Analysis of EUR/USD 5M

EUR/USD showed positive trades on Monday. One could say that the market had grounds for buying the euro. The industrial production report was published in the morning, which was below market expectations of a 1% decline. Industrial production was down by 0.6% in the euro area. This is exactly how the euro has been growing in recent weeks. European reports show pessimistic forecasts, so the actual values easily exceed them. On the other hand, forecasts for the U.S. reports are overestimated, so the actual value is almost always lower.

Federal Reserve Chair Jerome Powell's new speech did nothing for the market. Powell already spoke last week, and the week before last, so the market clearly understands his stance on monetary policy. And despite the fact that he remains hawkish, the market only chooses to see dovish hints for September. Any statement by any official can be interpreted in any direction. One can find a dovish hint in any statement of any official, and ignore everything else. Thus, the EUR/USD pair continues to exhibit illogical growth. The last three highs on the hourly chart show us that the upward movement is slowing down, which may be a harbinger of the beginning of a corrective movement. However, so far we are talking about a correction to the trend line, which is not so far from the price.

Only one trading signal was formed on Monday, as volatility was very low again. The price rebounded from the level of 1.0889 in the European trading session, after which it managed to climb about 25 pips at the peak. Traders could earn these 20-25 pips by manually closing the deal. And now there is no need to expect the price to generate a signal and work out the nearest target within the day.

COT report:

The latest COT report is dated July 9. The net position of non-commercial traders has remained bullish for a long time. The bears' attempt to gain dominance failed miserably. The net position of non-commercial traders (red line) has been declining in recent months, while that of commercial traders (blue line) has been growing. Currently, they are approximately equal, indicating the bears' new attempt to seize the initiative.

We don't see any fundamental factors that can support the euro's strength, while technical analysis also suggests that the price is in the consolidation zone – in a triangle. Now the pair's movement will depend on which border the price leaves.

Currently, the red and blue lines are approaching each other, which indicates a build-up in short positions on the euro. During the last reporting week, the number of long positions for the non-commercial group decreased by 1,500, while the number of short positions decreased by 11,600. As a result, the net position increased by 13,100. According to the COT reports, the euro still has significant potential for a decline.

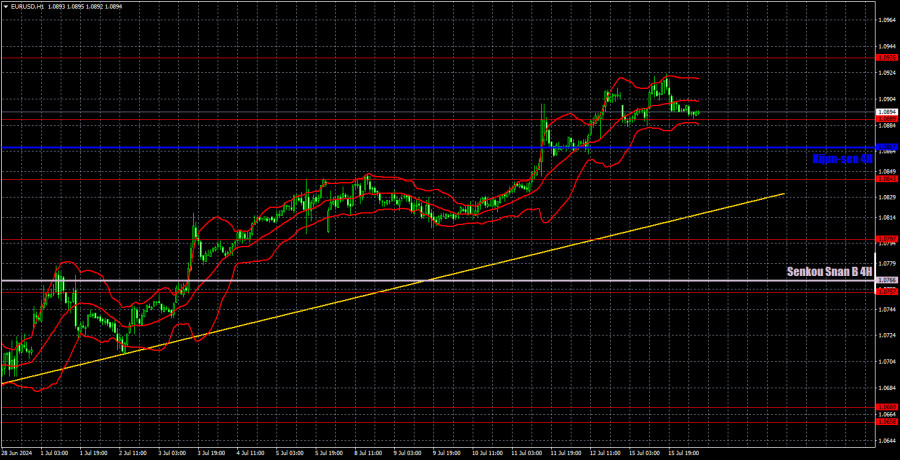

Analysis of EUR/USD 1H

On the 1-hour chart, EUR/USD failed to break through the 1.0658-1.0669 area and continues to form a new uptrend. We currently have an ascending trend line, above which the upward trend remains intact. All the economic reports from the last weeks have had a devastating impact on the dollar, so there's no sign of a decline yet. Meanwhile, the global downtrend remains on the 24-hour timeframe, which means that the pair could still fall back to the 1.06 level.

On July 16, we highlight the following levels for trading: 1.0530, 1.0581, 1.0658-1.0669, 1.0757, 1.0797, 1.0843, 1.0889, 1.0935, 1.1006, 1.1092, as well as the Senkou Span B (1.0766) and Kijun-sen (1.0857) lines. The Ichimoku indicator lines can move during the day, so this should be taken into account when identifying trading signals. Don't forget to set a Stop Loss to breakeven if the price has moved in the intended direction by 15 pips. This will protect you against potential losses if the signal turns out to be false.

Today, the EU's economic calendar will feature the ZEW Economic Sentiment Index for Germany and the bloc. The U.S. retail sales report will be in focus. In general, we don't expect strong and sudden movements today. There may be small bursts of activity, but most likely the pair will only move by around 20-40 pips.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;