The GBP/USD currency pair fell by almost 900 points on Friday and Monday. However, we would draw the attention of traders to another fact. On Monday, the pound adjusted upwards by 550-600 points. That is, more than within the framework of almost any correction as part of the downward trend, which has lasted for more than a year and a half. We consider this moment important, not another collapse of the British currency, which has occurred so often that everyone is already used to it. It was about such a sharp departure of quotes in the countertrend direction that we talked about when we discussed how a downward trend could and should correctly end. Don't get us wrong. Right now, we are talking purely from a technical point of view. It is clear that if a new batch of "optimistic" news comes tomorrow, the pound may well resume its decline, which it likes to be so much. Now the geopolitical situation in the world is such that you never know where the next "smart" news will come from, which will collapse the markets. Nevertheless, if we talk exclusively about "technology," we would say that Monday's movement could be the starting point for a new upward trend. Another question is, how long and strong will it be?

However, it can already be said that the pound broke all imaginable and unimaginable anti-records at the beginning of this week. It dropped to a price value that no one had ever seen. The pound almost reached price parity with the dollar, and this event was comparable in its madness to the fall of oil to $ 0 per barrel, which we have also seen. The last three years have turned out to be crazy, and it would be strange to think that the markets at such a time will move in the usual, calm mode. We are sure this is not the last shock for traders and investors. Each subsequent year seems to be trying to break the previous year's records for various cataclysms.

Were there specific reasons for the collapse of the pound?

From our point of view, no. We have already said repeatedly that the market likes to act by inertia. What does the whole current technical picture look like for traders? There is a currency that has been falling for a long time. To make a profit, you should not conduct a deep analysis; you should simply sell it and calculate the profit on the transaction. The fundamental background is bad, and the geopolitical one is even worse. The prospects for the British economy after Brexit are "out." What else do you need to sell the British pound without hesitation? That's what we saw on Friday and Saturday. We also recall that, from time to time, good news comes from the UK. For example, there have been seven consecutive increases in the key rate of the Bank of England. However, the market ignored them. Now he can start catching up, and everyone will talk about how bad things are in the USA.

From our point of view, the topic of taxes in the UK is even more absurd. The tax cuts in the country were known even before Liz Truss took office as prime minister, who promised a reduction if she became the new leader of the Conservatives. As soon as she became one, she repeated her promises: taxes would not increase, and some would decrease. Therefore, when on Friday, Kwasi Kwarteng, the new finance minister, announced that some taxes would be reduced and others would not be increased, what was unexpected about this news? It is even better to ask differently: why did the pound react with a collapse to this news? We believe it was a state of shock multiplied by the inertia of the downward trend. The market caught the new strong news and, without even analyzing it, rushed to sell the pound. This theory is confirmed by a strong upward correction that occurred on the same Monday and may be the beginning of a new uptrend. After all, the tax cuts will be aimed at stabilizing the economy and easing the burdens of a lot of British households in the face of high energy prices. And the deficit of the British budget, as they say, is not the first and not the last time.

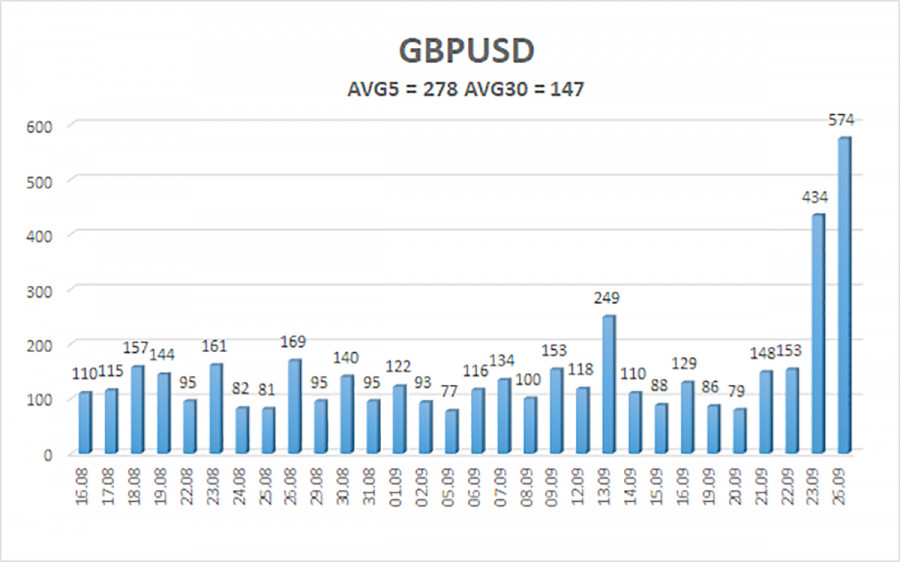

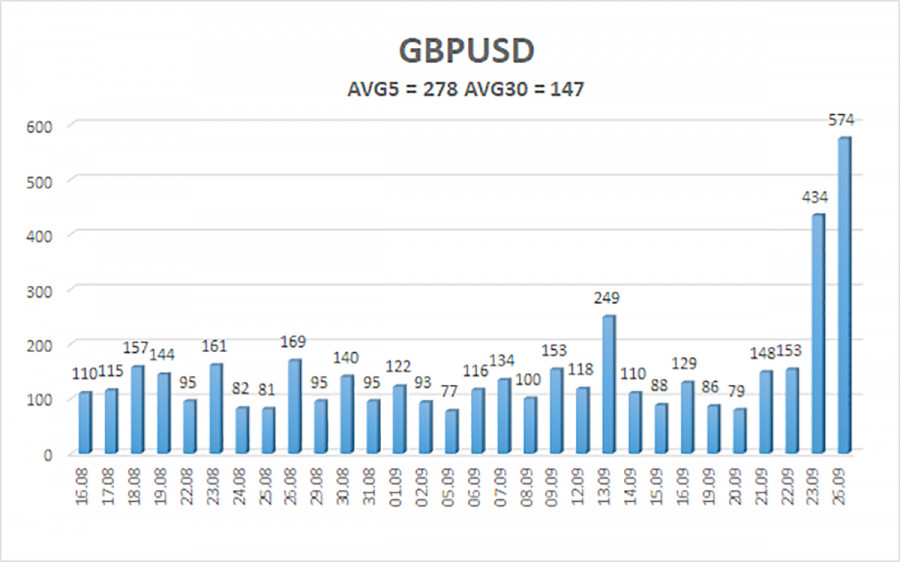

The average volatility of the GBP/USD pair over the last five trading days is 278 points. This value is "very high" for the pound/dollar pair. On Tuesday, September 27, thus, we expect movement inside the channel, limited by the levels of 1.0358 and 1.0914. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement.

Nearest support levels:

S1 – 1.0498

S2 – 1.0254

S3 – 1.0010

Nearest resistance levels:

R1 – 1.0742

R2 – 1.0986

R3 – 1.1230

Trading Recommendations:

The GBP/USD pair is still being adjusted in the 4-hour timeframe. Therefore, at the moment, new sell orders with targets of 1.0498 and 1.0358 should be considered if the Heiken Ashi indicator turns down. Buy orders should be opened when fixed above the moving average with targets of 1.1353 and 1.1475.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong.

The moving average line (settings 20.0, smoothed) identifies the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.