The Federal Reserve Bank of New York released the July 2023 Survey of Consumer Expectations, median inflation expectations declined across all three horizons, falling from 3.8% to 3.5% at the one-year-ahead horizon - the lowest level since April 2021, and from 3.0% to 2.9% at both the three-year and five-year-ahead horizons.

UST yield is rising, and along with negative sentiment in Asia due to negative signals from China is putting pressure on the Japanese yen and supporting the US dollar.

China's economy, a key trading partner for both Australia and New Zealand, is slowing down. Industrial output increased 3.7% from a year earlier, slowing from the 4.4% pace seen in June. Investment in fixed assets in Q1 grew 3.4% y/y, compared to a 3.8% gain in the previous period. The trade balance increased, but this growth does not reflect an increase in exports, but a rapid decline in imports, primarily of raw materials, which will lead to a further slowdown in production. Domestic demand is getting weaker, retail sales in July increased by 2.8% against 3.1% a month earlier.

China's economic slowdown will inevitably impact Australian and New Zealand exports, leading to a decline, which will also put pressure on these countries' currencies.

So far, the trend favors the US dollar strengthening against G10 currencies, as the demand for risk as the primary driver of global economic growth slows down, and the dollar as the main safe-haven asset is unmatched, as the Japanese yen significantly falls behind in yield.

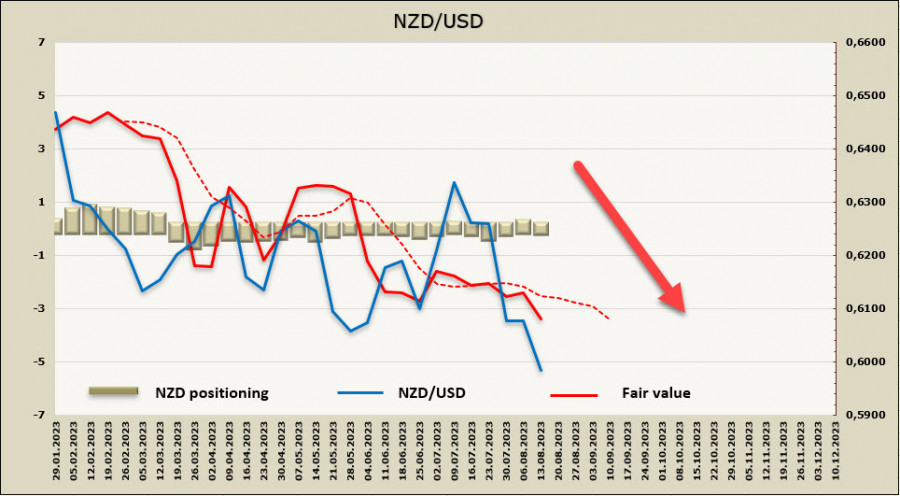

NZD/USD

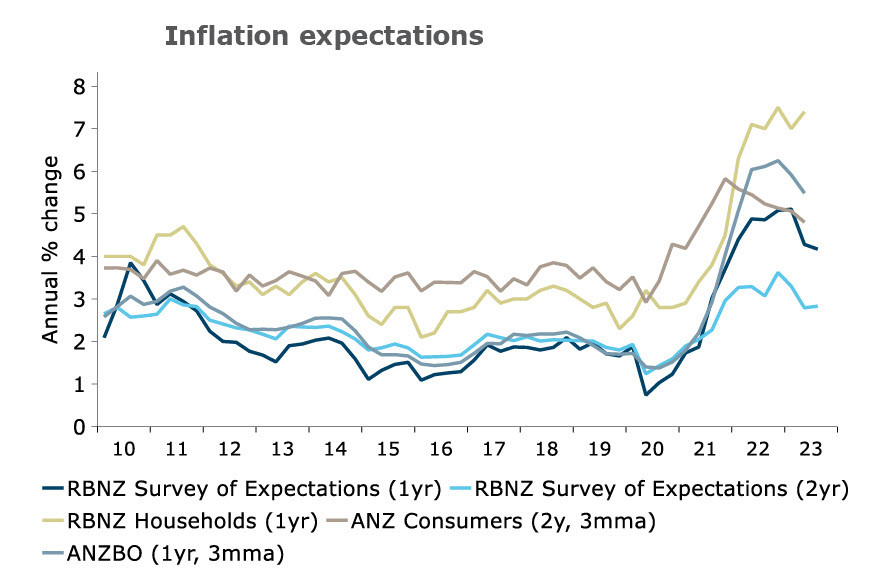

The Reserve Bank of New Zealand's inflation expectations survey published last week showed some progress. The only indicator that increased was two-year expectations, which increased from 2.79% to 2.83%. Other forecasts, however, showed opposite dynamics - the one-year forecast dropped by 11 basis points to 4.17%, the forecast for 5 and 10 years decreased to 2.25% and 2.22%, respectively.

Inflation expectations are important for projecting central bank actions. At the moment we can say that the data is not so unambiguous as to force the RBNZ to abandon the current strategy, at the next meeting it is expected that the rate will be kept unchanged at 5.5% and the RBNZ will continue to monitor developments. It is assumed that if the RBNZ does raise the interest rate again, it will not be before November, and by that time much could change.

The RBNZ was set to hold a meeting on Tuesday. Since the rate is expected to remain unchanged, there is likely to be some decline in NZD quotes in response to the results.

Speculative positioning in NZD remains neutral, with a weekly change of -120 million, a bearish bias of -22 million, i.e., minimal. The estimated price is declining, despite the fact that New Zealand bond yields are higher than UST yields.

The kiwi, as expected, found no grounds for corrective growth. The pair has reached the 0.5978 target, and now we expect it to move towards the lower band of the bearish channel at 0.5870/5900.

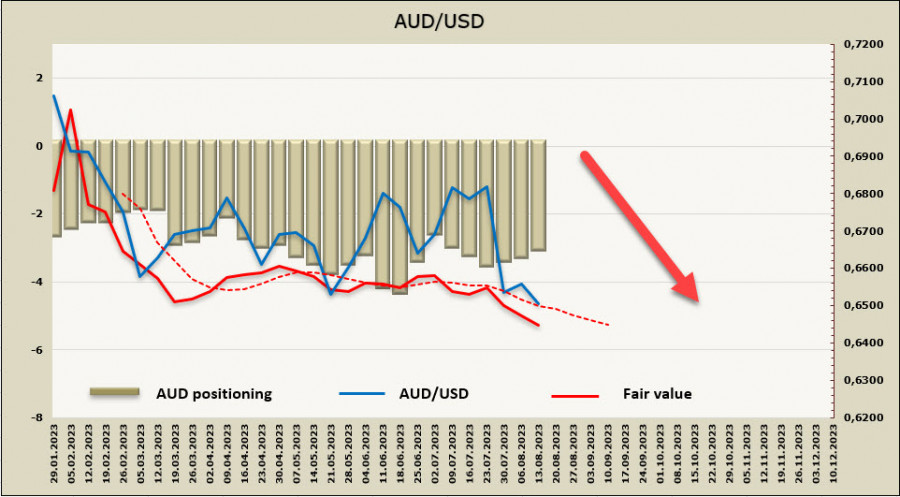

AUD/USD

The Reserve Bank of Australia's minutes published on Tuesday morning had no noticeable impact on AUD quotes. The minutes confirmed that the RBA considered raising rates at the August 1 meeting but chose to interpret signs of slowing inflation as "encouraging." As such, the rate was left unchanged.

Inflation in the second quarter fell deeper than expected, and the GDP forecast anticipates slow growth of 0.7% in 2023. Unemployment in June remained at 3.5%, which will support wage growth and, as a consequence, inflation. Overall, the economy has started to slow down, and therefore inflation has also started to decrease, but the rate of decline is still very low. There's still a chance that, after a pause, the RBA will again raise the rate once or twice, and this will prevent the AUD from falling too low against the USD.

The net short position in AUD decreased by 599 million over the reporting week to -2.826 billion. Despite this, the estimated price is going down, meaning that currently the direction of financial flows is clearly not in favor of the Australian dollar.

As expected, after slightly correcting higher, there was a re-test of the local low at 0.6460. The test was unsuccessful so far, as support held, but there's still a high chance of another downward wave. We expect the pair to fall, with the main target being the lower band of the channel at 0.6330/50.