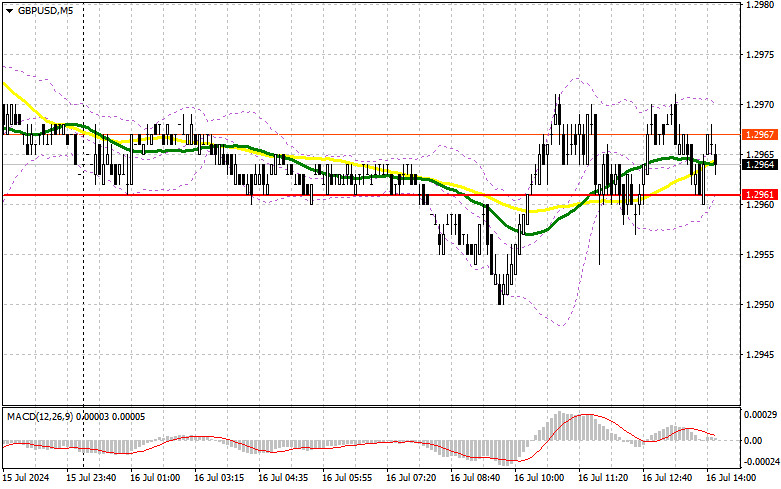

In my morning forecast, I focused on the 1.2961 level and planned to make market entry decisions from there. Let's look at the 5-minute chart and understand what happened. A decline and a false breakout at this level led to an entry point for long positions, but as you can see on the chart, this did not lead to anything interesting. As a result, the technical picture was revised for the second half of the day.

To open long positions on GBP/USD, the following is required:

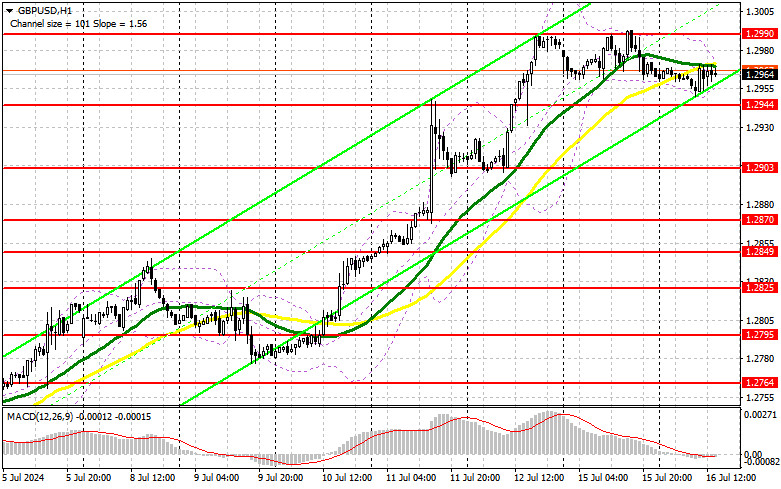

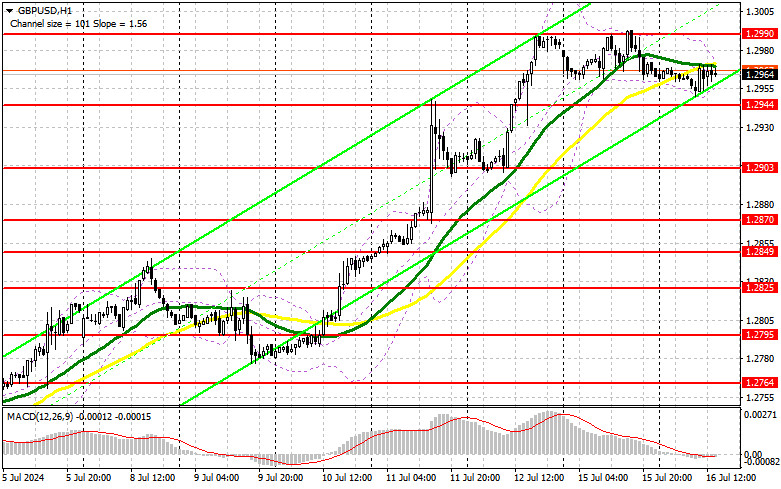

The lack of US statistics and the absence of demand in the GBP/USD pair could lead to a more significant downward movement of the pound after the release of several data points scheduled for the second half of the day. Strong figures on US retail sales, the import price index, and the NAHB housing market index, along with a hawkish stance from FOMC member Adriana D. Kugler, could lead to a more significant correction in the pound and a test of the new support at 1.2944. Only forming a false breakout, similar to what I discussed above, will provide an entry point for long positions aiming to update the 1.2990 high. A breakout and retest from top to bottom of this range will strengthen the pound's upward potential, leading to an entry point for long positions with the possibility of testing 1.3026. The furthest target will be the 1.3059 area, where I plan to take profits. In the scenario of a decline in GBP/USD and the absence of bullish activity at 1.2944 in the second half of the day, the pressure on the pair will increase. This will also lead to a decline and an update of the next support at 1.2903. However, even this will not significantly harm the bullish market. Forming a false breakout will be a suitable condition for opening long positions. I plan to buy GBP/USD immediately on a rebound from the 1.2870 low, targeting an intraday correction of 30-35 points.

To open short positions on GBP/USD, the following is required:

Sellers showed themselves but did not receive support from major players. This pauses the downward correction in anticipation of US statistics. In case of a rise in the pair, I prefer to act on sales only after forming a false breakout around the monthly high and resistance at 1.2990. Only this will be a suitable option for opening short positions against the trend, targeting a decline to the support of 1.2944. A breakout and retest from the bottom to the top of this range will hit the buyers' positions, leading to a stop-order sweep and opening the way to 1.2903. The furthest target will be the 1.2870 area, where I will take profits. Testing this level will significantly harm the pound's upward potential but will not change the overall picture. In the scenario of a rise in GBP/USD and the absence of activity at 1.2990 in the second half of the day, buyers will have a chance to continue the growth. In this case, I will postpone sales until a false breakout at 1.3026. If there is no downward movement, I will sell GBP/USD immediately on a rebound from 1.3059, targeting a downward correction of 30-35 points intraday.

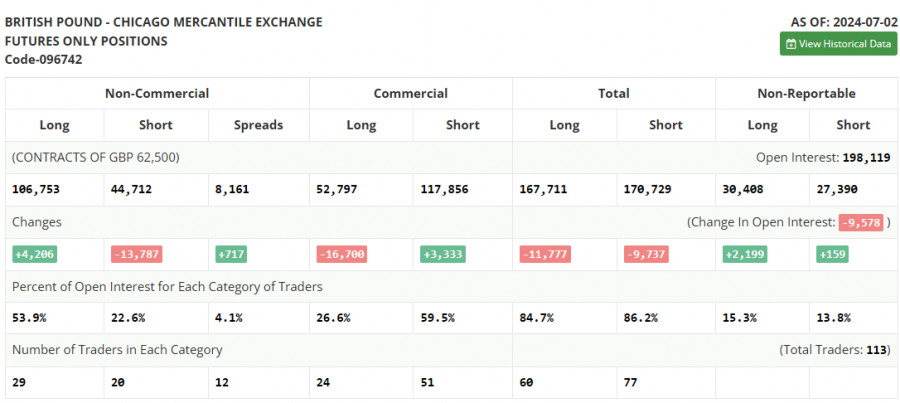

In the COT report (Commitment of Traders) for July 9, there was an increase in long positions and a decrease in short ones. The pound is overbought, but the bullish market has not disappeared. This week, the optimal strategy will be buying on corrections, as there are currently no grounds for breaking the monthly high. Pay attention to US retail sales data and the ongoing comments from British and American politicians. Only direct hints of rate cuts in the US with specific dates will lead to the development of a bullish market for the pound. The latest COT report states that long non-commercial positions increased by 4,206 to 106,753, while short non-commercial positions fell by 13,787 to 44,712. As a result, the spread between long and short positions increased by 717.

Indicator Signals:

Moving Averages:

Trading is around the 30 and 50-day moving averages, indicating problems for pound buyers.

Note: The period and prices of the moving averages considered by the author are on the hourly H1 chart, differing from the classical daily moving averages on the D1 chart.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator around 1.2944 will act as support.

Description of Indicators:

- Moving Average (MA): Defines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving Average (MA): Defines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD (Moving Average Convergence/Divergence): Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and meet specific requirements.

- Long non-commercial positions: Represent the total long open position of non-commercial traders.

- Short non-commercial positions: Represent the total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.