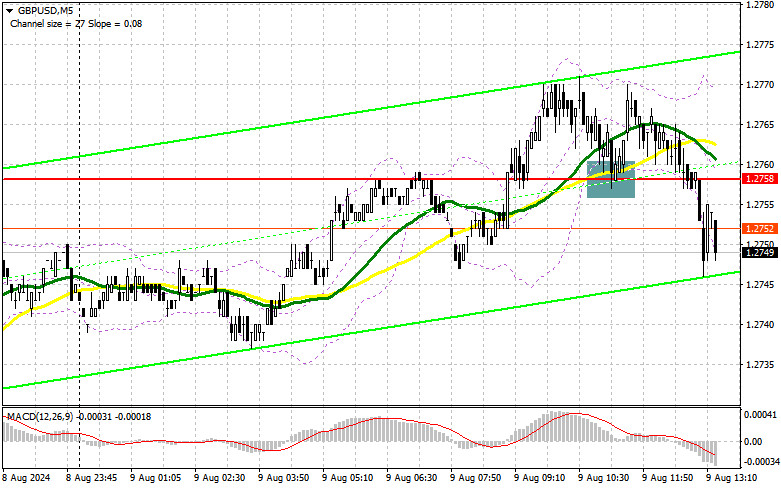

Em minha previsão da manhã, concentrei-me no nível de 1.2758 e planejei tomar decisões de negociação a partir desse ponto. Vamos examinar o gráfico de 5 minutos e analisar o que aconteceu. O rompimento e o subsequente reteste de 1.2758 levaram a um ponto de entrada para compra. No entanto, após uma alta de 12 pontos, o ímpeto enfraqueceu, resultando em um retorno para cerca de 1.2758 e, em seguida, uma queda da libra abaixo desse nível. Diante disso, o quadro técnico para a segunda metade do dia foi completamente revisado.

Para abrir posições de compra em GBP/USD:

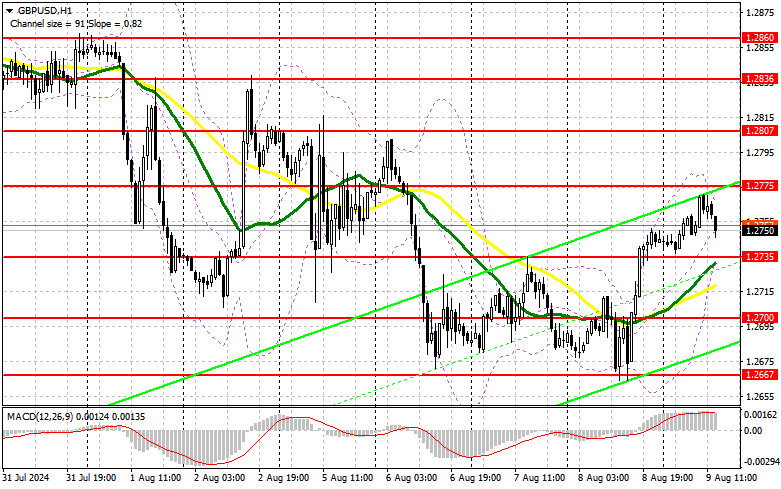

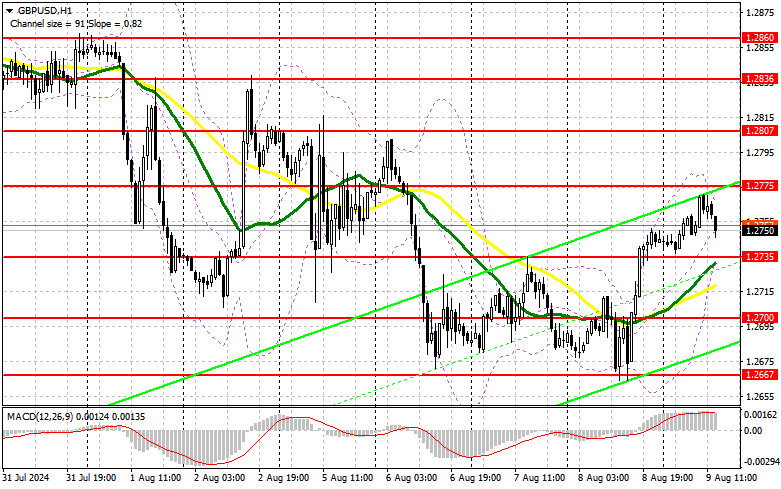

Dada a ausência de estatísticas significativas do Reino Unido, os movimentos ativos dos compradores em torno de 1,2758 não surpreendeu, mas o suporte de grandes players não foi evidente. É provável que o par negocie dentro de um canal lateral durante a segunda metade do dia, uma vez que não há lançamentos de dados significativos nos EUA nem discursos de membros do Federal Reserve programados. Considerando que já vimos tentativas dos compradores, é improvável que alguém tente romper a máxima diária novamente. Portanto, prefiro agir em uma queda em torno do suporte mais próximo, em 1,2735, formado com base nos resultados de ontem. Somente a formação de um falso rompimento seria uma condição adequada para abrir posições longas, visando uma alta em direção à resistência em 1,2775, que não conseguimos alcançar anteriormente. Um rompimento e reteste dessa faixa de cima para baixo aumentariam as chances de uma alta da libra, oferecendo um ponto de entrada longo com uma possível saída em 1,2807. O alvo mais distante seria a área de 1,2836, onde planejo realizar lucros.

Se o GBP/USD cair e não houver atividade de compra em torno de 1,2735 na segunda metade do dia, o que pessoalmente duvido, a libra pode cair mais significativamente, levando à renovação do suporte em 1,2700 e aumentando as chances de uma queda maior. Portanto, somente a formação de um falso rompimento em torno desse nível seria uma condição adequada para abrir posições longas. Planejo comprar GBP/USD imediatamente em um rebote do mínimo de 1,2667, visando uma correção intradiária de 30-35 pontos.

Para abrir posições curtas em GBP/USD:

Os vendedores demonstraram que ainda estão presentes, e agora espero sua primeira atividade em torno da resistência em 1,2775. Somente a formação de um falso rompimento confirmaria a presença de grandes players no mercado, apostando em novas quedas da libra, o que proporcionaria uma oportunidade para abrir novas posições de venda , visando o suporte em 1,2735.

Um rompimento e reteste de baixo para cima dessa faixa minaria os compradores, levando à ativação de stop-losses e abrindo o caminho para 1,2700. O alvo mais distante seria a área de 1,2667, onde planejo realizar lucros. Testar esse nível restabeleceria a tendência de baixa. Se o GBP/USD subir e não houver atividade de venda em 1,2775 na segunda metade do dia, os compradores terão uma boa chance de recuperar o par até o final da semana. Nesse caso, adiaria a venda até um falso rompimento em 1,2807. Se não houver movimento descendente, venderei GBP/USD imediatamente em um rebote de 1,2836, mas apenas visando uma correção descendente de 30-35 pontos.

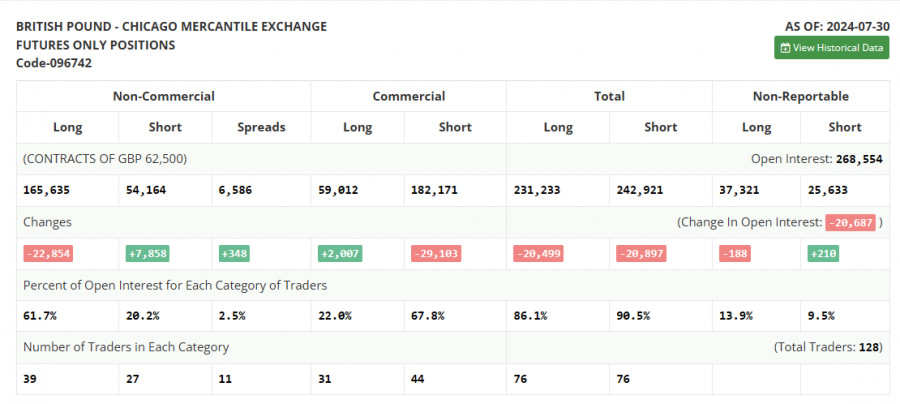

No relatório COT de 30 de julho, houve um aumento nas posições curtas e uma redução nas posições de compra. Essa mudança no equilíbrio de poder não é surpreendente, pois o Banco da Inglaterra indicou claramente durante sua reunião que pretende continuar reduzindo as taxas de juros, uma vez que a economia agora necessita de suporte especial após enfrentar a inflação. A decisão do Federal Reserve de manter as taxas de juros inalteradas, em contraste com o Banco da Inglaterra, resultou na queda da libra, que provavelmente continuará no futuro próximo.

O último relatório COT mostra que as posições de compra não comerciais diminuíram em 22.854, para 165.635, enquanto as posições curtas não comerciais aumentaram em 7.858, para 54.164. Como resultado, a diferença entre posições de compras e vendas aumentou em 348.

Sinais de indicadores:

Médias móveis:

As negociações estão ocorrendo acima das médias móveis de 30 e 50 dias, indicando um maior crescimento do par.

Observação: O período e os preços das médias móveis são considerados pelo autor no gráfico horário 1H e diferem da definição geral das médias móveis diárias clássicas no gráfico diário D1.

Bandas de Bollinger:

Caso haja uma queda, o limite inferior do indicador, em torno de 1,2735, atuará como suporte.

Descrições de indicadores:

- Média Móvel (MA): Determina a tendência atual ao suavizar a volatilidade e o ruído. Período 50. Marcado em amarelo no gráfico.

- Média Móvel (MA): Determina a tendência atual ao suavizar a volatilidade e o ruído. Período 30. Marcado em verde no gráfico.

- MACD (Convergência/Divergência de Médias Móveis): EMA rápida Período 12. EMA lenta Período 26. SMA Período 9.

- Bandas de Bollinger: Período 20.

- Traders não comerciais: Especuladores como traders individuais, fundos de hedge e grandes instituições que utilizam o mercado de futuros para fins especulativos e atendem a requisitos específicos.

- Posições de compra não comerciais: A posição de compra total em aberto dos traders não comerciais.

- Posições de venda não comerciais: A posição de venda total em aberto dos traders não comerciais.

- Posição líquida total não comercial: A diferença entre as posições de venda e de comrpas dos traders não comerciais.