EUR/USD failed to start a corrective movement or sustain its rise. US markets were closed for the celebration of Independence Day. As we had warned, volatility fell to its lowest levels, but by now this is hardly surprising to anyone. The market continues to trade "at half pace." There is no desire to push the pair up or down. The movements we have observed in recent months are more like convulsions. Even when the price is following a trend, it means that traders can expect around 100-200 pips over several weeks. Or these 100-200 pips will be covered in a couple of days, and then everyone will watch a flat, a correction, and another flat for several weeks.

We would like to point out that it is impossible to have market movements "on demand." The market, its major players, market makers, and banks trade in ways that are profitable for them. Therefore, it is pointless for traders to be upset about the lack of movement. Retail traders have never been able to influence the price because their trading volumes are too small. Therefore, the only thing they can do in the current situation is to understand it. One must clearly realize that the pair is showing very weak movements or a flat 80-90% of the time. So one should trade accordingly. Currently, the euro is rising again, but it could just as easily fall today. All the current movements take much more time than usual.

The Federal Reserve minutes was published Wednesday evening, which we immediately characterized as an "absolutely secondary and unnecessary event." Some traders see the word "Fed" in the event's name and they already consider it important. When in fact, the Fed minutes is a mere formality, and all the necessary information is already provided to the market immediately after the meeting, not two weeks later.

Moreover, what is the point of the Fed minutes, Fed meetings, or Jerome Powell's speeches if the market does not react to them? This week, Powell gave a speech in which he once again mentioned that there is no rush to lower the key rate. And what happened? The dollar did not react to an event that should have led to its growth. The last Fed meeting can be considered hawkish, and naturally, the minutes of this meeting is also hawkish. But even these events did not provoke the market to buy the dollar.

The market has been expecting a rate cut from the Fed since January and they will have to wait for a very long time. The fact that monetary policy easing has not yet begun does not have a favorable effect on the dollar. Meanwhile, the European Central Bank has started lowering its rates and may reduce them again in September. The divergence between ECB and Fed rates is increasing, to which the EUR/USD pair reacts with microscopic declines. More precisely, it reacts by refusing to move down. Thus, the pair's movements are currently very weak; the downtrend remains intact but is also very weak.

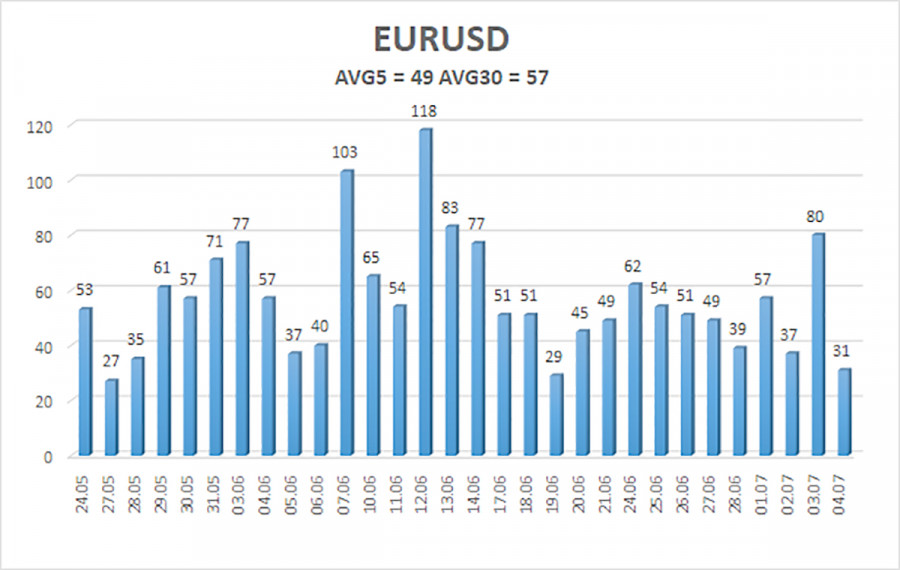

The average volatility of the EUR/USD pair over the last five trading days as of July 5 is 49 pips, which is considered a low value. We expect the pair to move between 1.0763 and 1.0861 on Friday. The higher linear regression channel is directed upwards, but the global downtrend remains intact. The CCI indicator entered the oversold area, but it has already been worked out by a bullish correction.

Nearest support levels:

S1 - 1.0803

S2 - 1.0742

S3 - 1.0681

Nearest resistance levels:

R1 - 1.0864

R2 - 1.0925

R3 - 1.0986

Trading Recommendations:

The EUR/USD pair maintains a global downtrend, and the price is located above the moving average on the 4-hour timeframe. In previous reviews, we said that we are waiting for the continuation of the downward trend. At this time, short positions remain valid, but the corrective move may continue for some time. Unless, of course, it develops into a new upward trend. The third consecutive rebound from 1.0681 provoked another round of the bullish correction. We don't recommend buying the euro, as we believe that the global downtrend has resumed, and the single currency has no grounds for growth other than local ones. But the price may rise for some time as part of the correction. Especially this week, when most of the US data turned out to be disappointing.

Explanation of the chart:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.