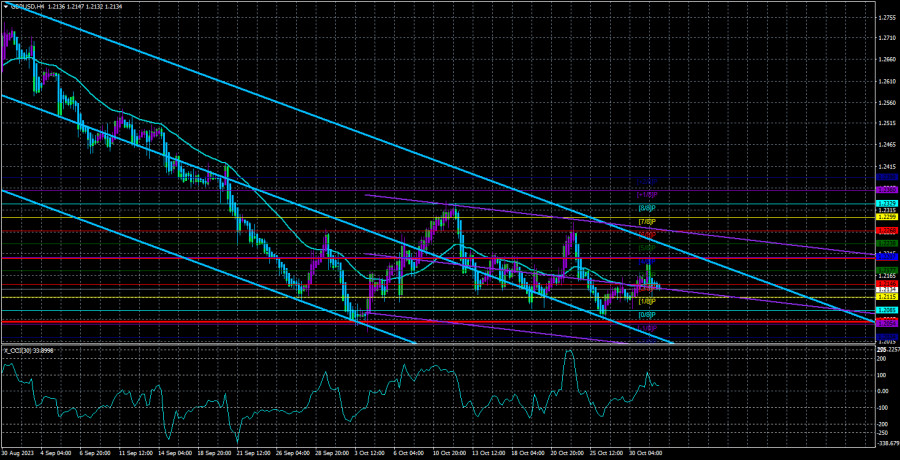

The GBP/USD currency pair traded with much less volatility on Tuesday than the euro, as European reports had a rather indirect connection to the pound. Nevertheless, there was a correlation between the euro and the pound, so the latter almost exactly mirrored the movements of the former. However, for the euro, a corrective scenario that allows for a systematic increase in the pair is still in play, while for the pound, it appears as if the downward trend has already resumed. Each subsequent price peak is lower than the previous one, and the price is persistently aiming at the Murray level of "-1.8"-1.2054.

In principle, such movement of the British pound is quite logical, although we would prefer to see a more substantial correction before the decline resumes. Consider this: inflation in the UK is extremely high (much higher than in the EU or the US), the economy has been near zero growth every quarter, the rate has already risen to 5.25%, and the Bank of England is unlikely to raise it further. Macroeconomic statistics in the UK, if not dismal, are quite mediocre. In the US, on the other hand, reports regularly please traders, and the economy is far from a recession. Thus, the overall background clearly points to the further rise of the US currency.

From a technical perspective, there are also few buy signals. The price has been in a limited price range for several weeks but still can't be corrected properly and is slipping down. In the 24-hour time frame, the price couldn't even rise above the critical line, although it is located very close to it. In the remaining days of the current week, the background for the pound and the dollar will be so strong that the pair can significantly fluctuate in various directions. Don't expect support from the Bank of England unless they come up with a surprise. Macroeconomic statistics from the US mainly favor dollar buyers, so there is not much hope for the pound. The probability that the British currency will find support from the macroeconomic or fundamental background this week is about 20–30%.

Tonight, the results of the Fed meeting, the second to last this year, will be announced. The key rate is expected to remain unchanged with a 99% probability. The FedWatch tool even gives a 3% chance of a rate cut on November 1. On December 13 (the last Fed meeting of the year), the probability of a rate hike was 29%. Thus, if we do see another tightening, it will likely happen in December. However, for the dollar, it's not significant when the next rate hike occurs. The fact remains: inflation in the United States is rising again, and the Fed has almost all the cards in hand to combat price instability. The economy is growing at a good pace, the labor market is strong, unemployment is low, and business activity is recovering. The regulator can quite comfortably afford to raise the rate one or two more times, which is excellent for the American currency. The market can expect further tightening based on this factor and continue to buy the dollar.

Thus, this evening, Powell may talk about a new acceleration of inflation and hint once again that the tightening cycle is not yet complete. If inflation continues to show unsatisfactory values, the rate will be raised again. In the current circumstances, the probability of Powell adopting hawkish rhetoric is higher than that of dovish rhetoric. Therefore, it seems that the decline of the British currency will continue. Only macroeconomic data from across the ocean, which will start coming in today, can spoil the dollar's holiday. The ISM index, the ADP report, and the JOLTs report - these data could be weaker than expected, leading to dollar sell-offs. Local sell-offs within a single day.

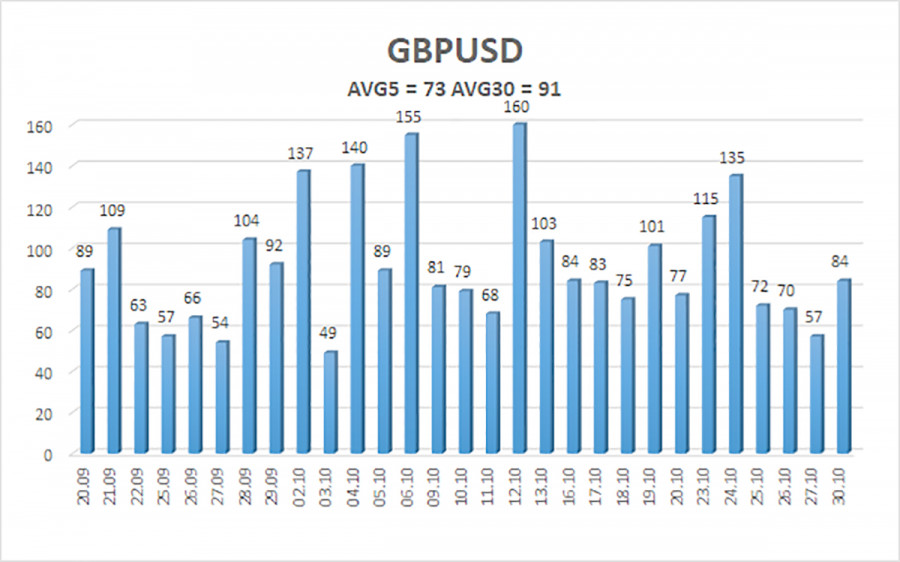

The average volatility of the GBP/USD pair over the past 5 trading days as of November 1st is 73 points. For the pound/dollar pair, this value is considered "medium." Therefore, on Wednesday, November 1st, we expect movement within the range of 1.2060 and 1.2206. A reversal of the Heiken Ashi indicator upwards will signal a new attempt at correction.

Next support levels:

S1 - 1.2115

S2 - 1.2085

S3 - 1.2054

Nearest resistance levels:

R1 - 1.2146

R2 - 1.2177

R3 - 1.2207

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair may have completed its feeble attempts to correct. Therefore, short positions can be considered at the moment, with targets at 1.2085 and 1.2054 in case the price is below the moving average. If the price consolidates above the moving average, long positions with targets at 1.2207 and 1.2238 will become relevant, but in this case, the pound will require support from the fundamentals and macroeconomics.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are pointing in the same direction, it means the trend is strong at the moment.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will trade over the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.