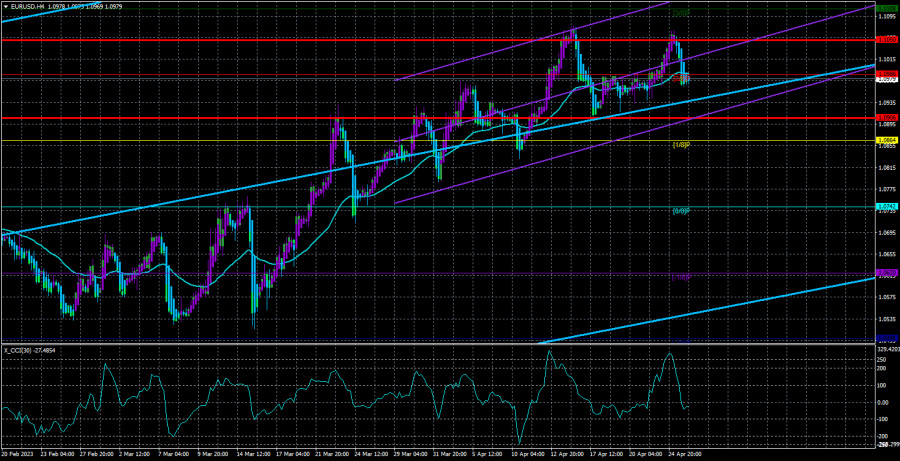

On Tuesday, the EUR/USD currency pair unexpectedly showed a rather strong decline for many. At the beginning of the day, the pair reached the previous local peak near the 1.1060 level but immediately turned downward, falling nearly 100 points during the day. Naturally, there were no macroeconomic or fundamental reasons for this. There were no important events or publications throughout the day yesterday. Therefore, based on the overall picture of the situation, the absolutely logical growth of the dollar also looked strange. We argue that the US currency should appreciate, and it should appreciate significantly. The CCI indicator has entered the overbought area (above the +250 mark) for the second time, which, again, happens extremely rarely. That is, we already have two strong sell signals and signals of a strong overbought state for the pair.

This is what we have been talking about constantly in recent weeks. The European currency is growing without reason, and traders interpret most news and publications in favor of the euro currency or as they see fit. The macroeconomic background for the dollar is stronger than for the euro. The Federal Reserve rate is still rising, as is the ECB rate, but the former remains higher, and inflation is falling faster. There are now many more reasons for the growth of the dollar than for the growth of the euro after it has already risen almost 600 points.

In the 24-hour timeframe, whether growth will continue is still being determined. Overcoming the important Fibonacci level of 50.0% indicates traders' desire to continue buying, but the two overbought signals on the 4-hour timeframe cannot be ignored. We have already said earlier that, in theory, the market may completely ignore all sell signals, and the exchange rate depends only on the actions of market participants, not on technical analysis. Technical analysis only visualizes what is happening in the market but does not control it. However, if the technical analysis does not allow prediction, then the question arises: why is it needed at all? Now we are in exactly such a situation – all sell signals are still not being executed, and the euro currency maintains a high probability of collapse at any moment.

Philip Lane did not surprise the market.

What to say about yesterday when there were no important events? Yes, one can note the speech of Philip Lane, who repeated for the hundredth time what the market has long known. After the ECB's May meeting, it will carefully study the incoming information and raise rates only following it. The ECB rate will continue to rise, but at what value and pace, central bank representatives cannot say. Although there are many more "dovish" statements about ending tightening soon, Fed representatives are still essentially saying the same thing. But it should be remembered that inflation in the United States has already fallen to 5%, and the effect of raising rates can be observed within 18 months. Therefore, it is indeed time for the Fed to pause.

As for the ECB, there is no pause, but the ECB has much more limited options for raising rates. The European economy continues to balance on the verge of negative growth, and no one wants to allow a recession. We still believe that the European regulator will raise rates three more times by 0.25%, and that's it. And this is only 0.5% higher than the possible increase in the Fed rate in 2023. And if this factor has supported the euro currency in the last one and a half months, it has long been worked out. Consequently, the European currency should fall. At this time, it is again fixed below the moving average line, again literally by 10 points. The last local peak was not updated, so the technical probability of it falling is increasing. But be careful: before the fall begins, the pair may crawl up for several more weeks with the last of their strength.

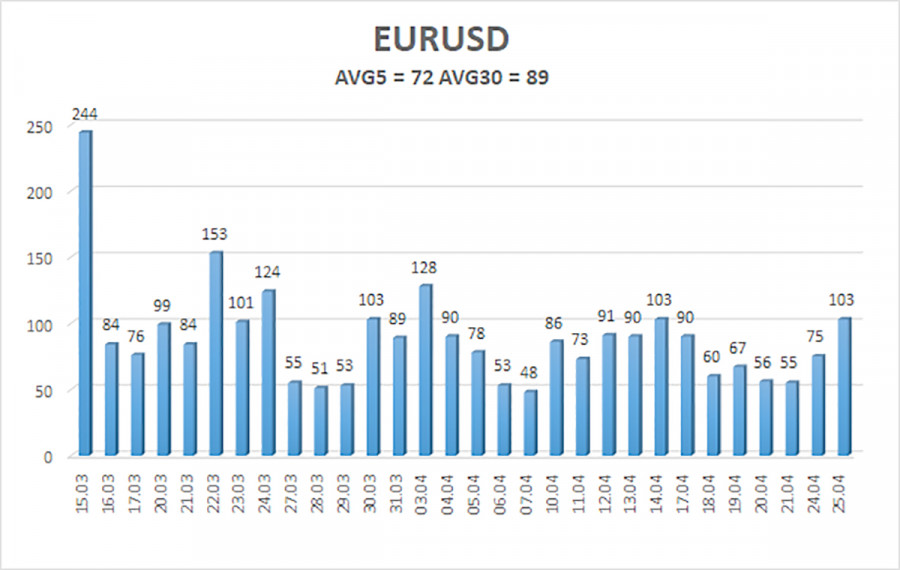

The average volatility of the euro/dollar currency pair over the last five trading days as of April 26 was 72 points and is characterized as "medium-low." Thus, we expect the pair to move between levels 1.0906 and 1.1050 on Wednesday. A reversal of the Heiken Ashi indicator back up will indicate a possible resumption of the upward movement.

Nearest support levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest resistance levels:

R1 – 1.0986

R2 – 1.1108

R3 – 1.1230

Trading recommendations:

The EUR/USD pair is trying to correct this again. Or finally start a downtrend. You can stay in short positions with targets of 1.0906 and 1.0864 until the Heiken Ashi indicator turns up. Long positions can be opened after the price consolidates above the moving average with targets of 1.1050 and 1.1108.

Explanation of illustrations:

Linear regression channels - help determine the current trend. If both are directed in one direction, then the trend is strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal is approaching in the opposite direction.