Analysis of GBP/USD 5M

On Tuesday, the GBP/USD pair sustained its decline and once again exhibited superb volatility for the fourth consecutive day, reminiscent of the good old times. This time, the price dropped to the 1.2691-1.2701 range, which it could not overcome. Therefore, an upward correction can be expected by the end of the week. The descending trend line remains valid and the pair maintains a downward trend. Thus, the price can quite freely correct upwards by 100 pips, and the downtrend will not be negated. And 100 pips for the pound this week is a trivial matter.

There were no significant events in the United Kingdom or the United States. We would only highlight a few speeches by the Federal Reserve's monetary committee members, which calmed the market—no one is planning to hold an emergency meeting or lower the rate before September 18. Officials also assured the market that even on September 18, a rate cut is not predetermined. Everything, as before, will depend on inflation and other macroeconomic indicators. If the economy slows down significantly, then it would be possible to talk about an intervention by the Fed. However, until September 18, only data for the second quarter will be published, so no conclusions about a slowdown can be made. The Fed's decision will depend only on inflation.

During the Asian trading session, the price formed a good sell signal near the critical line. By the opening of the European session, the price had not moved far from the signal formation point, so traders could have conveniently opened short positions. By the US session, the price had fallen to the 1.2691-1.2701 area, and it overcame this mark at the beginning of the US session. However, a pullback began afterward, so short positions could have been closed after the price re-consolidated above the mentioned area. The profit from the transaction was about 60 pips. A bullish correction can also be expected, so long positions above the 1.2701 level are valid.

COT report:

COT reports for the British pound indicate that the sentiment among commercial traders has been constantly changing in recent years. The red and blue lines, representing the net positions of commercial and non-commercial traders, constantly intersect and are often close to the zero mark. According to the latest report on the British pound, the non-commercial group closed 22,800 buy contracts and opened 7,800 short ones. As a result, the net position of non-commercial traders decreased by 30,600 contracts over the week. But the buyers still have a considerable advantage.

The fundamental background still does not provide any grounds for long-term purchases of the pound sterling, and the currency has a real chance to resume the global downward trend. However, an ascending trend line formed in the 24-hour timeframe. Therefore, unless the price breaches this trend line, a long-term decline in the pound is not expected. The pound is rising despite almost everything, but even the COT reports show that major players are happily buying it.

The non-commercial group currently holds 165,600 buy contracts and 54,100 sell contracts. However, apart from COT reports, nothing else indicates potential growth in the GBP/USD pair. Such a strong buyer's advantage suggests a possible trend change.

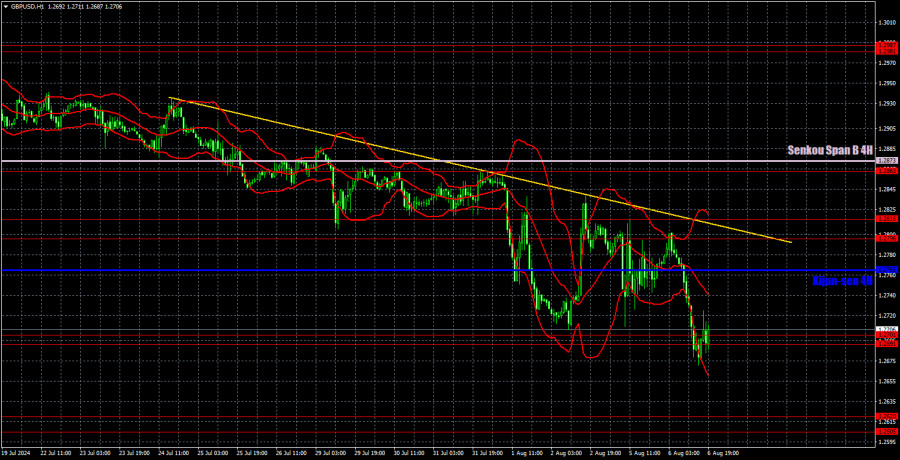

Analysis of GBP/USD 1H

In the hourly chart, GBP/USD has a real chance to sustain its decline. This is the only logical and consistent scenario when considering all factors: technical, fundamental, and macroeconomic. An upward correction may start today or tomorrow, but overall, until the Fed makes its first rate cut, we see no alternatives other than a decline in the British currency.

For August 7, we highlight the following important levels: 1.2269, 1.2349, 1.2429-1.2445, 1.2516, 1.2605-1.2620, 1.2691-1.2701, 1.2796-1.2816, 1.2863, 1.2981-1.2987, 1.3050. The Senkou Span B (1.2873) and Kijun-sen (1.2765) lines can also serve as sources of signals. Setting the Stop Loss to break even when the price moves in the intended direction by 20 pips is recommended. The Ichimoku indicator lines may shift during the day, which should be considered when determining trading signals.

On Wednesday, no macroeconomic events are scheduled in the UK or the US. Thus, volatility might be lower, and the price may correct slightly higher. Talking about a more substantial and prolonged rise in the British pound is only possible after surpassing the trend line. However, most factors still point downward.

Explanation of illustrations:

Support and resistance levels: Thick red lines near which the trend may end.

Kijun-sen and Senkou Span B lines: These Ichimoku indicator lines, transferred from the 4-hour timeframe to the hourly chart, are strong lines.

Extreme levels: Thin red lines from which the price previously bounced. These provide trading signals.

Yellow lines: Trend lines, trend channels, and other technical patterns.

Indicator 1 on COT charts: The net position size for each category of traders.