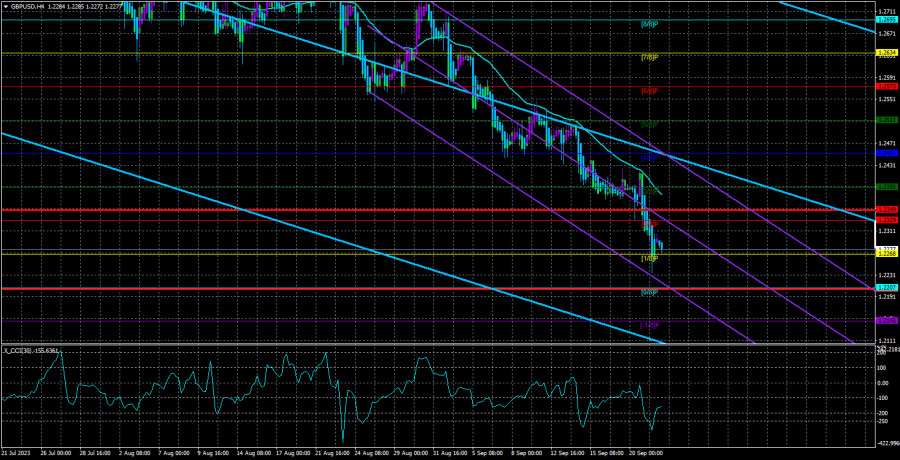

The GBP/USD currency pair showed a new downward movement on Thursday. Many factors indicated, if not in favor of the pound's growth, then in favor of a correction. We considered the possibility that the British currency could fall even in the event of a rate hike. Therefore, its decline without new tightening measures did not surprise us. However, the pound has been falling practically every day, the CCI indicator has entered the oversold zone for the third time, and there is still no sign of an upward correction.

We are now facing a downward inertia trend. The pound has risen in price (or at least remained undeservedly high) since the beginning of 2023. So if it loses another 200-300 points before starting to correct, we won't be too upset. In any case, the price has yet to firmly establish itself above the moving average over the past few weeks. So, what kind of growth can we talk about now?

Another significant event occurred on the 24-hour TF. There, yesterday's price crossed the Fibonacci level of 50.0%, which means it can continue to decline to the level of 1.1840. In principle, we expected a drop to this level anyway, but only after a correction. However, the market now shows it does not need a correction; it is ready for sale. We did not receive a buy signal around the level of 1.2304, so there is no reason to buy the pound now.

The Bank of England disappointed the pound to the maximum.

As mentioned above, we considered the possibility of the British currency falling even in case of a rate hike by the Bank of England. However, how was the pound supposed to react if, for the first time in 15 meetings, the rate did not increase? Naturally, the market interpreted this event as a softening of the "hawkish" stance, and now it expects the end of the tightening cycle, although the BoE's rate is at a fairly high level! The Fed's rate is also high and was always higher than the BoE's rate while the pound was rising (the last 12-13 months). Therefore, one fact of the end of the tightening cycle is enough for the pound to continue its decline.

The final communication stated that inflation continues to decline, although there are risks of its new acceleration. The Bank of England will not give up and retreat in the face of high inflation and will do whatever is necessary to reduce it. If signs of more sustainable inflationary pressure emerge, the rate may be raised several times. Restrictive monetary policy will remain in place for a long time until the consumer price index approaches the target level. Economic growth forecasts remain unsatisfactory, but the British economy still manages to avoid sliding into a recession.

In summary, we can say the following. The Bank of England is not a magician and cannot raise rates indefinitely. Therefore, in the British regulator's case, it may be better to fight inflation by keeping rates at peak levels for a long time. We did not expect the BoE rate to rise even to 5.25%. We did not expect a recession to start at such a rate. The British economy is performing well, but the British currency can still weaken in the coming weeks and months. Factors for its growth may only appear by the end of the year.

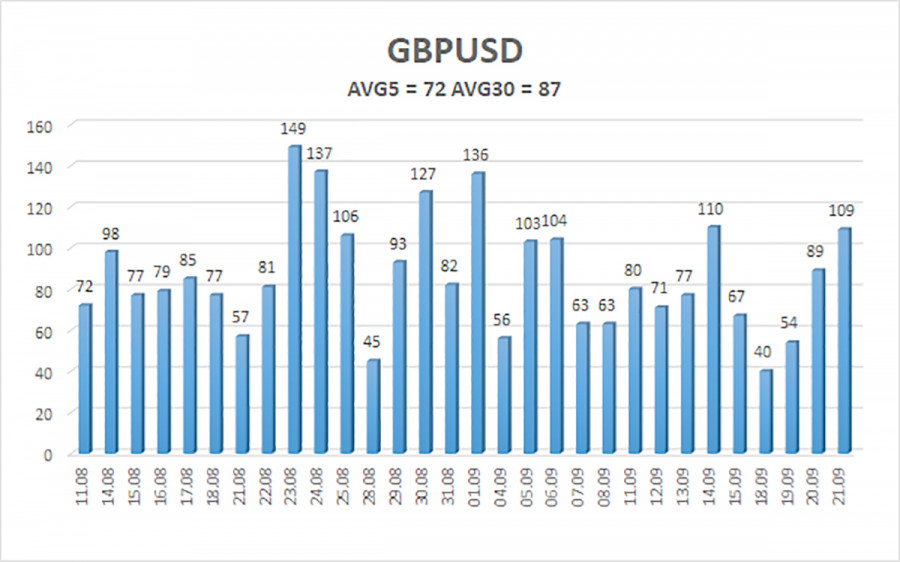

The average volatility of the GBP/USD pair over the last five trading days as of September 22 is 72 points. For the pound/dollar pair, this value is considered "average." Therefore, on Friday, September 22, we expect movement between 1.2206 and 1.2349. An upward reversal of the Heiken Ashi indicator will signal a new phase of upward correction.

Nearest support levels:

S1 - 1.2268

S2 - 1.2207

S3 - 1.2146

Nearest resistance levels:

R1 - 1.2329

R2 - 1.2390

R3 - 1.2451

Trading recommendations:

The GBP/USD pair in the 4-hour timeframe continues to hover near its local lows and regularly updates them. Therefore, at this time, you can continue to hold short positions with targets at 1.2207 and 1.2146 until the price consolidates above the moving average. Long positions can be considered after the price consolidates above the moving average with targets at 1.2451 and 1.2512.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both point in the same direction, it indicates a strong current trend.

The moving average line (settings 20,0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will move over the next day based on current volatility indicators.

CCI indicator - its entry into the overbought area (above +250) or oversold area (below -250) indicates that a trend reversal in the opposite direction is approaching.