On Monday, the GBP/USD currency pair remained static the entire day. Although we believe that this situation will most likely not last for long, the pound could very well follow the lead of the euro and experience a devaluation. In theory, it doesn't even matter if we're dealing with a typical low-volatility flat or a movement like the one we saw today. Trading is impossible in both the first and second cases. The only difference is that on the newest TF, the first option gives traders at least theoretical chances to open deals. This, however, also does not make much sense because it is very difficult to turn a profit on them. Therefore, all that is left to do is wait. Await the completion of the flat. Watch for the downward correction to continue.

The pound should continue to decline, as we have stated numerous times and will continue to do so. The traders were made aware by us that the pound had increased by 2000 points in just 2.5 months. From our perspective, this is a lot, especially considering the fundamental information that traders had access to at the time. Given that there were not enough fundamental or macroeconomic factors supporting the pound for it to increase by 20 levels in just 2.5 months, we continue to think that the correction that followed a protracted downward trend was primarily technical. As a result, a correction was visible, and the correction against the correction has since started. Similar circumstances apply to the euro currency, but traders there left early for the holidays around the New Year, leaving the pair unchanged, even though we also anticipate a significant decline for it.

International experts are watching for the pound to drop to 1.1500.

We have recently stated that we are anticipating a significant correction in the pound. Our opinion has been endorsed by numerous international publications, banks, and analytical firms, including Bloomberg and Goldman Sachs. Additionally, their experts discuss the UK economy's enormous problems, the strong and overbought pound, the likelihood of a protracted recession, and the Bank of England's reluctance to raise interest rates aggressively. According to them, each of these factors could result in a decline in the value of the pound in the upcoming weeks and months. And they concur entirely with what we think. As a result, we can anticipate another 500–600 point drop in the pair. Of course, waiting for a significant trend movement during the New Year's holidays is probably not worthwhile. But once the holidays are over, market participants will be on their own because there won't be any new factors driving the British pound's growth.

We previously stated that the pair is currently in a consolidation phase following a protracted downward trend. One could anticipate the emergence of a long-term upward trend if the pound had long-term growth drivers. However, such factors don't exist. The demand for the dollar could increase once more if the pandemic in China spreads beyond its borders. The demand for the dollar could start to increase significantly again if the global geopolitical situation worsens. It is important to realize that the dollar has increased in value recently for a reason. These are all the results of geopolitics and the pandemic. Both the pandemic and the geopolitical problems have not been solved. As a result, the US dollar may start to gain ground again against its less secure and riskier rivals.

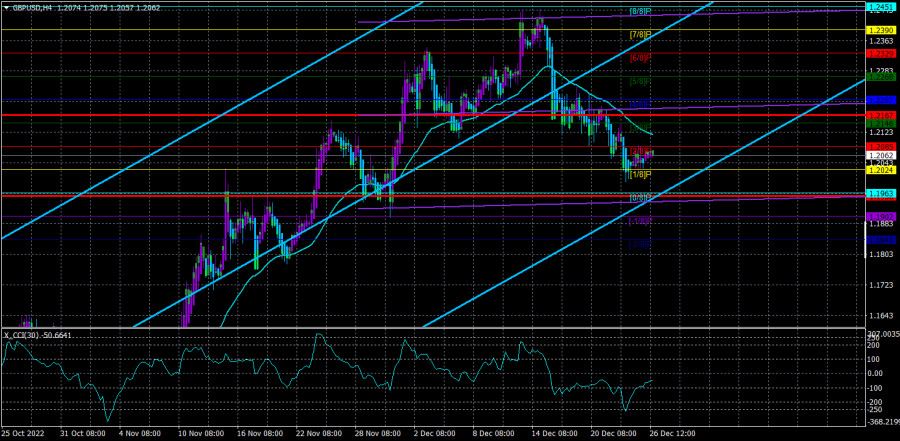

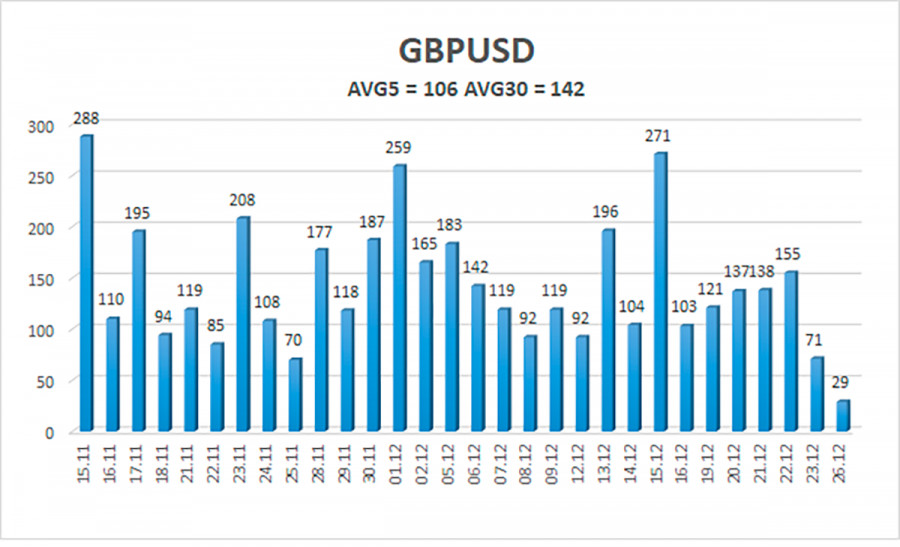

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 106 points. This value is "average" for the dollar/pound exchange rate. Thus, on Tuesday, December 27, we anticipate movement that is contained within the channel and is constrained by levels 1.1956 and 1.2167. The Heiken Ashi indicator's downward turn indicates that the downward movement may resume.

Nearest levels of support

S1 – 1.2024

S2 – 1.1963

S3 – 1.1902

Nearest levels of resistance

R1 – 1.2085

R2 – 1.2146

R3 – 1.2207

Trading Suggestions:

On the 4-hour timeframe, the GBP/USD pair is still trending downward. Therefore, in the event of a downward reversal of the Heiken Ashi indicator at this time, new sell orders with targets of 1.1963 and 1.1902 should be taken into consideration. When the moving average is fixed above, buy orders should be placed with targets of 1.2167 and 1.2207. A flat is also highly likely right now.

Explanations for the illustrations:

Channels for linear regression help identify the current trend. The trend is currently strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the likely price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.