EUR/USD started a new round of downward movement on Wednesday. The chart clearly shows that recently the pair has been trading between the levels of 1.0681 and 1.0742 with minimal exceptions. Thus, we have formed a local flat, but in general, the pair is headed downwards. Therefore, we are still considering short positions and we expect the euro to fall further. It's worth pointing out that the downtrend on the daily timeframe, which started last year, remains intact. We observed a two-month correction within this trend, but it did not surpass the last local high (on the 24-hour TF), so the downtrend persists. The targets remain unchanged: 1.0600, 1.0450, 1.0200, 1.0000. The price may not reach the last two targets, as no one knows when the Federal Reserve will start lowering rates and it has yet to provide a clear signal about the upcoming rate cuts. But when this finally happens, traders may start to preemptively react to the bearish information for the dollar, which will look like an upward movement on the charts. In this case, the global downtrend may end.

The fundamental background remains unchanged for the euro and the dollar. The main factor as to why the EUR/USD fell was the beginning of monetary policy easing in the Eurozone and the fact that the Fed does not intend to deliver its interest rate cut for now. Moreover, by the end of the year, the European Central Bank may cut rates twice more, which will cumulatively mean three cuts of 0.25% each. In our opinion, the Fed will start easing no earlier than December, which means at best one easing in 2024. As of early June, the Fed rate exceeded the ECB rate by 1%. By the end of the year, it may exceed the ECB rate by 1.5%. This will create an even greater imbalance in the financial conditions of the Eurozone and the US, a disbalance that will work in favor of the dollar.

In regards to the macroeconomic background, there are very few important events and reports this week. There was absolutely nothing noteworthy in the first three days of the week. Yes, there were secondary reports in Germany and the US, but they had no impact on the pair's movement. In the remaining two days of the week, we can highlight US reports like the third estimate of GDP numbers for the first quarter, durable goods orders, the personal consumption expenditures price index, and the University of Michigan consumer sentiment index. The first two will be published today, and the latter two on Friday.

However, traders should understand that there is an extremely low likelihood of the market suddenly turning bullish based on these reports. Even the likelihood of seeing a strong market reaction to these data is quite low. The market will probably react in some way, but it will probably be worth just 20-30 pips of movement, which are generally market noise. The pair must consolidate below the level of 1.0681, which would confirm if the price is ready to reach the first important target - the level of 1.0600. We expect the euro to fall for at least a few more months. From a technical standpoint, everything is also clear. Since the trend is downward, any consolidation above the moving average will only signify a correction.

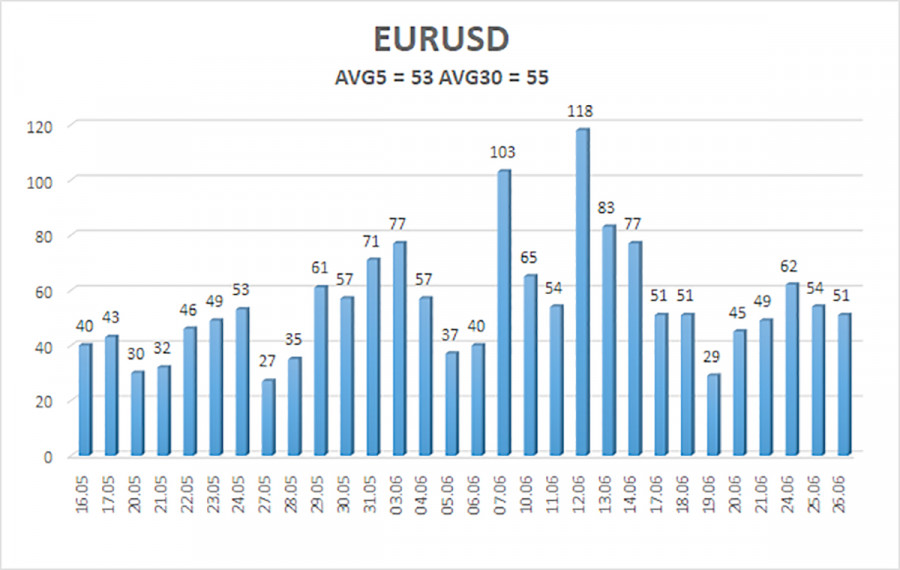

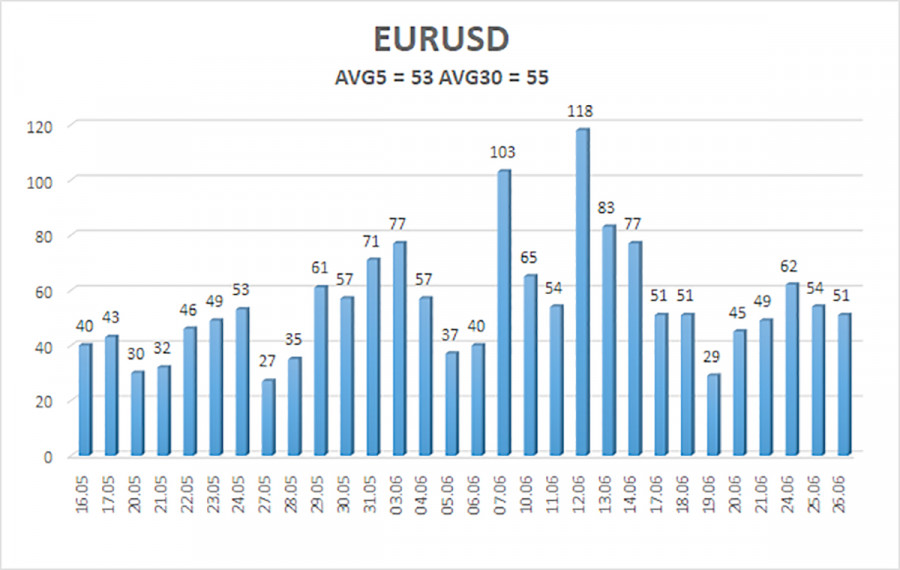

The average volatility of the EUR/USD pair over the last five trading days as of June 27 is 53 pips, which is considered a low value. We expect the pair to move between 1.0630 and 1.0736 on Thursday. The higher linear regression channel has turned upwards, but the global downtrend remains intact. The CCI indicator entered the oversold area, but it has already been worked out by an upward pullback.

Nearest support levels:

S1 - 1.0681

S2 - 1.0620

S3 - 1.0559

Nearest resistance levels:

R1 - 1.0742

R2 - 1.0803

R3 - 1.0864

Trading Recommendations:

The EUR/USD pair maintains a global downtrend, and the price is located below the moving average on the 4-hour timeframe. In previous reviews, we said that we are waiting for the downward trend to continue. At this time, short positions with the targets of 1.0681 and 1.0620 are still valid. A rebound from 1.0681 may provoke another round of the bullish correction. We don't recommend buying the euro, as we believe that the global downtrend has resumed, and the single currency has no grounds for growth. But the price may rise for some time as part of the correction.

Explanation of the chart:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.