On Thursday, the GBP/USD currency pair traded much more calmly than it had in recent days while still maintaining a corrective tone. Recall that over the past two weeks, the pound sterling has undergone active adjustment, fully meeting our expectations. Only the EUR/USD pair, which is not only not being adjusted but also attempting to maintain the upward trend of recent months, is now able to ask questions. The euro and the pound now have a strong correlation, which raises many additional questions. Remember that over the previous two weeks, there were no fundamental or macroeconomic backgrounds. We would comprehend such a movement of the two major currency pairs if the "foundation" at this time supported the euro but failed the pound. However, nothing comparable exists today.

2023 might not be any better for the British pound than 2022. It has grown significantly over the past three months, but it can also be seen as a banal correction. The 24-hour TF demonstrates exactly what we mean. If this is merely a correction, it might end soon given that the British pound currently lacks significant growth drivers. Another issue is that there aren't enough factors driving the US dollar's growth. For this reason, we recommend a period of consolidation over the coming months, during which the currency pair will alternately move by 500–600 points in each direction. In other words, we can get a flat on a 24-hour TF.

Scotland might leave the UK.

On the one hand, since London has repeatedly refused to allow different types of referendums in Edinburgh, it would have been possible to put an end to this issue for a very long time. A second referendum was first sought after Nicola Sturgeon claimed that the majority of Scots opposed leaving the EU in the 2016 referendum. It then attempted to force through an "advisory" referendum that doesn't appear to have any legal standing but was intended to determine the percentage of Scots who want to break away from England. However, Sturgeon was turned down, regardless of the prime minister.

London's stance is simple to comprehend and even appears to be logical and reasonable. A referendum was held in 2014, but the majority of Scots decided not to break away from England at that time. It is obvious that everything began to turn upside down in 2016, so the Scots' perceptions may evolve. However, because things are constantly changing in our world, it turns out that any region has the right to declare its independence whenever it wishes by holding a "legitimate expression of the will of the people." Even if the law does not specifically address such a situation. As a result, any country or region can secede at any time. Although it is challenging for us to assess how morally upright, ethical, and just this is, the fact remains. If this choice is accepted as fair, there will be 500–600 distinct states on the map of the world in 50 years.

Scotland alone is responsible for the desire to secede. And there is the issue with Nicola Sturgeon, who, if her party wins the parliamentary elections, has promised a referendum to her people by the end of 2023. Now that the party has won, it's important to keep the promises. And it's still very unclear how Ms. Sturgeon plans to carry them out. No court in the world will accept a referendum she holds without London's approval as legitimate. The right to hold a referendum was recently rejected by the British Supreme Court. However, Sturgeon will probably lose the following election if she does not call a referendum. The year 2023 looks to be just as interesting for the UK as the previous five or six years. Without a doubt, the pound will plunge back to parity or even lower if Britain loses Scotland.

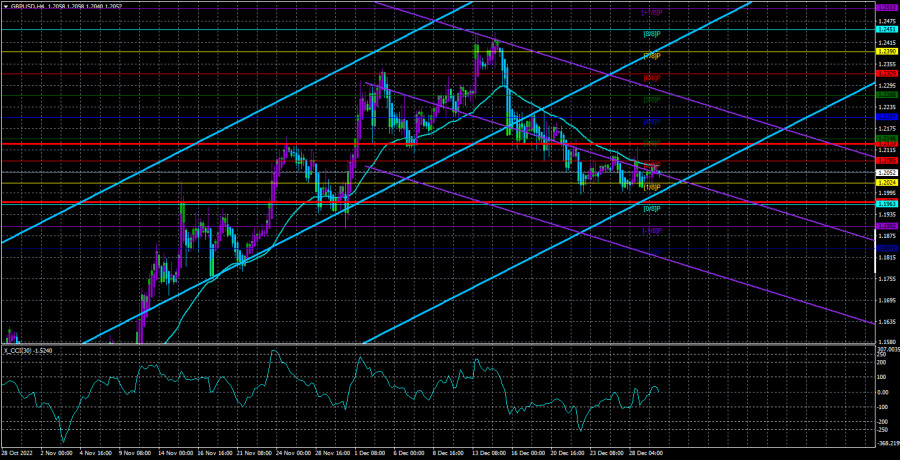

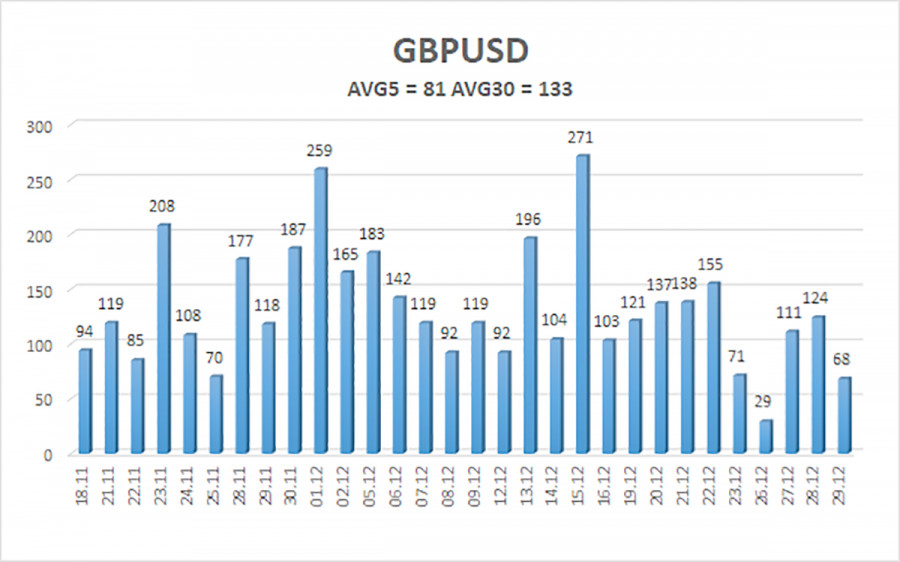

Over the previous five trading days, the GBP/USD pair has experienced an average volatility of 81 points. This value is "average" for the dollar/pound exchange rate. So, on Friday, December 30, we anticipate movement that is contained within the channel and constrained by the levels of 1.1971 and 1.2133. The Heiken Ashi indicator's downward turn indicates that the downward movement may resume.

Nearest levels of support

S1 – 1.2024

S2 – 1.1963

S3 – 1.1902

Nearest levels of resistance

R1 – 1.2085

R2 – 1.2146

R3 – 1.2207

Trading Suggestions:

In the 4-hour timeframe, the GBP/USD pair is still trending downward. Therefore, in the event of a downward reversal of the Heiken Ashi indicator or a price recovery from the moving average, new sell orders with targets of 1.1963 and 1.1902 should be taken into account. When the moving average is fixed above, buy orders should be placed with targets of 1.2133 and 1.2207. A flat is also highly likely right now.

Explanations for the illustrations:

Determine the present trend with the aid of linear regression channels. The trend is currently strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the likely price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.