EUR/USD traded mostly higher on Monday. Last week, the euro had substantial reasons to rise (or fall). Almost all of the US economic reports disappointed the market, and these were crucial reports on the labor market, unemployment, and business activity. The market is waiting for the Consumer Price Index to complete the full picture of the state of the American economy.

However, we would like to draw your attention to a different point. There were no important reports on Monday, nor any significant speeches, either in the Eurozone or in the US. Therefore, it is very difficult to explain why the euro rose again. On one hand, the market could have bought the pair simply based on last week's data. On the other hand, the results of the parliamentary elections in France were announced over the weekend, and last Monday already showed us that the market is very sensitive to this information.

In general, the whole issue boiled down to whether Marine Le Pen's party would win the elections or not. Last Monday, Le Pen's far-right party received fewer votes in the first round of voting. This triggered the euro's rise because the market somehow believes that the defeat of Le Pen's party's is quite positive news not only for France but for the entire Eurozone. We saw the same situation on Monday. Over the weekend, the second round of elections took place, and Le Pen's party lost once again, failing to garner enough votes not only for an absolute majority in Parliament but even for first place. The "New Popular Front" party took first place, Emmanuel Macron's party "Renaissance" placed second, while Marine Le Pen's party "National Rally" clinched third place.

Marine Le Pen's party managed to secure only 143 seats in the lower house, while the "New Popular Front" received 182 seats, and Macron's party got 168. Thus, there was no question of Le Pen's party imposing its will on the entire Parliament, which pleased the currency market.

In our opinion, political news should not have such a strong influence. We are talking about parliamentary elections in just one country, and the market initially did not factor in a victory for Le Pen's party into the euro's exchange rate. If that had been the case, the single currency would have been trading lower over the past two weeks. Instead, it has been rising, and it rose again on Monday because Le Pen's party lost. We believe that the market is using political factors as a formal reason to buy EUR/USD again. We do not see any threat to the entire EU economy in the event of a Le Pen victory. However, there is no point in discussing this now. It was important for us to see the market's reaction to this event, and we have seen it. At this rate, the euro (like the pound) could continue to rise for a very long time. For instance, the market could also use parliamentary elections in Hungary or Bulgaria as a reason to buy the euro.

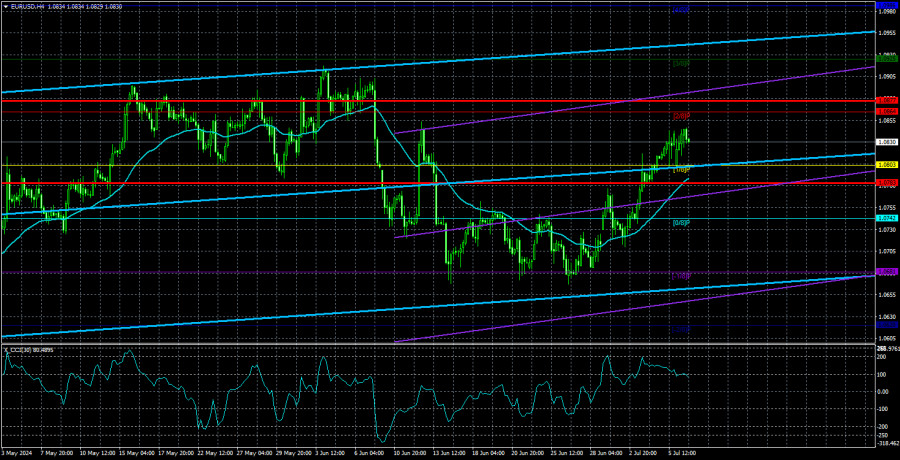

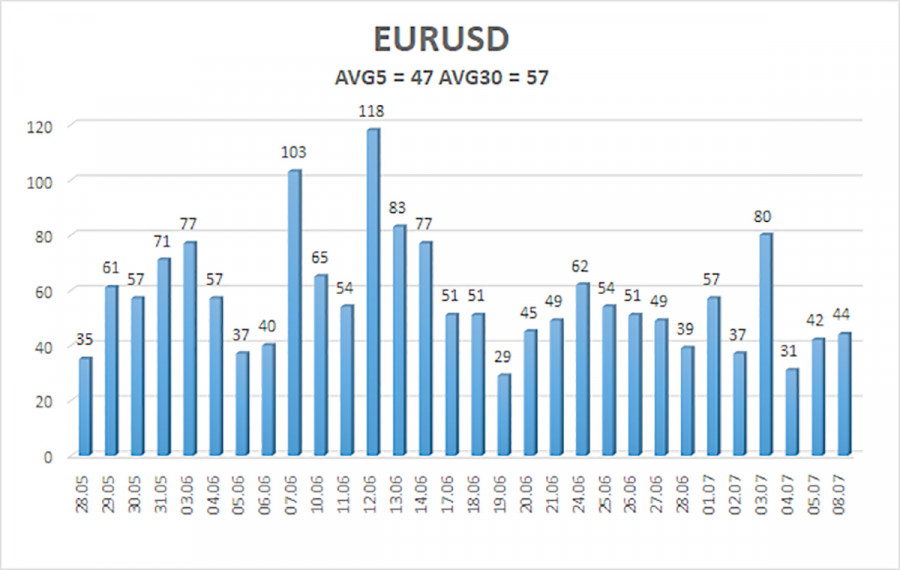

The average volatility of the EUR/USD pair over the last five trading days as of July 9 is 47 pips, which is considered a low value. We expect the pair to move between 1.0783 and 1.0877 on Tuesday. The higher linear regression channel is directed upwards, but the global downward trend remains intact. The CCI indicator entered the oversold area, but it has already been more than compensated by the bullish correction.

Nearest support levels:

S1 - 1.0803

S2 - 1.0742

S3 - 1.0681

Nearest resistance levels:

R1 - 1.0864

R2 - 1.0925

R3 - 1.0986

Trading Recommendations:

EUR/USD maintains a global downtrend, while it continues to rise on the 4-hour timeframe. In previous reviews, we said that we expect a continuation of the global downtrend. However, at this time we can't deny that the euro is rising again due to comprehensible reasons. Unfortunately, both the market and macro data are against the dollar at the moment. We believe that the euro can't start a new global trend right now when the ECB eases its monetary policy, so most likely the pair will continue to stay between the levels of 1.0650 and 1.1000. Traders may opt for short positions in the upper part of this range and after the price consolidates below the moving average. Targets are around the 1.0681 level.

Explanation of the chart:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.