The EUR/USD currency pair has long been prevented from further dropping, which would be the most logical outcome. Nonetheless, it should be acknowledged that we subconsciously expect the pair to move trendily and volatilely every day. In the market, things frequently go in different directions. Two of the five workdays may be entirely free to be flat. We can recall a time when the euro's volatility was stable for several months at a level of 40 to 50 points. Also, a flat was seen at the same time. Trading was simply impossible at the time, but you can't order the market because the market is made up of a large number of individuals who operate independently of one another. Hence, there is nothing that can be done about the "swing" that is currently being seen.

On the lower TF, it is advisable to use "swings," as we have already stated. These are pretty good movements because they are on the 4-hour TF "swing" and the lower ones. Regrettably, there aren't always movements on the lower charts where you can profit, but it would be ideal if the pair moved precisely every day. Hence, all we can do is make sure we don't miss days that are trending, like Monday and Wednesday of last week, when the market was intensely focused on the failure of major American banks and then Credit Suisse's financial report, which revealed numerous issues with the bank. It was feasible to make a ton of money on these swings as the dollar first declined and then the euro. On the other days, preventing significant losses was the major objective. The pair can only be traded in this manner for now. The scenario might not change even after the Fed meeting's outcomes are announced because it is evident to everyone that the rate will increase by 0.25% once more.

It is possible to stop the "bankfall" in the European Union.

In the interim, Credit Suisse is being actively saved. Technically speaking, the situation at the Swiss bank is not yet so dire that bankruptcy should be discussed. Yet, as soon as "smoke" starts to form, depositors demand their money back right once, and creditors demand payment for their loans, which makes the liquidity issue much worse. We might even argue that the revelation of the financial problems rather than the problems themselves is the worst part. There won't be panic or a capital outflow if no one is aware of the current issues. But, Credit Suisse's issues are now widely known. Now, Credit Suisse is being discussed for a possible acquisition by UBS, the largest Swiss bank, with Swiss government backing. UBS requests that the Swiss government make specific guarantees and pay for potential losses. All of this has only reached the level of rumors thus far, as official statements from Credit Suisse, UBS, and the government has all been declined.

Yet, we think a purchase will prevent the bank from going down. It should be kept in mind that Switzerland has long been one of the best places to keep the money. Also, all of its banks may be affected by the issues at one of its largest banks. In the long run, a systematic outflow of deposits may commence, something Switzerland would prefer to avoid. Thus, we are confident that the national government will provide the money required to save Credit Suisse and give UBS all the necessary assurances. It simply takes time. In general, we think the discussion surrounding the troubled Swiss bank is over and that the market has already resolved it.

Hence, the essential thing is not to bust any more banks in the near future, because the process of "bankfall," according to some experts, has already begun. Naturally, publications regarding a new economic crisis similar to the one in 2008 started to appear right away. But we think that for the time being, we should concentrate on more important events, including the Fed meeting. And to be even more specific, as everything stretches from traders, the "swing" should now play a crucial role for traders. Whatever the fundamental and macroeconomic backgrounds, if the pair is flat or sideways, there will be no movement

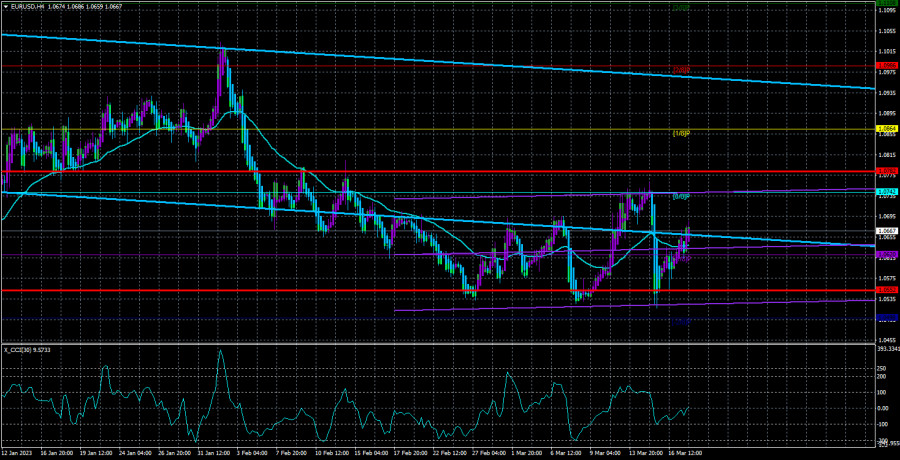

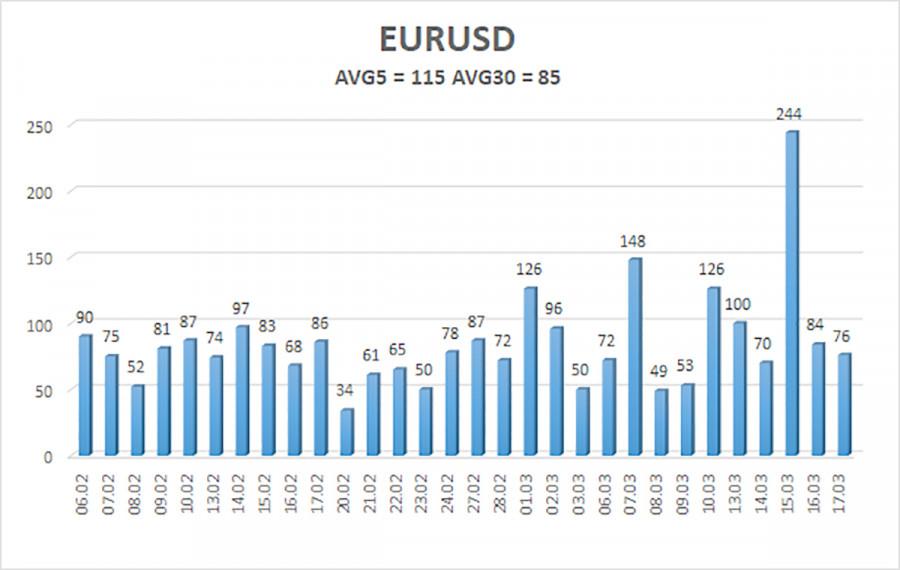

As of March 20, the euro/dollar currency pair's average volatility over the previous five trading days was 115 points, which is considered to be "high." Hence, on Monday, we anticipate the pair to move between 1.0552 and 1.0782. A new round of downward movement within the "swing" will be signaled by the Heiken Ashi indicator reversing direction back down.

Nearest levels of support

S1 – 1.0620

S2 – 1.0498

Nearest levels of resistance

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Trade Suggestions:

The EUR/USD pair is presently above the moving average and has once again shifted in direction. Until the Heiken Ashi indicator turns down, you can continue holding long positions with targets of 1.0742 and 1.0782. If the price is fixed below the moving average line, short positions can be initiated with targets of 1.0552 and 1.0498.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.