O par EUR/USD na terça-feira nem sequer tentou corrigir, pelo menos não na primeira metade do dia. Em geral, o euro continua a crescer como fermento quase todos os dias. O máximo que o dólar pode esperar nas condições atuais é uma correção de 50 a 60 pips. Assim, o cenário técnico permanece inalterado.

No entanto, o sentimento entre muitos analistas e especialistas em câmbio está mudando. O par tem subido quase diariamente, e é necessário uma explicação para esse movimento. Mas como explicá-lo quando não há notícias ou relatórios? Explicações clássicas começam a surgir, como "aumento do apetite pelo risco" ou "expectativas dovish crescentes em relação à Reserva Federal." Admito que quase qualquer movimento pode ser explicado com essas duas frases.

Um grande exemplo é quando o dólar americano cai sem uma razão clara, é porque o apetite pelo risco está aumentando no mercado. Se a moeda norte-americana sobe sem causas visíveis, é porque 'o apetite por risco está diminuindo no mercado'. Esse é todo o enigma. Os fatores que desencadeiam o aumento ou a queda do apetite por risco nunca são totalmente explicados. O método para prever esse apetite por risco também é um mistério. Na nossa perspectiva, a maioria dos especialistas parece explicar qualquer movimento apenas em retrospectiva. Na realidade, é muito mais simples. O par EUR/USD sobe simplesmente porque está sendo comprado.

É crucial lembrar que o mercado é controlado por grandes players, que realizam transações no valor de milhões e bilhões de dólares. Esses players significativos, incluindo diversos bancos e grandes fundos, possuem uma vasta quantidade de informações sobre o mercado e o sentimento predominante, muito mais do que os traders de varejo. Eles têm o poder de influenciar os preços e direcioná-los para onde desejam. E a direção desejada por eles, naturalmente, não é divulgada aos traders comuns, que estão diligentemente analisando notícias e relatórios. Além disso, os formadores de mercado podem nem mesmo considerar as notícias, relatórios e vários eventos. Eles não são obrigados a fazê-lo!

Como resultado, ocasionalmente observamos movimentos que são difíceis de explicar em retrospectiva. Por exemplo, o mercado vem antecipando um corte na taxa de juros do Fed desde janeiro. Durante todo esse período, o dólar americano caiu com muito mais frequência do que o cenário fundamental e macroeconômico sugeriria.

O mercado não reconhece a fraqueza na economia europeia, mas reage prontamente a dados macroeconômicos fracos dos EUA. Desde o início do ano, o mercado vem reagindo a um corte na taxa de juros do Fed que ainda não ocorreu, enquanto o afrouxamento da política monetária do Banco Central Europeu não desperta o mesmo interesse.

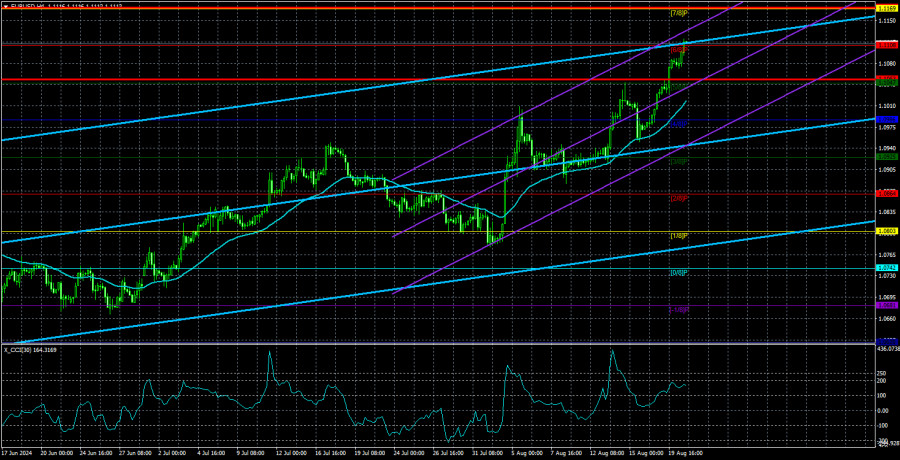

Assim, não há lógica aparente na atual alta do euro. Grandes players estão atuando no mercado, e eles têm sua própria lógica para a tomada de decisões atualmente. A única opção que resta é tentar segui-los ou fazer uma pausa até que os movimentos se normalizem. Até mesmo os indicadores técnicos que sugerem uma alta do dólar simplesmente não estão funcionando. O CCI entrou na zona de sobrecompra três vezes, e, mesmo assim, o par continua a subir tranquilamente.

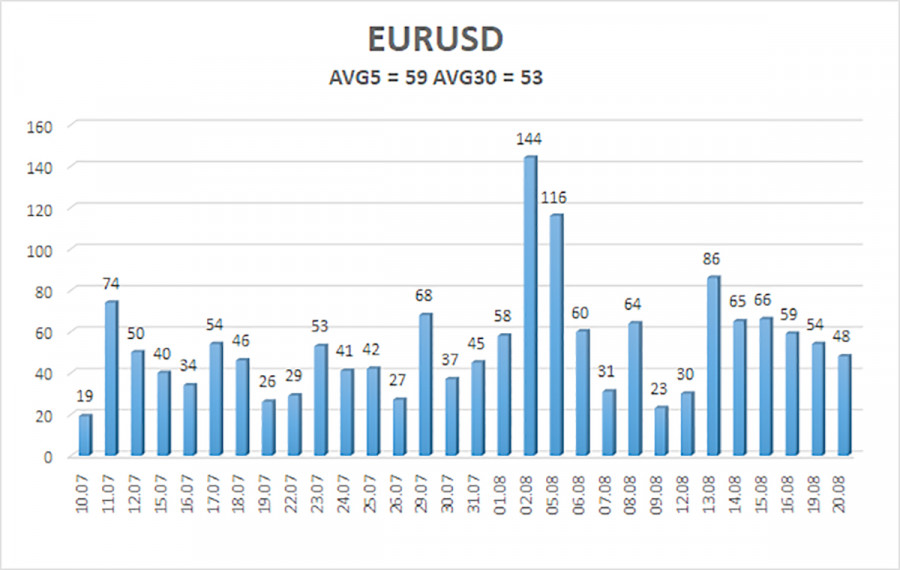

A volatilidade média do EUR/USD nos últimos cinco dias de negociação, a partir de 21 de agosto, é de 59 pips, o que é considerado moderado. Espera-se que o par se mova entre os níveis de 1,1052 e 1,1171 na quarta-feira. O canal superior da regressão linear está inclinado para cima, mas a tendência de baixa geral ainda prevalece. O indicador CCI entrou na zona de sobrecompra pela terceira vez, o que não só alerta para uma possível reversão da tendência para o lado negativo, mas também indica que o aumento atual pode ser totalmente ilógico.

Níveis de suporte mais próximos:

- S1 – 1.1047

- S2 – 1.0986

- S3 – 1.0925

Níveis de resistência mais próximos:

- R1 – 1.1108

- R2 – 1.1169

- R3 – 1.1230

Recomendações de negociação:

O par EUR/USD mantém uma tendência global de baixa, mas, no gráfico de 4 horas, o movimento de alta foi retomado devido a uma nova série de relatórios macroeconômicos dos EUA e ao desejo persistente do mercado de comprar euros e vender dólares. Em análises anteriores, mencionamos que esperamos quedas no euro a médio prazo, mas a alta atual parece quase provocativa. No entanto, seria imprudente negar que o preço está em um movimento ascendente, e ainda não há sinais de que isso termine em breve.

O mercado continua a aproveitar todas as oportunidades para compras, mas o quadro técnico alerta para uma alta probabilidade de término da tendência de alta local.

Explicações para as ilustrações:

Canais de regressão linear: ajudam a determinar a tendência atual. Se ambos estiverem voltados para a mesma direção, isso significa que a tendência é forte.

Linha de média móvel (configurações 20,0, suavizadas): determina a tendência de curto prazo e a direção na qual a negociação deve ser conduzida.

Níveis de Murray: níveis-alvo para movimentos e correções.

Níveis de volatilidade (linhas vermelhas): o provável canal de preços no qual o par passará as próximas 24 horas, com base nos indicadores de volatilidade atuais.

Indicador CCI: Entrar na área de sobrevenda (abaixo de 250) ou na área de sobrecompra (acima de +250) significa que uma reversão de tendência está se aproximando.