The EUR/USD currency pair traded more volatilely and interestingly on Wednesday. The decline of the European currency began overnight when there were no macroeconomic events, and the fundamental background was absent. Nevertheless, the US dollar strengthened during the Asian session, enough to overcome the moving average line. However, this consolidation could have been more-lived.

Over the past few days, we have consistently mentioned that the recent rise in the European currency is nothing more than a correction within a downward trend. Therefore, we do not expect anything from the euro except further decline. Market expectations that the Fed will start lowering the key rate much later than the ECB have yet to be confirmed. Some experts believe the European regulator may start the easing cycle before the Fed. And this, we remind you, is the factor that has been pushing the euro up for a long time. Thus, the fair value between the euro and the dollar has not yet been restored.

Moreover, in the 24-hour timeframe, we are dealing with a downward trend, and the euro's rise in recent months is also a correction. Therefore, we expect the pair to fall, at least to the last local minimum on the daily timeframe. That is, to the level of 1.0450. The decline should be more pronounced. Of course, a sudden change in the fundamental background can lead to a radical shift in market sentiment, but we do not see anything like that.

The ECB may start lowering rates in the upcoming meetings for one reason. Inflation in the European Union for February may decrease to 2.5%. Yes, there is still some way to reach 2%, but 2.5% is very close to the target. Therefore, for the European regulator, keeping rates at their maximum value no longer makes sense. Especially considering the state of an economy on the brink of a recession.

The European Parliament is also pressing on the ECB. Politicians believe the Central Bank still needs to manage to curb inflation, undermining trust in it. European consumers want price stability, and if the regulator cannot provide it, it negatively affects confidence in the central bank. The resolution states that the European Parliament is deeply concerned about high inflation, especially with high core inflation. Officials believe these two indicators have a detrimental effect on competitiveness, job creation, and the purchasing power of EU citizens. They call on Christine Lagarde to take all necessary measures to return inflation to 2%. The European Union Parliament also believes that the current situation increases economic uncertainty and increases the cost of living.

The resolution states that the ECB failed to predict the high rise in consumer prices two years ago, and it demands a review of the economic models on which monetary policy is based. The next ECB meeting will be on March 7. Key rates will remain unchanged, but Christine Lagarde's rhetoric may become softer if Friday's inflation decreases to 2.5%.

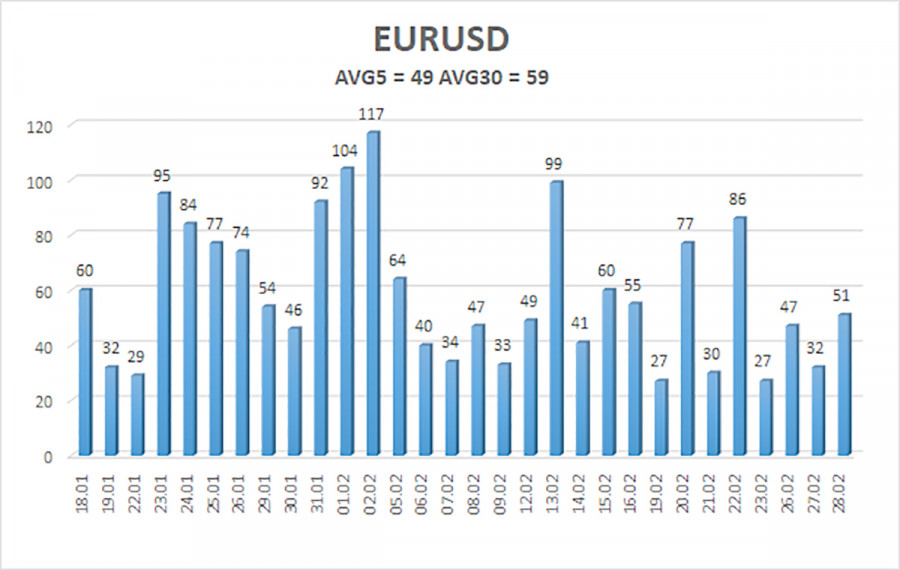

The average volatility of the EUR/USD currency pair for the last five trading days as of February 29 is 49 points, characterized as "low." Thus, we expect the pair to move between the levels of 1.0794 and 1.0892 on Thursday. The senior linear regression channel is still directed downward, so the downward trend continues. The oversold condition of the CCI indicator provoked a small upward correction, which may already be completed.

Nearest support levels:

S1 – 1.0803

S2 – 1.0742

S3 – 1.0681

Nearest resistance levels:

R1 – 1.0864

R2 – 1.0925

R3 – 1.0986

Trading recommendations:

The EUR/USD pair remains above the moving average line, but we continue to look towards short positions with a target of 1.0681, as the rise is corrective. The decline in the European currency is steady but slow and with frequent corrections. We see no reason for a global rise in the euro. Long positions could be considered with a target of 1.0864, as the price continues to be above the moving average, but the decline in quotes can resume anytime. The target has already been worked out twice. Caution is advised with purchases now.

Explanations for the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, the trend is strong.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and direction in which trading should be conducted now.

Murray levels – target levels for movements and corrections.

Volatility levels (red lines) – the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal towards the opposite side is approaching.