For the majority of the day on Wednesday, the EUR/USD currency pair was trading higher. Tradition dictates that we avoid discussing the outcomes of the Fed meeting and Jerome Powell's press conference in this post because it makes no sense to do so right away. Instead of the events themselves, we are more interested in how the market responds to them and how it understands them. Remember that the European currency has been trading completely irrationally in recent weeks or even months, with growth. Thus, the euro currency can increase regardless of how the Fed meeting turns out. And we must comprehend how the market has handled these developments. We will therefore do the analysis today following the European trading session. The reasoning behind this is straightforward: because the meeting finished late last night, the European platforms were unable to resolve the issue. Today's ECB meeting will also take place, and the response to the Fed's decision may be seen throughout the day. It turns out that several significant fundamental events are piling up on top of one another, making it more challenging than usual to determine exactly why the market is reacting as it is. So, first and foremost, we recommend not rushing but rather carefully comprehending everything.

Yesterday, the euro/dollar pair increased and quickly reclaimed its previous position above the moving average line. But keep in mind that the pair have been staying in a flat for the past three weeks, which is pretty obvious even over a four-hour period. The upward movement's present turn is therefore just a turn inside a side channel and has no significance. However, traders have once again seen justifications for purchasing the euro. We can only deduce that the flat is preserved at this time. This conclusion can be changed today, during the day, but we should keep in mind that the outcomes of the meetings of the ECB and the Fed were in reality known well in advance of the conclusion of the meetings themselves. As a result, the reaction may be less intense than expected, or it may be entirely impulsive. In other words, the price will move up and down a few times before returning to its initial position.

The EU experienced its third consecutive decline in inflation.

Let's now examine the report that may have an impact on Christine Lagarde's current stance. The European Union released an inflation report for January yesterday, and it showed a drop in the key indicator of 0.7% to 8.5% y/y. This is excellent news for the Eurozone, but after this report, the euro managed to increase. Why does that matter? Remember that the regulator has less incentive to raise rates aggressively the faster inflation falls. For instance, the dollar started to fall as criticism about the Fed's inability to exert strong pressure on monetary policy emerged in the United States when inflation started to subside. As the market anticipated that the regulator would slow the pace of tightening to 0.25% in February, the US inflation report from January caused a further decline in the value of the dollar. What was the reaction to the European inflation report? The euro is increasing. So, once again, we find ourselves in a circumstance where the outcome of a specific report is irrelevant in theory. The market saw it in the euro's favor, and the single currency is now increasing once more. At this point, this is all you need to know about the pair's movements.

While it's true that some analysts claim the core inflation rate remained at 5.2% y/y in January, it should be recalled that the estimates for core inflation did not anticipate a decrease. Instead, some experts anticipated its expansion. Regardless of your point of view, it is impossible to explain the euro's rise in response to news of falling inflation. Naturally, the ECB won't change its mind and will increase the rate by 0.5% twice more, but this doesn't alter the facts of the issue. The market is still only moving in one direction, which suggests that the side channel at the highs is still valid. The two are unable to even adjust regularly.

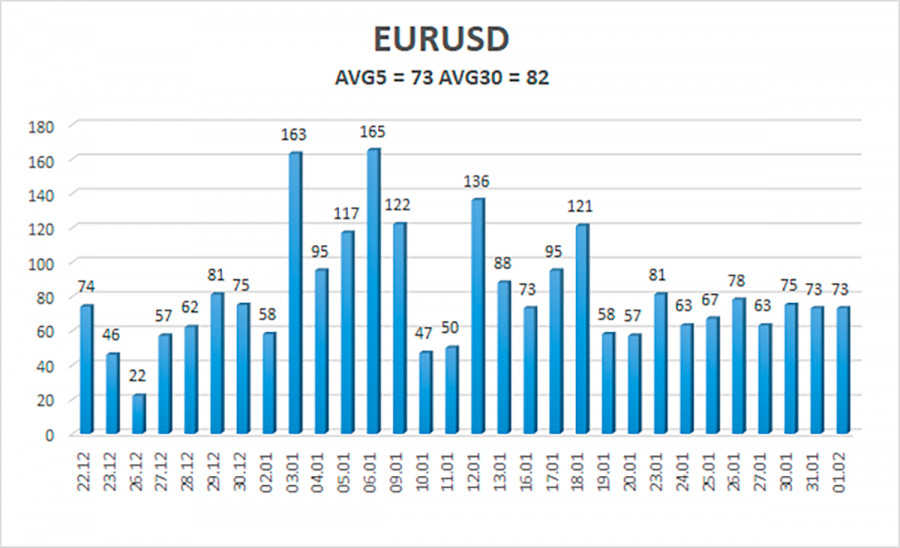

As of February 2, the euro/dollar currency pair's average volatility over the previous five trading days was 73 points, which is considered "normal." So, on Thursday, we anticipate the pair to move between 1.0837 and 1.0985. A new round of downward movement will be signaled by the Heiken Ashi indicator reversing downward.

Nearest levels of support

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest levels of resistance

R1 – 1.0986

R2 – 1.1047

R3 – 1.1108

Trading Suggestions:

The EUR/USD pair has returned to the area above the moving average, although it is still moving in a side channel. Until the Heiken Ashi indicator turns down, you can continue holding long positions with targets of 1.0925 and 1.0986. After fixing the price below the moving average line and setting a target of 1.0803, you can open short positions.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.