5M chart of GBP/USD

The GBP/USD pair showed a significant drop in the second half of last week, and on Monday, it started to correct. The British pound didn't stand still throughout the day, like the euro, the movement was quite strong, considering the almost complete absence of macro data. During the day, several representatives of the Federal Reserve's Monetary Committee spoke, but all of them took place in the second half of the day, and the pound began to appreciate from the very morning, so we conclude that this movement is of a technical nature. However, the pound is showing significant growth for almost no reason. For now, it can be attributed to the technical need to correct, but if it continues, then the pound can very quickly and easily restore the bullish trend. We, of course, continue to advocate for the continuation of the pair's fall, which remains heavily overbought.

If the euro was unlucky with trading signals, then the pound had wonderful ones. At the very beginning of the European trading session, the pair rebounded from the 1.2458 level, after which it managed to rise to the nearest target level of 1.2520, from which it rebounded twice. Thus, traders should have opened a long position, the profit on which was 35 points. Not much, but this made it possible to offset the loss on the EUR/USD pair, which is already a good thing.

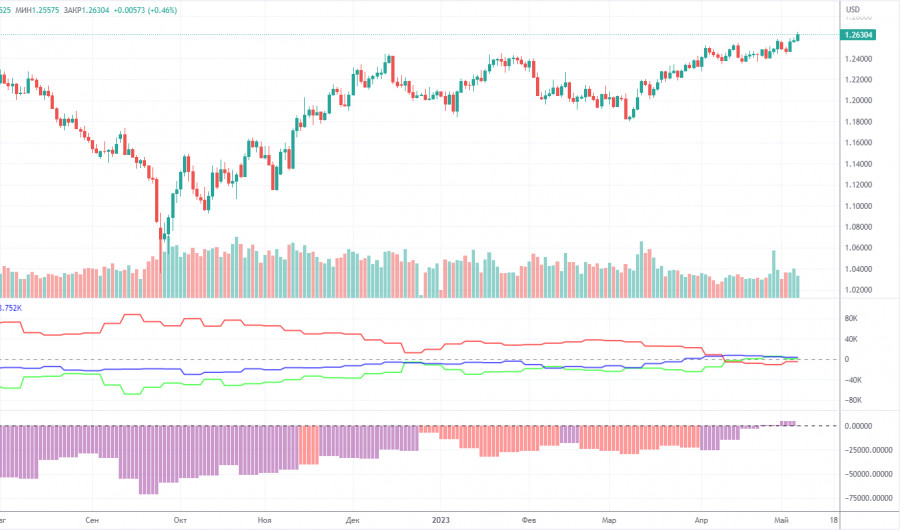

COT report:

According to the latest report on the British pound, the non-commercial group opened 12,900 long positions and 9,500 short positions. Thus, the net position of non-commercial traders increased by 3,400 and continues to grow overall. The net position has been steadily rising for the past 8-9 months, but the sentiment of major market players remained bearish during this time. It has turned slightly bullish just recently. Although the British pound is strengthening against the US dollar in the medium term, it is hard to explain this behavior from the fundamental point of view. There is still the possibility of a sharp decline in the pound. Perhaps it has even already begun.

Both major pairs are moving in a similar way now, but the net position of the euro is positive and even implies the imminent completion of the upward momentum, while the net position of the pound still suggests further growth, as it is neutral. The British currency has risen by 2300 points, which is a lot, and without a strong bearish correction, the continuation of growth would be absolutely illogical (even if we ignore the lack of fundamental support). The non-commercial group has a total of 67,000 shorts and 71,500 longs. I remain skeptical about the long-term growth of the British currency and expect it to decline soon but the market sentiment remains largely bullish.

1H chart of GBP/USD

On the 1-hour chart, GBP/USD broke through the ascending trend line last Friday, so according to all canons of technical analysis, the decline should continue. On Monday, the price corrected almost to the Senkou Span B and Kijun-sen lines, so a rebound from them could just provoke a new round of decline. However, take note that in the case with the previous three or four ascending trend lines, the decline did not continue after they were overcome. We would like to believe that the pound has finished its baseless growth, but this is the market, anything can happen. You need to be prepared for any scenario.

For May 16, we highlight the following important levels: 1.2349, 1.2429-1.2458, 1.2520, 1.2589, 1.2666. Senkou Span B (1.2550) and Kijun-sen (1.2560) lines can also generate signals. Rebounds and breakouts from these lines can also serve as trading signals. It is better to set the Stop Loss at breakeven as soon as the price moves by 20 pips in the right direction. The lines of the Ichimoku indicator can change their position throughout the day which is worth keeping in mind when looking for trading signals. On the chart, you can also see support and resistance levels where you can take profit.

On Tuesday in the UK, unemployment data, claims for unemployment benefits and wages will be published. Not the most important reports, but they can provoke some reaction. We also have the same picture in the US. Reports on industrial production and retail sales cannot be considered important, but they can provoke some reaction. I believe that the pound should resume its decline. The probability of such a scenario is high below the Ichimoku indicator lines.

Indicators on charts:

Resistance/support - thick red lines, near which the trend may stop. They do not make trading signals.

Kijun-sen and Senkou Span B are the Ichimoku indicator lines moved to the hourly timeframe from the 4-hour timeframe. They are also strong lines.

Extreme levels are thin red lines, from which the price used to bounce earlier. They can produce trading signals.

Yellow lines are trend lines, trend channels, and any other technical patterns.

Indicator 1 on the COT chart is the size of the net position of each trader category.

Indicator 2 on the COT chart is the size of the net position for the Non-commercial group of traders.