns out to be false. The only report of the day will be industrial production in the European Union. This is not the most significant report, and the Europeans can work out the US inflation report this morning, as they might not have had time to do it yesterday.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.

Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.