The EUR/USD currency pair has continued its downward trend for more than a week, which has not happened for over two months. As previously stated, we fully support the decline of the European currency and expect the pair to be around the last local minimum - around the fifth level. Even during the last round of corrective movement against the global upward trend, the pair has not corrected enough. Therefore, we expect it to go below the level of $1.05 from time to time. In recent months, the European currency has been constantly growing, which has caused confusion, as the state of the European economy is similar to the American one. The Fed rate is higher than the ECB rate and will remain so. The fact that the ECB may raise the rate in 2023 more than the Fed has the market more than worked out. Therefore, there are no further reasons for the growth of the euro.

However, there are also no reasons for the new strengthening of the American currency. In the last year and a half to two years, the fundamental background was very strong, so the pair either actively grew or declined. However, at this time, the geopolitical conflict in Ukraine no longer has as strong an influence on the market as it did a year ago. The pandemic is over, and the global economy has recovered from the crisis as best it could. Central banks are preparing to end the monetary policy tightening cycle. The next important theme on the horizon is lowering key rates, which can be expected by the beginning of next year. Then it will be important to determine which bank lowers rates faster and stronger. But we advocate consolidating the currency pair for the next 3–6 months. If you look at the 24-hour timeframe, you can already say that consolidation has begun, as since December of last year, the pair has been trading between levels 1.05 and 1.11.

The dollar is not worried about a possible default. As we have repeatedly said, the probability of a technical default in the US is elusive. The issue of the government debt limit arises every year and has at least, several possible solutions. Congress can raise the borrowing "ceiling," "freeze" it, and postpone the "limit." In any case, the problem will be solved, and there will be no default. During the Donald Trump administration, the US endured a more than month-long "shutdown" due to the same issue, but no default occurred. Even the US's main alarmist, Janet Yellen, states that the money in the Treasury will run out exactly on June 1 because it is impossible to calculate the exact amount of tax revenue. So there are certainly a few more weeks to resolve the problem. During this time, Democrats and Republicans might find common ground.

The problem would have been solved if each party had tried to get as few preferences as possible for itself. The Democrats, as the ruling party, are promoting the decision to increase the limit. Naturally, they are interested in the highest spending, as it depends on the results of their governance. Republicans are not interested in maximum spending, as they aim to seize power, for which the Democrats must show the poor performance of their work and cause social disapproval. Republicans, therefore, demand a serious reduction in federal spending, which will inevitably lead to the Democrats losing the next elections, both presidential and parliamentary. Naturally, Democrats do not agree with such a "generous" offer in exchange for approval to increase the "ceiling," and now they are dragging out the time, understanding perfectly well that the Republicans are not interested in a default either. It's a normal, natural political game. Refrain from speaking belatedly if the relevant decision will be taken in the last 5 minutes.

Meanwhile, the dollar is growing calmly, paying no attention to a possible default or other political games. This topic has no influence on the exchange rate of the American currency at the moment. The 4-hour TF maintains a downward trend, and the price falls for the first time after overcoming the moving average.

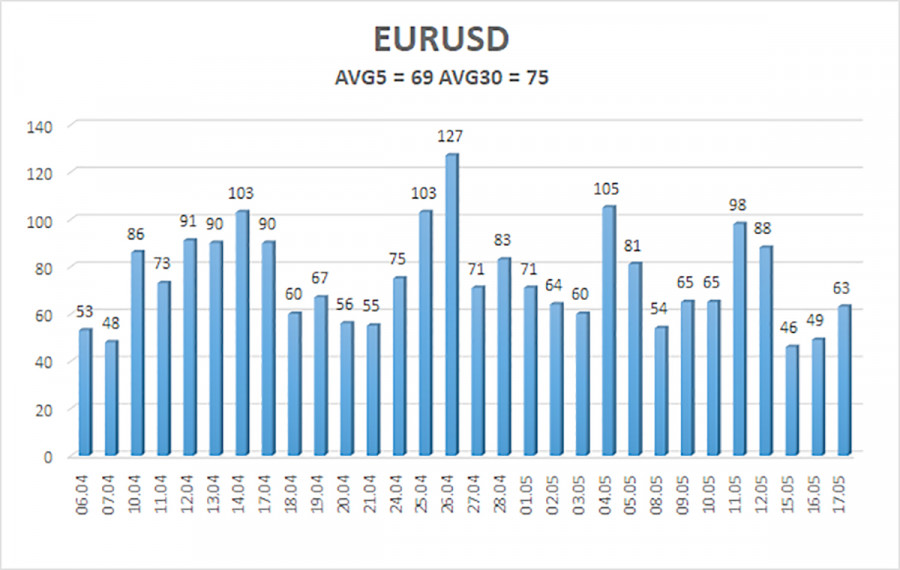

The average volatility of the euro/dollar currency pair over the last five trading days as of May 18 is 69 points and is characterized as "average." Thus, we expect the pair to move between levels 1.0775 and 1.0913 on Thursday. A reversal of the Heiken Ashi indicator upwards will indicate a new wave of corrective movement.

The nearest support levels:

S1 – 1.0803

S2 – 1.0742

S3 – 1.0681

The nearest resistance levels:

R1 – 1.0864

R2 – 1.0925

R3 – 1.0986

Trading recommendations:

The EUR/USD pair has left the sideways channel and may now continue to form a new downward trend. It is advisable to remain in short positions until the Heiken Ashi indicator reaches targets of 1.0803 and 1.0775. Long positions will become relevant before the price fixes above the moving average with a target of 1.0986.

Explanation of illustrations:

Linear regression channels - help to determine the current trend. If both are directed in one direction, then the trend is strong.

Moving average line(settings 20.0, smoothed) - determines the short-term trend and direction in which to trade now.

Murray levels - target levels for movements and corrections.

Volatility levels(red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI Indicator - its entry into the oversold area (below -250) or overbought area(above +250) means a trend reversal in the opposite direction is approaching.