On Monday, the GBP/USD currency pair displayed weak movements and remained almost flat. There were no significant events in the UK or the USA, making the market's absolute passivity quite logical. However, today, traders can expect crucial information to be released.

As a reminder, the United States publishes two business activity indices: S&P and ISM. The latter is far more important than the former, often causing a strong market reaction. The JOLTs report will also be published today, providing insights into job openings in the USA. It serves as a somewhat analogous indicator to unemployment and Nonfarm Payrolls. While slight deviations from the forecast might not trigger strong market reactions, significant deviations will capture traders' attention. Hence, we anticipate increased volatility starting today.

Unfortunately, predicting the exact values of these reports in advance is impossible, so traders should be prepared for movement in either direction. We have consistently maintained that a decline in the pound is the most logical and reasonable scenario. However, this week's agenda includes the Bank of England meeting, NonFarm Payrolls, unemployment figures, ISM indices, and other significant reports. If American statistics disappoint, the dollar might experience a further decline. Conversely, indications from Andrew Bailey and his colleagues about continued tightening could lead to the British pound rising again.

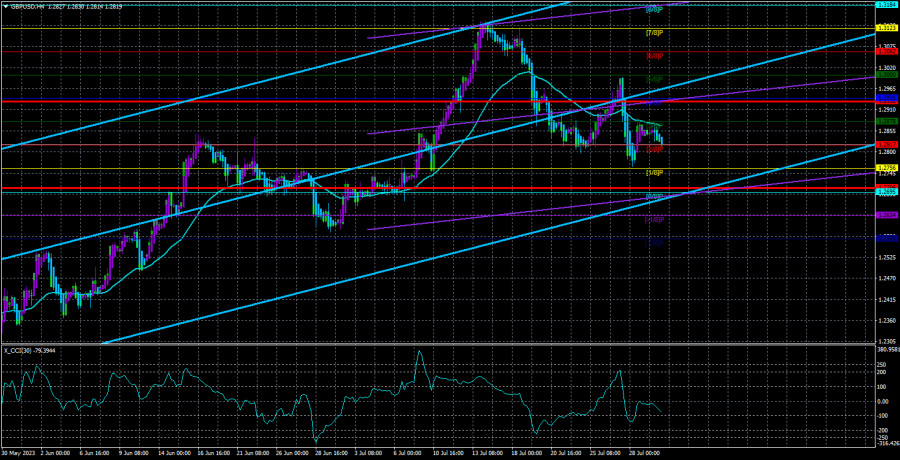

Currently, no technical indicators suggest a resumption of the upward trend. The price remains below the moving average, indicating the decline will persist.

Neel Kashkari expressed concerns, although not overly strong ones. The most interesting events for the British pound are scheduled for Thursday this week. For now, let's focus on the American economy. In addition to all the reports mentioned above, information from Federal Reserve officials has already begun to emerge. As a reminder, until last Wednesday, they were prohibited from commenting on the economy and monetary policy. Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, was the first to break this silence. He stated that the unemployment rate may rise soon while inflation has decreased significantly. However, he needed help answering whether the regulator has concluded the tightening cycle and is open to another rate hike. "Now everything depends on the incoming macroeconomic information. Future rate decisions will depend on it," Mr. Kashkari believes.

This rhetoric resembles what we've heard before. If inflation strengthens over the next few months, the Federal Reserve will likely proceed with further tightening. The Federal Reserve can afford this move despite concerns from Kashkari and other policymakers, as unemployment remains low, the labor market shows no signs of issues, and GDP growth outpaces predictions. The question is whether further tightening is necessary. If inflation decreases over the next two months (leading to the next meeting), why raise the rate again when the CPI could already be at 2.5% (for example)? Consequently, the Federal Reserve is closer than ever to completing the tightening process.

If the Bank of England signals that it is also approaching this point, the pound may continue to lose its position. The market has long been indifferent to the decisions made by the Federal Reserve, and everything now depends on the stance of the British regulator regarding interest rates. While the pound's inertial growth may resume, believing in its strengthening with each passing day becomes increasingly challenging.

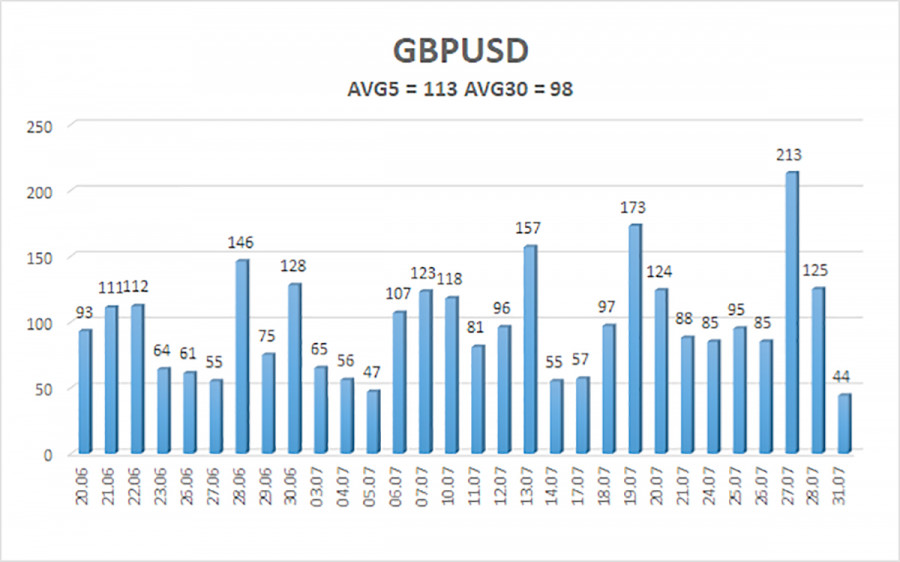

The average volatility of the GBP/USD pair over the last five trading days is 113 pips, a value considered "high" for the pound/dollar pair. On Tuesday, August 1st, we expect movements between 1.2706 and 1.2932. An upward reversal of the Heiken Ashi indicator will signal a new upward movement phase.

Nearest support levels:

S1 - 1.2817

S2 - 1.2756

S3 - 1.2695

Nearest resistance levels:

R1 - 1.2878

R2 - 1.2939

R3 - 1.3000

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair has again moved below the moving average. It is advisable to maintain short positions with targets at 1.2756 and 1.2706 until the Heiken Ashi indicator shows an upward reversal. If the price is securely established above the moving average, long positions may be considered with targets at 1.2932 and 1.3000.

Illustrations' explanations:

- Linear regression channels help in determining the prevailing trend. When both channels are aligned in the same direction, it indicates a strong trend.

- The moving average line (settings 20.0, smoothed) defines the short-term trend and the preferred trading direction.

- Murray levels are the target levels for potential price movements and corrections.

- Volatility levels (red lines) represent the likely price channel within which the pair is expected to move in the next 24 hours based on the current volatility indicators.

- The CCI indicator's entry into the oversold zone (below -250) or the overbought zone (above +250) signals an upcoming trend reversal in the opposite direction.