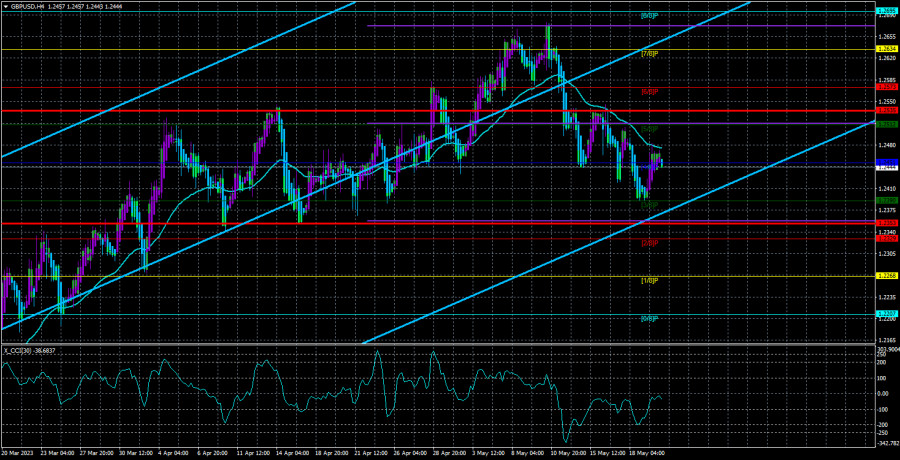

GBP/USD developed a slight correction on Friday, approaching the moving average line. At the moment, the price has rebounded from the moving average, indicating a potential resumption of the downward movement. This development is both logical and expected. It should be noted that the British pound's correction has been purely symbolic, considering its significant rise over the past two months. Moreover, this uptrend was largely unfounded. The CCI indicator has twice entered the overbought zone, and the current 280-pip decline in the pair can hardly be considered a substantial correction after a 900-pip increase. Therefore, we maintain the view that the British pound should continue to fall at a faster pace than it currently does. This process may require some time because a potential 600-pip decline, for example, does not mean it will occur within two weeks or without any interim corrections.

On Friday, the pound received a boost from Powell's statement. The head of the Federal Reserve expressed a high probability of pausing the tightening of monetary policy, a development that should not have come as a shock to the market. Nonetheless, traders briefly pushed the US dollar down but a 50-pip loss should not undermine the emerging downward trend. The rebound from the moving average itself serves as a signal to sell.

On the 24-hour time frame, the current correction is barely visible. We believe it should ideally finish near the 1.1800 level. There are currently limited grounds for a more significant decline in the pound as the global fundamental backdrop does not support either the dollar or the British currency. Over the past year, the fundamental factors have been primarily influenced by the monetary policies of the Bank of England and the Federal Reserve, accounting for around 70% of the overall picture. Currently, this factor is reaching its culmination as both central banks are prepared to halt their tightening cycles. Despite the hawkish rhetoric from Andrew Bailey and his colleagues, the Bank of England may also abandon further tightening after 12 rate hikes.

The US debt ceiling problem does not directly affect USD but limits its growth

On the other hand, British macroeconomic statistics continue to disappoint markets. Of course, the fact that inflation doesn't ease after 12 consecutive rate hikes by the Bank of England is a key concern. The economy has been teetering on the edge of a recession for several quarters, and it is surprising that it has not started yet, considering that even the Bank of England warned of a prolonged (8-quarter) recession. Undoubtedly, the longer interest rates remain high (with no grounds for lowering them), the higher the likelihood of a recession. We believe that the UK cannot escape this eventuality. However, for now, the UK economy is not as bad as it could be but it is still far from its perfect shape.

In the United States, there is currently only one problem that requires a prompt resolution. The debt ceiling will be raised, frozen, or its implementation will be postponed in any case. The problem will be resolved one way or another. However, the markets are still nervous about this issue, which may explain the relatively weak growth of the US dollar despite all the factors favoring it.

President Joe Biden is currently on tour this week, but that does not mean negotiations have stalled. Progress has not been made yet, but apart from Biden, there are numerous congressmen who can negotiate on his behalf. However, no one will rush into a decision. There is still one week until June 1, and as we anticipated, the resolution will most likely come at the last minute. This is not surprising, as each party is trying to maximize its benefits from the future agreement. When the decision to raise the limit is announced, the dollar may receive additional market support, which again would be entirely logical. Therefore, we continue to anticipate a downtrend in the US dollar.

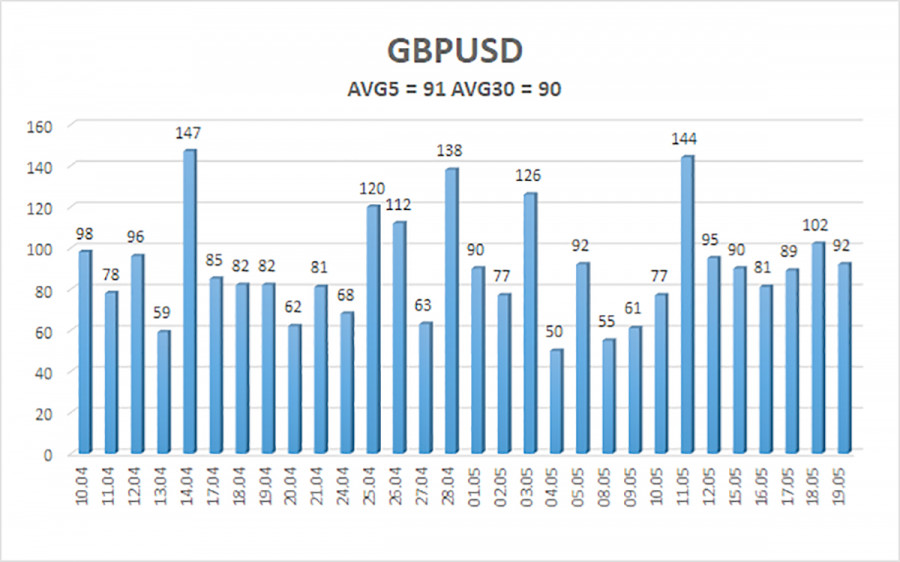

The average volatility of the pair for the past 5 days was in the range of 91 pips. This range is considered average for the pound/dollar pair. On Monday, May 22, we expect the pair to trade in the channel between 1.2353 and 1.2535. The downside reversal in the Heiken Ashi indicator will signal the resumption of the downtrend.

Nearest support levels:

S1 – 1.2390

S2 – 1.2329

S3 – 1.2268

Nearest resistance levels:

R1 – 1.2451

R2 – 1.2512

R3 – 1.2573

Trading recommendations:

GBP/USD has gone through a slight correction on the 4-hour chart, making sell positions relevant with the downward targets at 1.2390 and 1.2353. Short positions should be opened after the Heiken Ashi indicator reverses to the downside. Long positions can be opened when the price settles above the moving average with the targets at 1.2535 and 1.2573.

Description:

Linear regression channels help define the current trend. If both channels are moving in one direction, the trend is really strong.

The moving average (20-day period, smoothed) shows a short-term trend and suggests the direction of trading.

Murray levels are target levels for price movements and corrections.

Volatility levels (red lines) represent a possible channel where the price is likely to stay in the next 24 hours based on the current volatility rate.

When the CCI enters the oversold zone (below -250) or the overbought zone (above +250), a trend is about to reverse soon.