Long positions on GBP/USD:

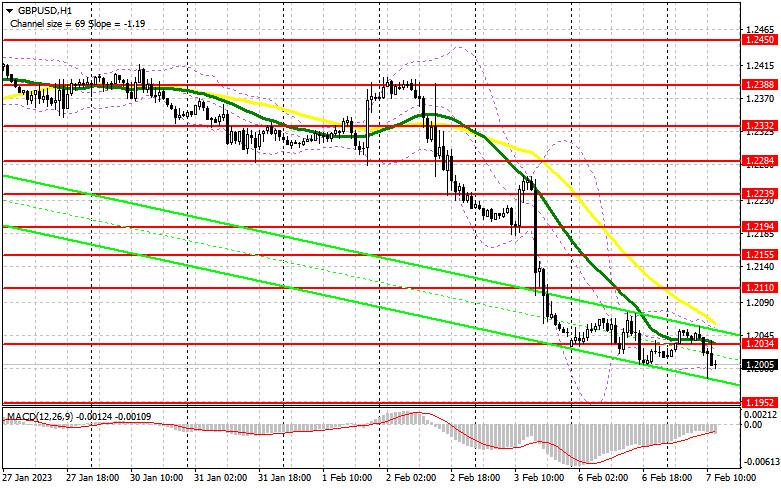

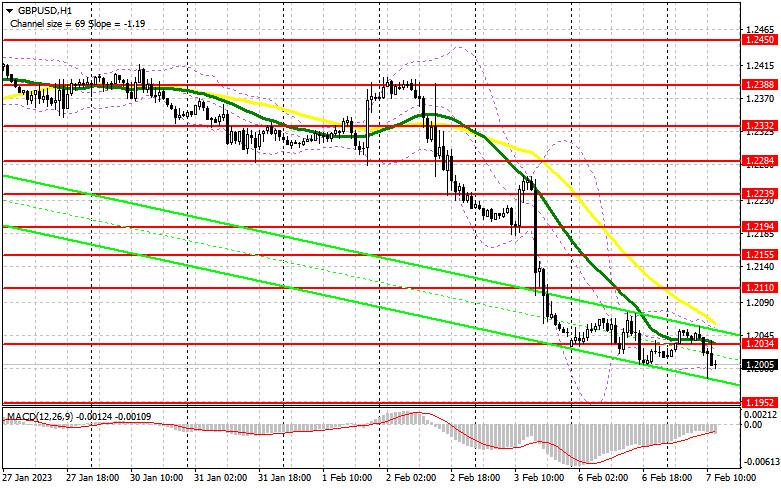

In my previous forecast, I drew your attention to the level of 1.2012 and recommended entering the market from there. Let's have a look at the 5-minute chart and analyze the situation. The pair failed to break through 1.2012 as after a strong return to this level, it was tested from above, which created a buy signal. However, the price did not show a strong upward movement. After soaring by 20 pips, the pressure on the pair returned so the pair returned below 1.2012. Thus, the technical picture was reconsidered.

While there are no new entry points, we should pay attention to the US data and the speech of Fed Chairman Jerome Powell. Only his statements may bring bears back to the market. This may drag the pound down to the monthly lows. Considering how much the pair has already fallen since it broke out of the sideways channel last week, I would not bet on a strong intraday decline. If the price falls after the US data release, we may receive buy signals near a new low of 1.1952. A false breakout at this level can give a good entry point with the target at the resistance of 1.2034, which was formed in the morning. The moving averages, which limit the upside potential, pass near the resistance level, so bulls need to try very hard to push the price higher. If the pair settles above this level and forms a top-down test of it after Powell's statements, the GBP/USD pair may go up to the high of 1.2110. Reaching above this level, the price may touch 1.2155, where you may lock in profits. If bulls fail to protect 1.1952, the bear market will continue. For this reason, it would be better to postpone opening long positions. It is better to open long positions after a decline and a false breakout near the next support of 1.1881. One can also buy the pound on a rebound from 1.1829, allowing an intraday correction of 30-35 pips.

Short positions on GBP/USD:

Bears are trying to dominate the market but bulls are actively buying the British pound after it reaches new weekly lows. The fact that the pair almost trades near the moving averages indicates that the market's future direction is uncertain, making bears hesitate when trying to take the market under their control. Now they need to protect the resistance level of 1.2034, which is where the moving averages are passing. In the second half of the day, if the price reaches above this level, a false breakout may be enough to get a sell signal with the target at 1.1952. A breakthrough and a reverse downward test of this level are likely to reinforce the bears' position in the market, creating a sell signal with the target at 1.1881, the test of which will indicate that the downtrend may continue. The next target is located in the area of 1.1829. However, the price will only get to this area if Powell remains hawkish on the overheated labor market. There I will book profits. If the GBP/USD pair grows and we see a lack of activity from bears at 1.2034, bulls will take control of the market again, and the equilibrium will return. In that case, a false breakout near 1.2110 may give an entry point into short positions. If there is no activity there, it would be better to sell the British pound from the high of 1.2155, counting on an intraday pullback of 30-35 pips.

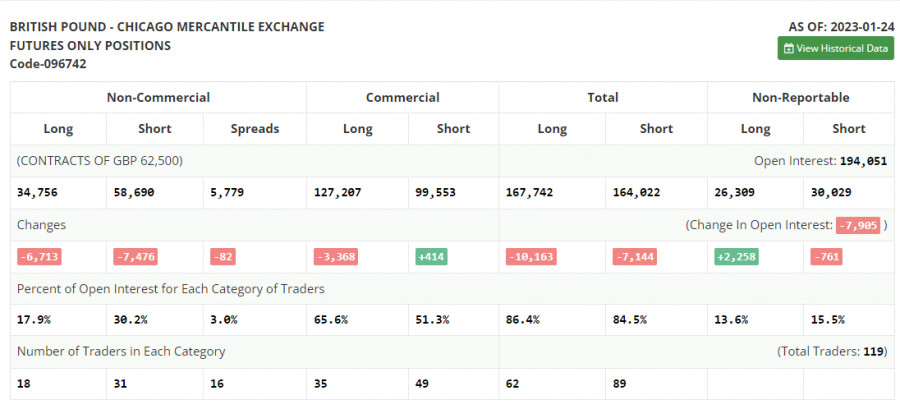

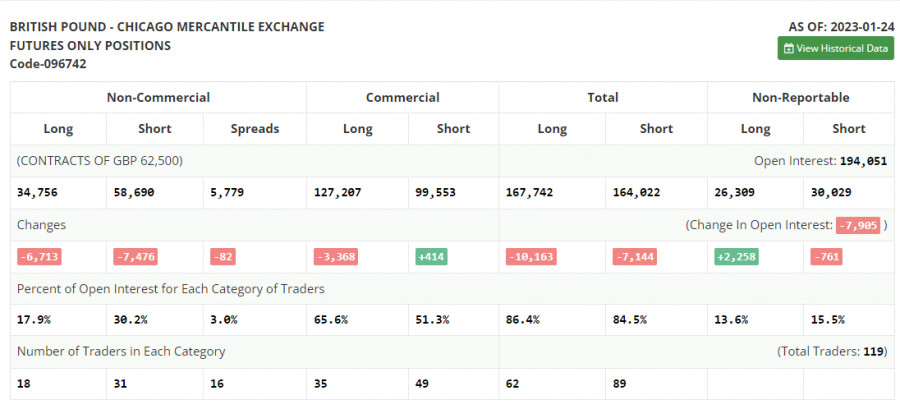

COT report

The COT report from January 24 logged a drop in long and short positions. However, the current decline was quite acceptable. The fact is that the UK government is coming across tough times. It is struggling with strikes and demands to raise wages and at the same time, it is trying to achieve a steady decline in inflation. However, this is of less importance at the moment since traders are waiting for the meetings of the Fed and the BoE. The Fed is expected to switch to a less hawkish stance, whereas the BoE may remain aggressive. This may have a positive effect on the pound sterling. That is why I will bet on its further rise. The recent COT report showed that the number of short non-commercial positions decreased by 7,476 to 58,690, while the number of long non-commercial positions decreased by 6,713 to 34,756. As a result, the negative value of the non-commercial net position dropped to -23,934 from -24,697 a week earlier. Such minor changes will hardly affect the market situation. Thus, we will continue to closely monitor the economic indicators for the UK and the decision of the Bank of England. The weekly closing price rose to 1.2350 against 1.2290.

Signals of indicators:

Moving Averages

Trading is carried out slightly below 30- and 50-day moving averages, which points to an uncertainty in the market.

Note: The author considers the period and prices of moving averages on the one-hour chart which differ from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the pair increases, the upper band of the indicator at 1.2050 will offer resistance.

Description of indicators

- Moving average determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving average determines the current trend by smoothing volatility and noise. The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- Total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.