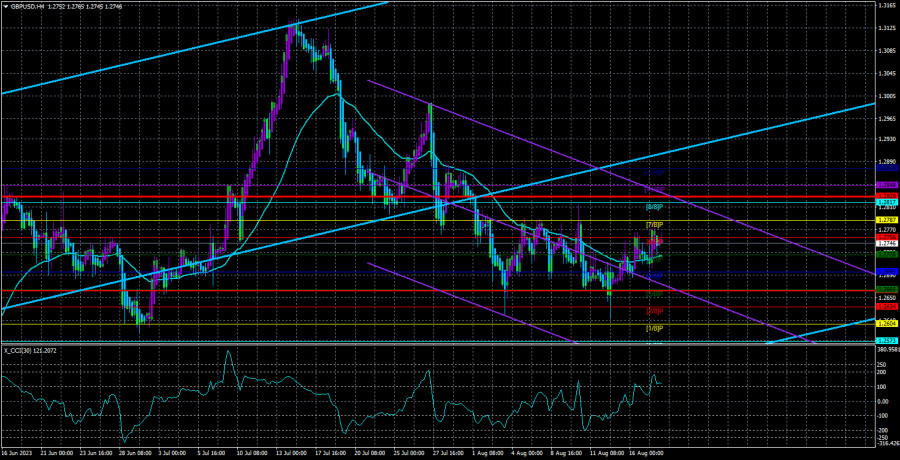

The GBP/USD currency pair exhibited no noteworthy movements on Friday. The price continues to correct both in the global and local senses. After a double rebound from the level of 1.2634, the pair is aiming for the upper boundary of the sideways channel, i.e., the level of 1.2787. This level has already been reached, so a new round of downward movement within the same channel may begin soon. Since we are currently in a range, trading the pair is inconvenient and inadvisable. While we mentioned that it's better to trade the euro on higher timeframes, in the case of the pound, trading on higher timeframes is not profitable since the pair is not showing any trend movement. Overall, the situation could be more pleasant.

A consolidation above the level of 1.2787 could trigger a continuation of the upward correction, which will not break the established concept. Let us remind you that the concept involves a prolonged decline in the British currency. Corrections are integral to any trend, so a slight upward move would not hurt. However, there is still a risk of resuming an illogical and unjustified upward trend that was difficult to explain several months ago. On the 24-hour timeframe, we still do not see a breakthrough of the Ichimoku cloud, so even after the last month's decline, the upward trend has not changed to a downward one.

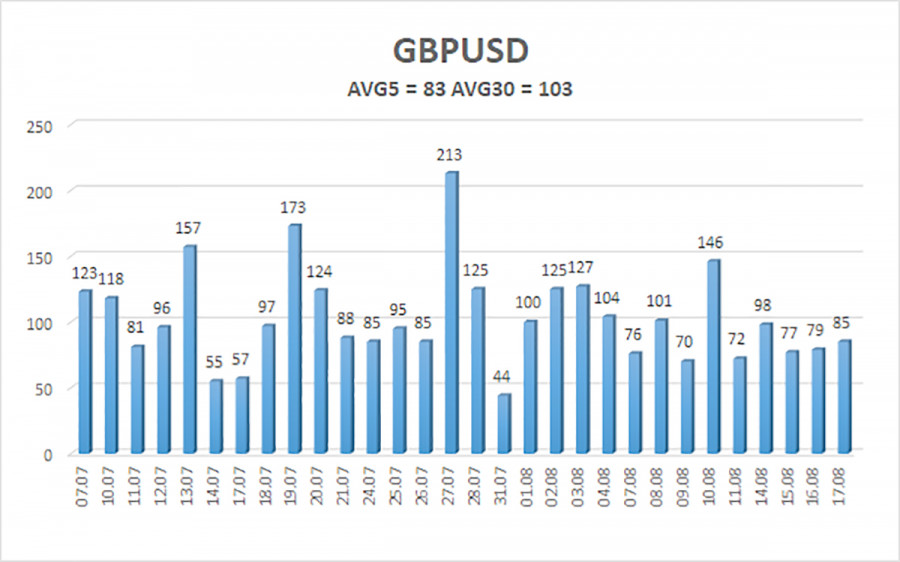

There was virtually no macroeconomic data on Friday, and there will be none today. Volatility for the pound did not exceed 100 points last week, and any value below this level is considered "average." The pound is certainly moving more actively than the euro (which is historically the case), but the range spoils everything.

ECB rhetoric is more important than the Fed

This week, there will be even fewer significant events than last week. What can we highlight? Business activity indices? The Jackson Hole symposium, which only starts on Friday? A few speeches by Fed representatives? The U.S. durable goods orders report? All of these are interesting, but what matters is the market's reaction to them. All business activity indices and the durable goods orders report could only provoke a reaction if the actual values differ significantly from the forecasts. Fed representatives' speeches – we observe quite a few of these almost every week. The Fed's policy is currently clear and understood, and it is unlikely that Bowman or Gulsbee will report anything extremely important.

The market does not believe in a rate hike in September or the end of the tightening cycle. A few months ago, Jerome Powell indicated that the regulator was shifting to a "one hike every two meetings" approach, so there should be a pause in September. However, the latest inflation report, showing an acceleration in inflation, suggests we may see at least one more rate hike. And if the August report also shows an acceleration, tightening may occur as early as September. More questions are now being posed to the ECB, for which a brief pause is also expected. If signals start coming from the ECB about even slower tightening, it may be a reason for the European currency to accelerate its decline against the dollar.

The average volatility of the GBP/USD pair over the last five trading days is 84 points. For the pound/dollar pair, this value is considered "average." Therefore, on Monday, August 21, we expect movement within the range limited by levels 1.2646 and 1.2816. A downward reversal of the Heiken Ashi indicator will signal a downward spiral within the lateral channel.

The nearest support levels:

S1 – 1.2726

S2 – 1.2695

S3 – 1.2665

The nearest resistance levels:

R1 – 1.2756

R2 – 1.2787

R3 – 1.2817

Trading Recommendations:

The GBP/USD pair in the 4-hour timeframe has secured itself above the moving average, but we are still in a flat market overall. You can trade now based on rebounds from the upper (1.2787) or lower (1.2634) boundaries of the sideways channel, but reversals may occur without reaching them. The moving average may be crossed very often, but it does not signify a change in trend.

Explanations of illustrations:

Linear regression channels - help determine the current trend. If both are directed in one direction, the trend is strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction to trade now.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.