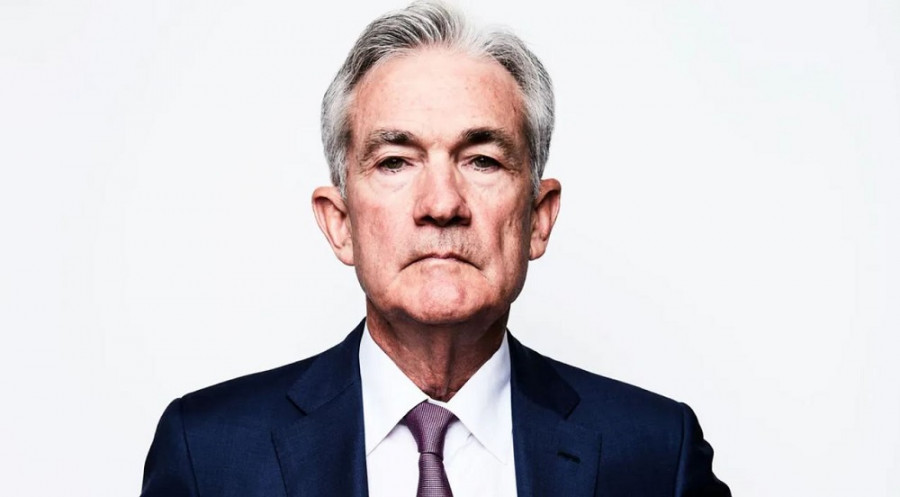

The EUR/USD pair suddenly fell, having tested the 6th figure. Although traders failed to hold steady in this price area, market participants are showing growing interest in the U.S. currency. The greenback was not only supported by Friday's strong Nonfarm Payrolls report, but also by Federal Reserve Chairman Jerome Powell, who sounded some rather hawkish signals on Tuesday. The Fed chief spoke at the Economic Club in Washington, D.C., where he commented on the latest economic data and also spoke on inflation.

Powell's ambivalent message

The pair initially surged by nearly 100 points amid the general weakening of the U.S. dollar. It reacted this way because Powell mentioned that the disinflationary process has begun in America. He did however clarify that the process, in particular, is observed in goods but hasn't kicked in the service sector yet.

The market interpreted these words against the greenback, as Powell's rhetoric was "final" in the context of a possible hawkish rate hike. Such assumptions were reinforced after the Fed chief reacted rather calmly to January's Nonfarm payrolls, making it clear that Friday's jobs report would not change the central bank's approach to future interest rate hikes.

In the backdrop of such conclusions, the EUR/USD jumped from 1.0690 to the target of 1.0770 within an hour. But Powell's follow-up rhetoric allowed the bears to test the 6th figure again.

Long, long way to go

After acknowledging the fact that the U.S. began the disinflationary process, Powell noted that it may take a long time for the consumer price growth rate to slow down. As part of his speech, he highlighted that getting inflation down to 2% will take a "significant period of time." In this context, he used phrases that were different in form (but identical in meaning) - that the Fed would take "a considerable period of time" and that it was "still early in the process" in general.

But in the end, Powell was very specific about the timing, which is uncharacteristic of him, stating that inflation in the U.S. won't slow down until 2024. He said the following verbatim: "My guess is it will take certainly into not just this year, but next year to get down close to 2%."

Powell expanded on this point by making two other important points. First, he said that interest rates will continue to rise. Since rates have not yet reached an acceptable level for fighting inflation (without specifying what level of the rate is "acceptable"). Secondly, he reassured the markets that the Fed would have to hold policy at a restrictive level for "some time". Again, Powell also did not specify how long the Fed intends to keep the rate at the peak level.

However, despite the wording (except for the reference to 2024), Powell made it clear that the U.S. central bank is not going to curtail its hawkish strategy in the foreseeable future. In practice, that means the Fed will increase the rate by 25 points not only in March, but probably at the next two meetings as well. Investors now place a 71% probability of a 25-point rate hike at the Fed's May meeting, according to the CME's FedWatch tool. The likelihood of another round of hikes at the June meeting is estimated at 35% (which is not insignificant given the slowdown in U.S. inflation).

Conclusions

Despite the fact that bears failed to settle in the area of the 6th figure, bearish sentiment still dominates the pair. As a matter of fact, Powell ruled out the end of the current tightening cycle (thereby, denying the rumors) and announced further steps in the direction of the range of 5.25-5.50%.

At the same time, the European Central Bank did not ally itself with the euro at the end of its February meeting. ECB President Christine Lagarde, while announcing the realization of the 50-point scenario in March, simultaneously cast doubt on further rate hikes. According to her, after the March decision "we will then evaluate the subsequent path of our monetary policy,". Euro-area headline inflation has decelerated for the third straight month, and at a fairly brisk pace (it came in at 8.5% in January against a forecast of 9.0%). If the core CPI in February-March repeats the trajectory of the headline inflation, a "post-March" rate hike will be highly questionable.

From a technical point of view, the pair is between the middle and bottom lines of the Bollinger Bands indicator, as well as under the Tenkan-sen lines. According to Tuesday's results, the bears were unable to push through the support level of 1.0700 (bottom line of the Bollinger Bands on the D1). If the bears overcome this barrier, the next target will be 1.0600, which corresponds to the upper limit of the Kumo cloud on the same chart.