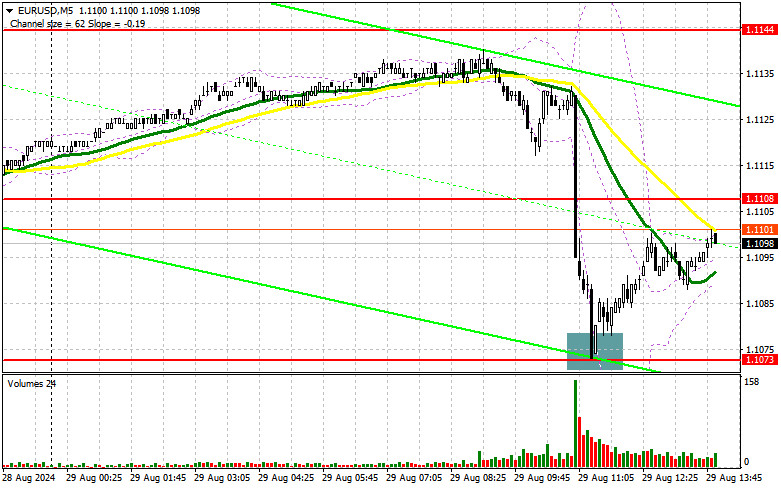

In my morning forecast, I highlighted the level of 1.1073 and planned to make trading decisions based on it. Let's look at the 5-minute chart to analyze what happened. The decline and the formation of a false breakout at this level provided an excellent entry point for buying the euro, resulting in a gain of over 25 points. For the afternoon session, the technical picture was slightly revised.

To Open Long Positions on EUR/USD:

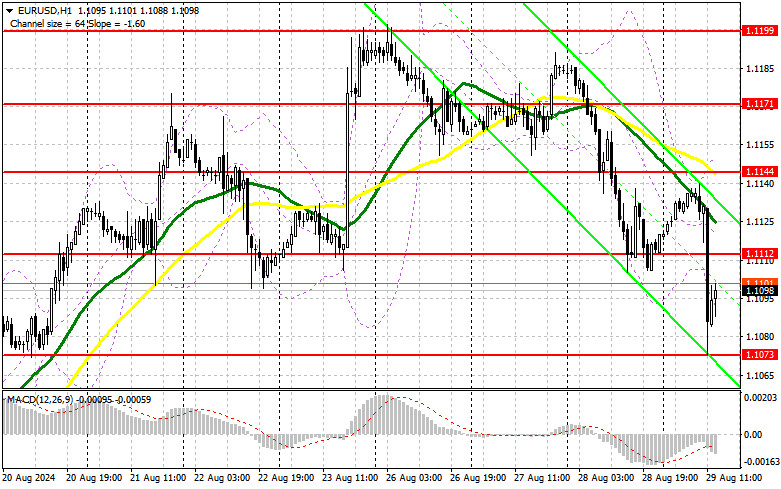

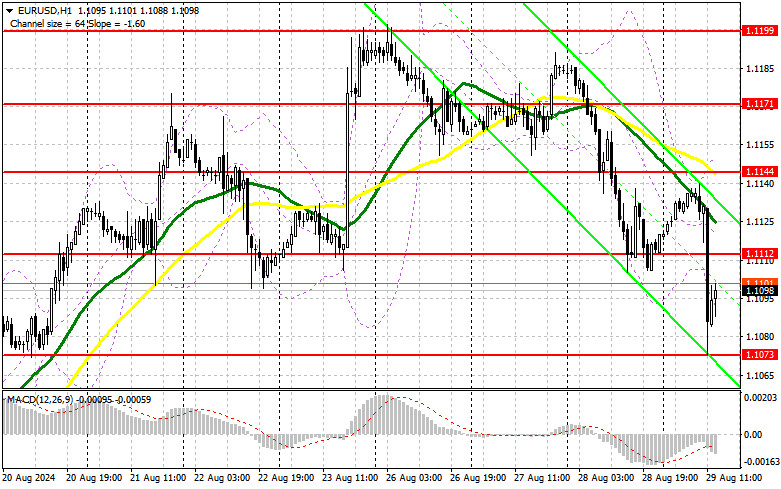

The euro declined in the first half of the day, likely due to traders continuing the downward correction following a strong rebound during the Asian session, rather than due to any specific statistics. Ahead of us are several important data releases from the U.S., including GDP growth figures for the second quarter, which will be crucial. Speeches by FOMC member Raphael Bostic will also be closely watched and could potentially harm the upward potential of the U.S. dollar, shifting demand back to the euro. I plan to act on the decline after a false breakout around the nearest support at 1.1073, which performed well in the first half of the day. This would be a suitable condition for opening long positions, expecting a rise in the euro and a test of new resistance at 1.1112, formed during the first half of the day. A breakout above this range could push the pair higher, potentially testing 1.1144, where the moving averages are located. The ultimate target will be the high of 1.1171, where I will take profit. In the event of further declines in EUR/USD and a lack of activity around 1.1073 in the afternoon, considering that this level has already been tested once today, sellers could strengthen their positions and have a chance for a larger correction. In such a case, I will only enter after a false breakout around the next support at 1.1053. I plan to open long positions immediately on a rebound from 1.1033 with a target of a 30-35 points upward correction within the day.

To Open Short Positions on EUR/USD:

Sellers have reasserted themselves, indicating a shift away from risky assets by investors. Let's see how the pair performs during the U.S. session after the GDP-related statistics are released. If the data remains unchanged, it could help the euro recover somewhat, so a false breakout around the new resistance at 1.1112 would be an opportune moment to open new short positions, continuing the bearish trend towards updating the support at 1.1073. I expect the first signs of significant buyers at this level. A breakout and consolidation below this range, followed by a retest from below, will provide another selling point with movement towards 1.1053. The ultimate target will be the 1.1033 level, where I will take profit. If EUR/USD moves upwards and there are no bears at 1.1112, which cannot be ruled out, buyers will regain the initiative and have a chance to update the daily high. In this case, I will postpone selling until testing the resistance at 1.1144. I will also sell there, but only after a failed breakout. I plan to open short positions immediately on a rebound from 1.1171 with a target of a 30-35 points downward correction.

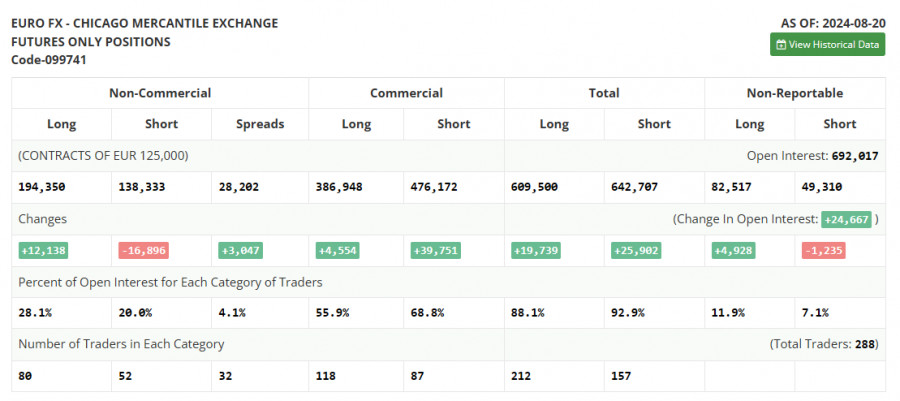

The COT (Commitment of Traders) report for August 20 showed an increase in long positions and a substantial reduction in short positions. This indicates a continued bullish sentiment among risk asset buyers. The recent speech by Fed Chairman Jerome Powell at Jackson Hole, which is not yet reflected in this report, is likely to lead to further shifts in favor of euro buyers. However, the dollar's future direction will depend entirely on incoming data related to inflation and the US labor market. I recommend paying particular attention to these indicators. The COT report indicates that long non-commercial positions increased by 12,138 to 194,350, while short non-commercial positions fell by 16,896 to 138,330. As a result, the gap between long and short positions increased by 3,047.

Indicator Signals:

Moving Averages:

Trading is below the 30 and 50-day moving averages, indicating a potential decline for the euro.

Note: The period and prices of moving averages are considered by the author on the H1 chart and differ from the general definition of classic daily moving averages on the D1 chart.

Bollinger Bands:

In the event of a decline, the lower boundary of the indicator at around 1.1098 will act as support.

Indicator Descriptions:

- Moving Average: (Smoothing volatility and noise to define the current trend). Period 50. Marked in yellow on the chart.

- Moving Average: (Smoothing volatility and noise to define the current trend). Period 30. Marked in green on the chart.

- MACD Indicator: (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands: Period 20.

- Non-commercial Traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.

- Long Non-commercial Positions: Represent the total long open positions of non-commercial traders.

- Short Non-commercial Positions: Represent the total short open positions of non-commercial traders.

- Net Non-commercial Position: The difference between short and long positions of non-commercial traders.