Analysis of macroeconomic reports:

Quite a lot of macroeconomic events are planned for Thursday. The Eurozone's economic calendar is empty, but noteworthy releases in the UK and the U.S. GDP and industrial production data will be released today in Great Britain. While these reports are not considered crucial, as the market often ignores them, we might still see a slight reaction if the actual values deviate from the forecasts.

In the U.S., less significant reports on retail sales, industrial production, and unemployment claims will be published. The market is currently set to buy both currency pairs, so new weak data from the U.S. could trigger another drop in the dollar.

Analysis of fundamental events:

Only a speech by Federal Reserve representative Patrick Harker can be noted among the fundamental events for Thursday. However, after the U.S. inflation reports this week, it is unlikely that Harker will be able to convince the market that the Fed has yet to decide on the key interest rate. The market is convinced that the rate will not just be lowered in September but reduced by 0.5%. Based on this factor alone, the dollar may continue to decline.

General conclusions:

Both currency pairs might see a slight pullback during the penultimate trading day. However, it is important to remember that five reports will be released today in the UK and the U.S., so both currency pairs could show gains if the U.S. data disappoints again, as they have been for the past four months. In addition, the market firmly believes that the Fed will start easing monetary policy in September. Currently, both currency pairs are showing an upward trend.

Basic rules of a trading system:

1) The strength of a signal is determined by the time it took for the signal to form (bounce or level breakthrough). The shorter the time required, the stronger the signal.

2) If two or more trades around a certain level are initiated based on false signals, subsequent signals from that level should be ignored.

3) In a flat market, any currency pair can produce multiple false signals or none at all. In any case, it's better to stop trading at the first signs of a flat market.

4) Trades should be opened between the start of the European session and mid-way through the U.S. session. All trades must be closed manually after this period.

5) In the hourly time frame, trades based on MACD signals are only advisable amidst substantial volatility and an established trend, confirmed either by a trendline or trend channel.

6) If two levels are too close to each other (from 5 to 20 pips), they should be considered as a support or resistance zone.

7) After moving 15 pips in the intended direction, the Stop Loss should be set to break-even.

What's on the charts:

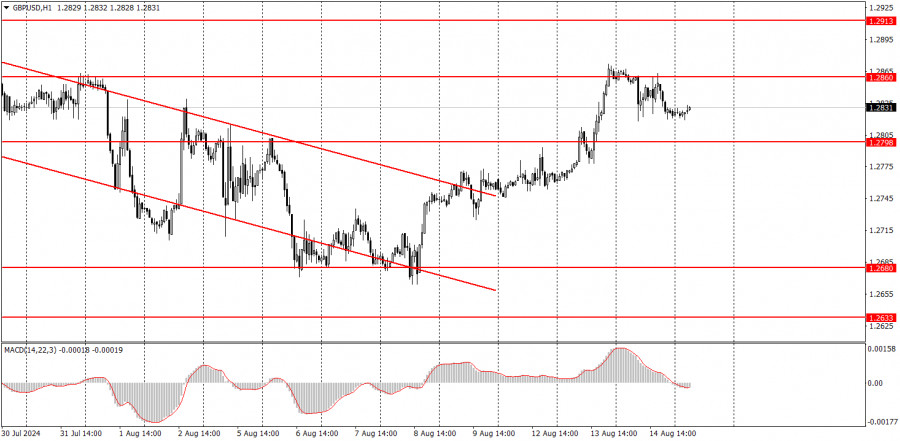

Support and Resistance price levels: targets when opening long or short positions. You can place Take Profit levels near them.

Red lines: channels or trend lines that depict the current trend and indicate the preferred trading direction.

The MACD (14,22,3) indicator, encompassing both the histogram and signal line, acts as an auxiliary tool and can also be used as a source of signals.

Important speeches and reports (always noted in the news calendar) can profoundly influence the price dynamics. Hence, trading during their release calls for heightened caution. It may be reasonable to exit the market to prevent abrupt price reversals against the prevailing trend.

Beginners should always remember that not every trade will yield profit. Establishing a clear strategy, coupled with effective money management, is key to long-term success in trading.