GBP/USD sustained its decline on Thursday, but volatility increased only slightly despite the Bank of England and Federal Reserve meetings. The pair's movements on Wednesday and Thursday could have been entirely different. That's why we always refrain from making conclusions immediately after central bank meetings. The market can react to these events for up to 24 hours, and conclusions should not be made hastily. The pair is likely sustaining a technical decline caused by the pound's overbought condition. Let's delve into it.

The U.S. central bank did not lower the key interest rate, but Fed Chair Jerome Powell hinted that easing policy in September is possible. He has never given such clear indications regarding timing before. It may not happen, but Powell's rhetoric has become more dovish. Therefore, the dollar could have easily fallen on Wednesday and Thursday. However, this did not happen. From our perspective, the market has long since priced in the first rate cut in the U.S. and two more subsequent cuts.

Regarding the BoE, the central bank lowered the key interest rate, which was expected. However, not all market participants were sure of such a decision, and the decision itself was made with a margin of just one vote (only five out of nine members voted for the cut). Nevertheless, the pound's decline was logical because few anticipated a rate cut from the BoE in the summer from the beginning of this year. Roughly speaking, the market expected the Fed to cut rates back in March and was pricing it in advance until July 31. However, the market expected the BoE to ease rates in the fall or winter, so it had not priced it beforehand.

We still believe that the GBP/USD pair should continue to decline. Even if the Fed begins easing monetary policy in September, it won't change anything. The pound climbed too high and showed an unjustified rise for too long. The pair closed Thursday below the critical line in the 24-hour time frame, so now, from a technical perspective, the decline can continue. The first medium-term target is the Senkou Span B line, which lies at 1.2580.

We still do not believe in the long-term growth of the British currency. Even if the Fed begins easing monetary policy in September (the main bearish factor for the dollar), the BoE will simultaneously cut rates. Where is the pound's advantage here? Besides, the dollar has often fallen in recent months due to weak U.S. macroeconomic data. If the Fed starts lowering the key rate, the economy should begin to "recover," and the indicators should improve. In any case, everything favors the dollar, which has been falling undeservedly for too long.

It is also worth mentioning that economic reports for the dollar are somewhat ambiguous right now. If forecasts for key reports are so overestimated, the dollar could fall forever since they will never be met. Also, the worst and simply awful indicator values in the U.S. are generally much better than similar ones in the Eurozone or the UK.

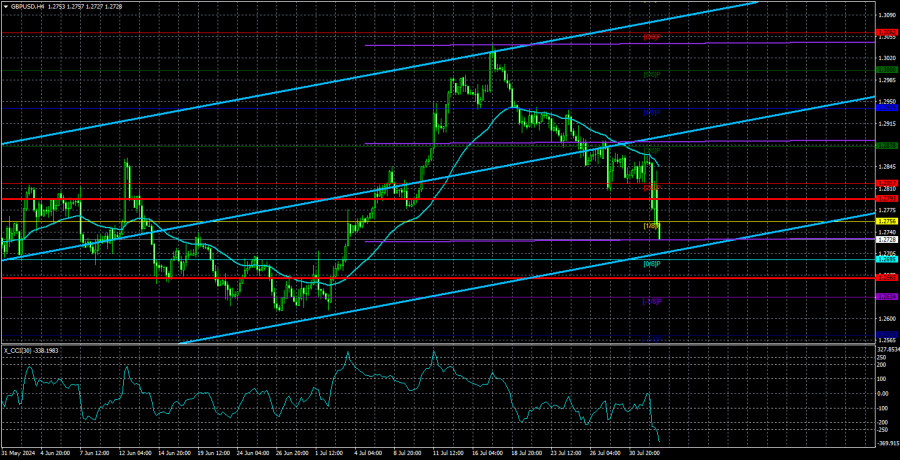

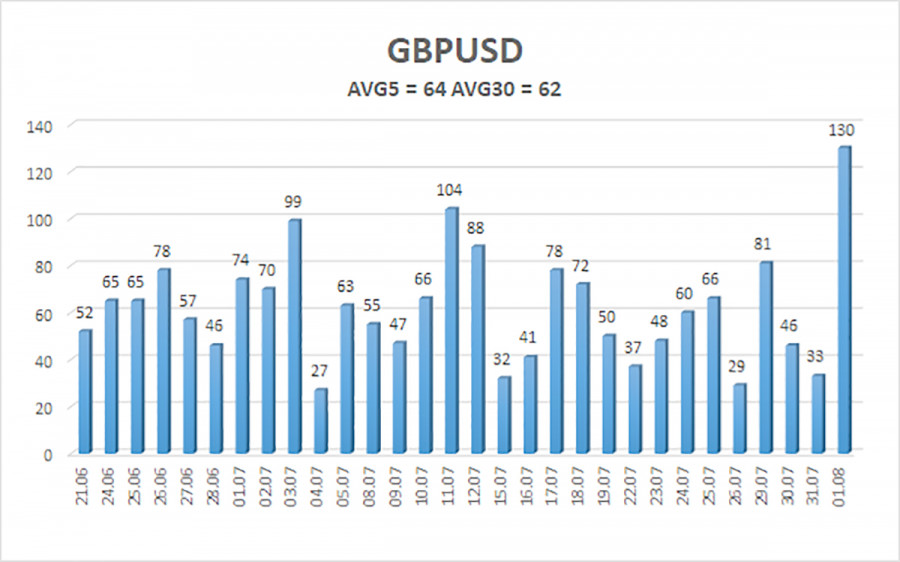

The average volatility of GBP/USD over the last five trading days is 64 pips. This is considered a low value for the pair. On Friday, August 2, we expect movement within the range limited by 1.2665 and 1.2793. The higher linear regression channel is directed upwards, signaling the continuation of the upward trend. The CCI indicator has entered the overbought area twice, signaling a potential trend reversal. In addition, a bearish divergence has formed.

Nearest Support Levels:

- S1 – 1.2695

- S2 – 1.2634

- S3 – 1.2573

Nearest Resistance Levels:

- R1 – 1.2756

- R2 – 1.2817

- R3 – 1.2878

Trading Recommendations:

The GBP/USD pair continues to trade below the moving average line and has a real chance for a significant decline. Volatility remains low, but short positions are currently valid, with initial targets at 1.2695 and 1.2634. We are not considering long positions at the moment, as all the bullish factors for the British currency (which are not much) have already been factored in by the market multiple times. Even if the pound shows a new round of growth, it will not add logic to such a movement.

Explanations for Illustrations:

Linear Regression Channels: help determine the current trend. If both are directed in the same direction, it means the trend is strong.

Moving Average Line (settings 20,0, smoothed): determines the short-term trend and the direction in which trading should be conducted.

Murray Levels: target levels for movements and corrections.

Volatility Levels (red lines): the probable price channel in which the pair will spend the next 24 hours, based on current volatility indicators.

CCI Indicator: Entering the oversold area (below 250) or the overbought area (above +250) means a trend reversal is approaching.