The EUR/USD currency pair traded very weakly on Wednesday for most of the day. The volatility was quite low. By tradition, we do not consider the results of the Fed meeting, as well as the initial reaction of the market to them. Recall that the market can react to such an important event within 24 hours after it occurs. For example, European markets did not have the opportunity to work out the results of the Fed meeting since they were already closed at the time of their publication. Therefore, we believe the results should be summed up no earlier than Thursday evening, when all market participants can make their transactions on the foreign exchange market. Recall also that the market reaction can be almost any. The US dollar may fall on Wednesday evening, and on Thursday morning, it may rise. The only thing we are waiting for is an increase in volatility. But everything is ambiguous here because if the Fed does not surprise the market with anything, then the movements will be quite weak. For example, 100 points.

Thus, at this time, the prospects opening up for the dollar are slightly better than those opening up for the euro. First, the price has settled below the moving average. Even if, after the Fed meeting, it goes above this line, you will need to see where it will be on Thursday evening. Second, even in the illustration above, it is perfectly noticeable that the pair is still near its 20-year low. Third, on the 24-hour TF, it never managed to overcome the Ichimoku cloud. Fourth, all those factors that brought the pair so low remain in force. Accordingly, the growth of recent weeks may be a simple correction because we still do not have serious signals for the beginning of an upward trend.

The ADP report turned out to be strong, but this does not mean Nonfarms will be strong.

Since we are not considering the results of the Fed meeting, we will pay attention to the US labor market. This Friday, the most important reports on Nonfarm and unemployment will be published there, which may be even more important than the results of the Fed meeting. The Fed's rate hike has been known for a long time, and traders have had enough opportunities and time to work them out. But in the case of NonFarm Payrolls, no one knows how many new jobs have been created in the American economy. Accordingly, the reaction on Friday may be unpredictable. In the meantime, let's analyze the ADP report published yesterday.

This report shows the state of the labor market in the United States. To be more precise, it shows the change in the number of employees in the private sector. It would be logical if the values of both reports coincided or showed approximately the same dynamics, but this happens very rarely. Usually, the values of these reports do not match. At the same time, it is also important to determine how much the actual values correspond to the forecast ones. Yesterday, the ADP report showed an increase of 239 thousand employees, more than in August or September. However, comparing this number with the figures observed six months or a year ago, it is about two times lower. Thus, there is already a negative dynamic.

Now let's look at the NonFarm Payrolls reports. The last value was 263 thousand. Moreover, a year ago, an average of 600-700 thousand were created per month. This means that we have negative dynamics here too. However, it should be understood that a year ago, the economy was actively recovering after the "coronavirus crisis." QE programs continued to work, and the rates were ultra-low. Therefore, it is unsurprising that GDP grew at a cruising pace, the labor market was at peak values, and unemployment was minimal. At this time, the US economy is not yet entering a recession or crisis, as the GDP for the third quarter showed, and a value in the range of 200-300 thousand is normal for it. Therefore, we believe that the ADP report is neutral. If Nonfarms come out in the same range on Friday, this will be considered normal for the American economy and will not indicate the presence of problems. The dollar may react neutrally to these figures.

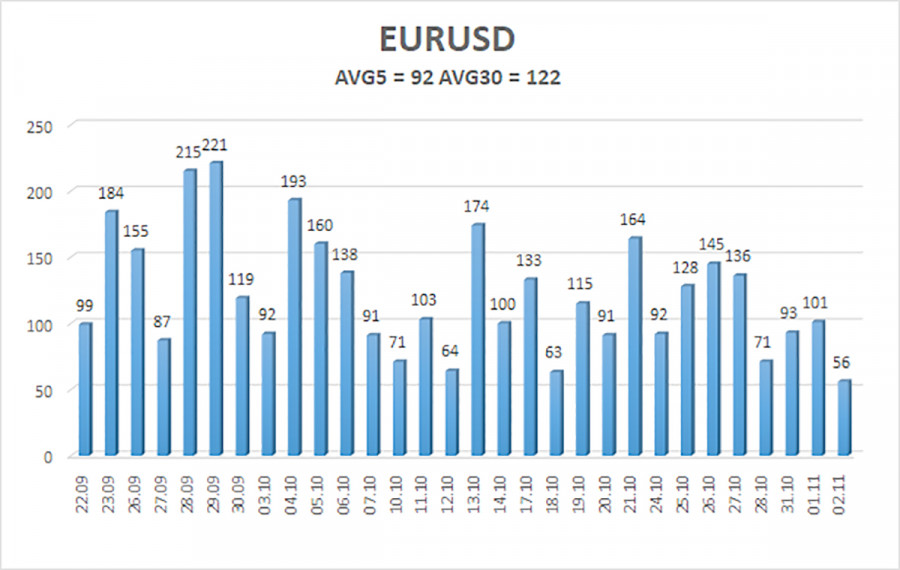

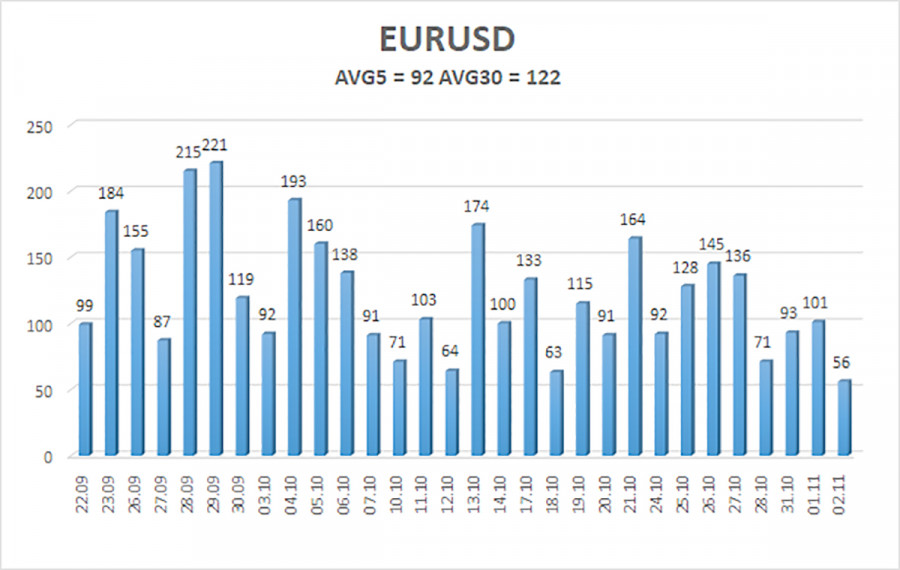

The average volatility of the euro/dollar currency pair over the last five trading days as of November 3 is 92 points and is characterized as "high." Thus, we expect the pair to move between 0.979 and 0.9953 on Thursday. The upward reversal of the Heiken Ashi indicator signals a round of upward correction.

Nearest support levels:

S1 – 0.9766

S2 – 0.9644

S3 – 0.9521

Nearest resistance levels:

R1 – 0.9888

R2 – 1.0010

R3 – 1.0132

Trading Recommendations:

The EUR/USD pair has consolidated below the moving average. Thus, it would be best if you stayed in short positions with a target of 0.9766 until the Heiken Ashi indicator turns up. Purchases will become relevant again no earlier than fixing the price above the moving average with goals of 0.9953 and 1.0010.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.