As anticipated, EUR/USD traded slightly higher on Monday. The market chose to use the first trading day of the week as a chance for the pair to correct upwards, given that the euro has notably declined recently. We believe that this decline was entirely predictable, but it doesn't imply that the euro should fall every day without any corrections.

Fundamentally, as before, as a month ago, and as three months ago, the backdrop continues to suggest that the euro should fall. If the market previously had doubts about whether the European Central Bank would begin easing monetary policy in June, now there is no longer any doubt about this. The ECB has finally started to lower its rate, and even before the rate cut it was already 1% below the Federal Reserve's rate. Now the ECB's rate is even lower and will continue to decrease, even if the process is gradual. Meanwhile, the Fed may not even start its own rate cut cycle in September, as many analysts and traders currently expect. Take note that the market anticipated the first Fed rate cut in March, then in June, and now in September. It was wrong in the first two instances, and it refused to admit its mistake by buying the U.S. dollar. It is likely to be wrong for the third time because inflation in the U.S. remains significantly higher than what would warrant a discussion about rate cuts.

The most interesting part is that Fed officials themselves are starting to talk about December as the time for the first rate cut. Minneapolis Fed President Neel Kashkari said it's a "reasonable prediction" that the U.S. central bank will wait until December to cut interest rates. "We need to see more evidence to convince us that inflation is well on our way back down to 2%," Kashkari said in an interview.

It is worth highlighting the fact that U.S. economic reports have deteriorated significantly over the past two months, but they started to decline from very high levels. Therefore, even if it declined in the last two months, this does not push key macroeconomic indicators into negative territory. For instance, GDP growth rates in the first quarter were three times lower compared to the third quarter of last year. However, they still amount to 1.3% per quarter. On the other hand, over the past two years, we have not seen economic growth of more than 0.3% in the European Union and the United Kingdom. Therefore, "bad" U.S data is much better than "good" data from Europe. And most importantly, this allows the Fed to maintain its rate at its peak level for as long as it wants.

Therefore, we can't guarantee that the Fed will lower its rates in December. In fact, we believe that the Fed is much closer to tightening policy again rather than easing it for the first time. The last two inflation reports from the U.S., which the market responded to with a USD sell-off by 100 pips each time, looked simply ridiculous – each of the inflation figures showed a slowdown of just 0.1%.

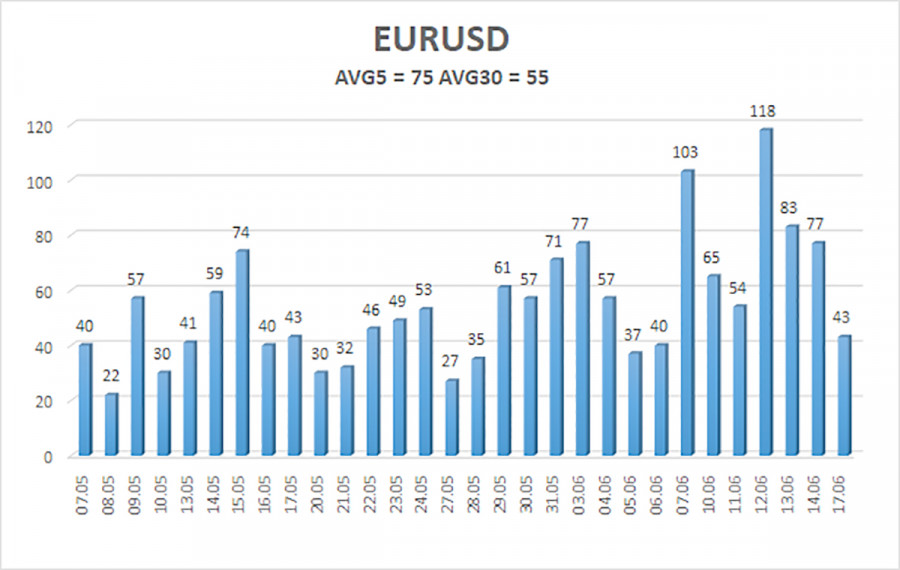

The average volatility of the EUR/USD pair over the last five trading days as of June 18 is 75 pips, which is considered an average value. We expect the pair to move between the levels of 1.0652 and 1.0802 on Tuesday. The higher linear regression channel has turned upwards, but the global downtrend persists. The CCI indicator entered the oversold area once again, but at this time we do not expect a strong uptrend.

Nearest support levels:

S1 - 1.0681

S2 - 1.0620

S3 - 1.0559

Nearest resistance levels:

R1 - 1.0742

R2 - 1.0803

R3 - 1.0864

Trading Recommendations:

The EUR/USD pair maintains a global downtrend, but on the 4-hour TF, it has consolidated above the moving average. In the previous review, we said that we don't consider long positions and that we should wait for a continuation of the downtrend. At this time, short positions are still valid. The targets are 1.0620 and 1.0559. The rebound from 1.0681 triggered a bullish correction, but we expect it to end soon. We don't recommend buying the euro, as we believe that the global downtrend has resumed, and the single currency has no grounds for growth.

Explanation of the chart:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.