On Monday, there was almost no movement in the EUR/USD currency pair. Volatility was low, which can be partially attributed to the absence of significant macroeconomic and fundamental events. Moreover, Mondays frequently feature weak movements. After the weekend, the market needs to "swing," which takes some time. However, the pair continued to trade below the moving average line, indicating that there is currently no flat. An attempt to break over the moving average line was made last week, but it was unsuccessful due to the news on US inflation. The US dollar should have increased in price as January witnessed a very minor slowdown in inflation. As the market recognized its mistake, it stopped selling it and started buying it again. We witnessed a false overcoming of the moving at this point, which was shortly leveled. According to the Heiken Ashi indicator's current downward trend, the pair may fall to the levels of 1.0590 and 1.0620 today. We anticipate that the European currency will continue to decline for at least another two to three weeks. The pair can successfully shift downwards during this period. If the market is set for an upward trend in 2023, it will be sufficient to begin developing one later.

As we've already mentioned, the market has already figured out one of the main things that have been helping the euro currency in recent months. The market was able to anticipate a 1.25% rate increase because the ECB had previously disclosed its expectations for the upcoming several months. As inflation is still extremely high, the European Central Bank will probably not stop at this level of tightening, but the market is still in the dark regarding the regulator's next moves. In any case, the euro currency cannot continue to appreciate even if the "hawkish" sentiment holds strong through May and June. In any case, corrections are necessary.

Olli Rehn: Interest rates will continue to rise until the summer.

The statement by Olli Rehn, a member of the ECB monetary committee, may have been the sole event on Monday. He delivered the speech that was, in theory, required of him. He specifically stated that the rate hike should continue since core inflation is still too high and has not slowed down. The rate should increase by 0.5% again in March. It is advised to keep growing the pace until the summer when it should reach its maximum level. So, for a very long period, the rates will need to be kept high enough for inflation to recover to 2%. In general, all of these theses have been known to the market for a long time, except for the statements regarding the potential continuation of tightening into the summer. As we previously stated, the ECB is expected to maintain its "hawkish" stance, which may support the euro in the medium term. But, it is important to keep in mind that the Fed may also continue to raise interest rates until the summer. And in this instance, the Fed rate will almost certainly be higher by that time than the ECB rate. As a result, in our opinion, the euro will no longer enjoy widespread support. Therefore, it should no longer be justified in a sharp decline in the price parity area.

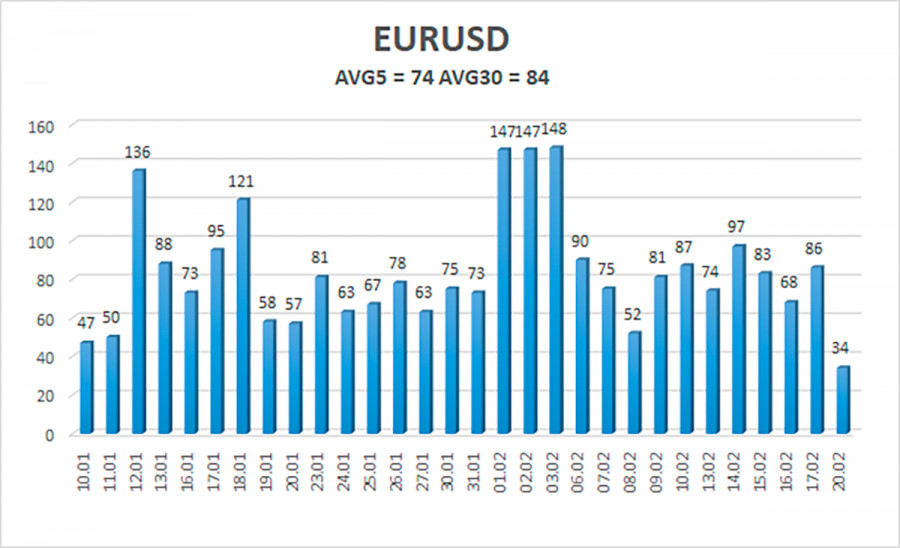

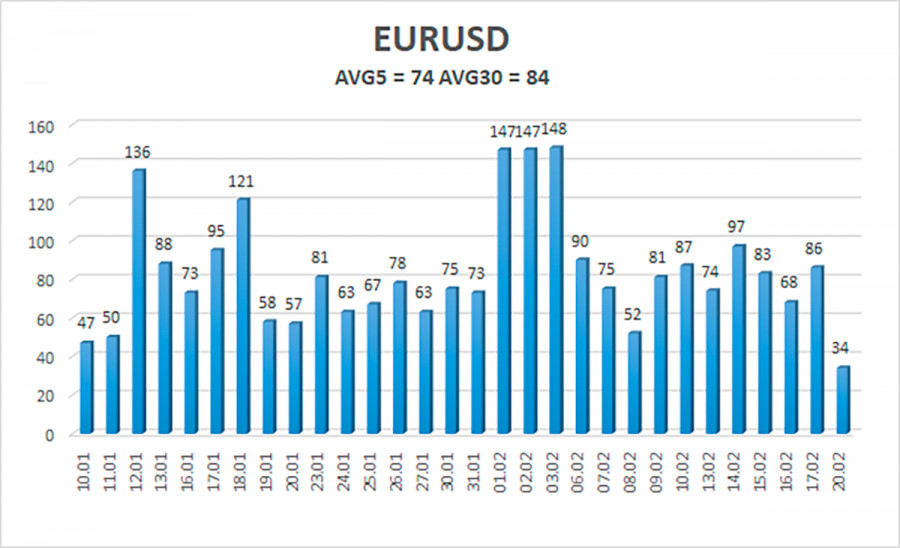

We see the level of 1.0600 as the lowest target for the present downward movement because there is around where the Senkou Span B line intersects the 24-hour TF. The critical line was crossed on the same TF. The pair has been slowly declining to this point, and this week's macroeconomic and fundamental conditions are not expected to stop it. Hence, nothing has altered in our prognosis as of yet. While volatility has recently dropped to a relatively low level of 74 points per day, we continue to anticipate a fall in the pair, albeit a slow one. Market participants appear to indicate that there aren't many reasons to engage in aggressive trading right now. As a result, you must choose between waiting for new, significant publications and events or relying on weak movements right away.

As of February 21, the euro/dollar currency pair's average volatility over the previous five trading days was 74 points, which is considered to be "normal." Thus, on Tuesday, we anticipate the pair to move between 1.0590 and 1.0738 levels. A new round of correction will be signaled by the Heiken Ashi indicator's upward movement.

Nearest levels of support

S1 – 1.0620

S2 – 1.0498

S3 – 1.0376

Nearest levels of resistance

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Trade Advice:

The EUR/USD pair is still moving south. Before the Heiken Ashi indication comes up, we can now consider opening new short positions with targets of 1.0590 and 1.0620. After the price is fixed above the moving average line, long positions can be initiated with targets of 1.0742 and 1.0864.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.