GBP/USD rose again on Wednesday. The British currency started to show more bullish bias during the US session, coinciding with Federal Reserve Chief Jerome Powell's second testimony before the U.S. Congress. Recall that a day earlier, the market found nothing interesting in Powell's speech, and the pound even edged lower, giving traders hope for a logical downward movement. However, these hopes were dashed by Wednesday. The pound sterling resumed its rise, while the euro remained stagnant. Therefore, it is unlikely that Powell's speech provoked the dollar's fall. In that case, both the euro and the pound would have risen simultaneously.

However, there were no other significant events on Tuesday or Wednesday. Thus, we are forced to refer to Powell's speech and try to unearth something that could theoretically have triggered a new decline in the dollar. It makes no sense to even consider Powell's hawkish statements. If they had any weight in the eyes of traders, the dollar would have risen on both Tuesday and Wednesday. Therefore, we will skip all of Powell's statements about the Fed not being ready to start easing monetary policy.

In addition, Powell said that in the coming months, the central bank might face the problem of an economic slowdown, and the labor market might cool even further. What does this imply, and what measures will be taken? The Fed chair did not specify. He merely suggested that the central bank would pay attention not only to inflation but also to economic growth rates and business activity in the future. Does this mean that with a more significant drop in GDP growth rates, we can expect an earlier rate cut? No, because inflation is still far from the target level. If the rate is lowered now, inflation will never reach 2%. So, what can be inferred from these statements by Powell? Nothing. Powell simply expressed his concern on this issue.

However, the market could very well interpret these words as a call for new short positions on the dollar, but only in the GBP/USD pair. The British currency is still a trading instrument that appreciates under any conditions and circumstances. We still find it difficult to expect growth from it, as the vast majority of factors indicate a bearish direction. But what can be done if the market ignores all these factors? Or perhaps the Bank of England is simply conducting currency interventions that prevent the pound from declining. By the way, the UK recently held Parliamentary elections, in which the Labour Party won. Later, the prime minister changed. Maybe the market is reacting so vigorously to these events? Although it is difficult to say how the Labour Party is better than the Conservatives. Yes, under the Conservatives' tenure, the economy significantly deteriorated, and the pound fell to record lows, but who said it would be better under the Labour Party? We still believe that the market is simply using every formal factor to buy the pound. Or maybe the market has nothing to do with it - the pound is being pushed up by the BoE and/or market makers.

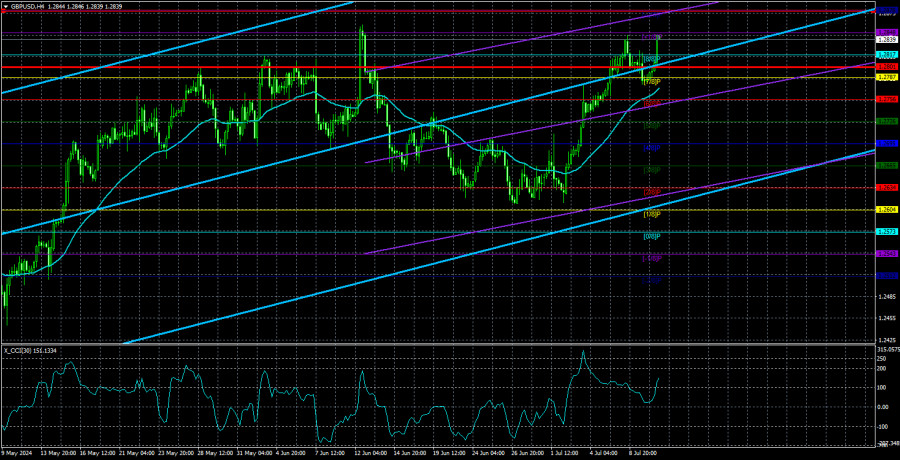

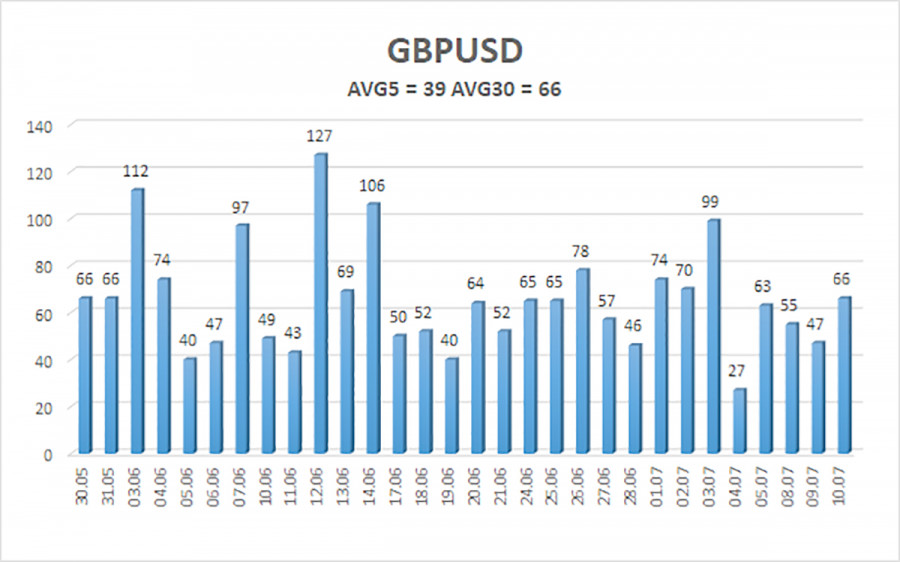

The average volatility of GBP/USD over the last five trading days is 39 pips. This is considered a very low value for the pair. Today, we expect GBP/USD to move within a range bounded by the levels of 1.2801 and 1.2879. The higher linear regression channel is pointing upwards, which suggests that the upward trend will continue. Last week, the CCI indicator entered the overbought area and drew divergence from the last two highs, indicating an impending decline.

Nearest support levels:

S1 - 1.2817

S2 - 1.2787

S3 - 1.2756

Nearest resistance levels:

R1 - 1.2848

R2 - 1.2878

Trading Recommendations:

The GBP/USD pair continues to rise rapidly, ignoring all factors in favor of the dollar. Although the US released quite a number of disappointing data last week, we believe that this isn't enough for the pound to sustain its growth. We don't see how the pound would be able to rise above the level of 1.2817. Yes, a new batch of weak (relative to overestimated forecasts) US data may exert a significant amount of pressure on the dollar once again, and in addition to that, the fundamental background, the policy of the Federal Reserve and the BoE no longer carry significant weight for the market. Therefore, we cannot say that long positions are the obvious choice at this time. But, from a technical perspective, longs remain valid.

Explanation of Illustrations:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.