Trade Analysis and Tips for Trading the British Pound

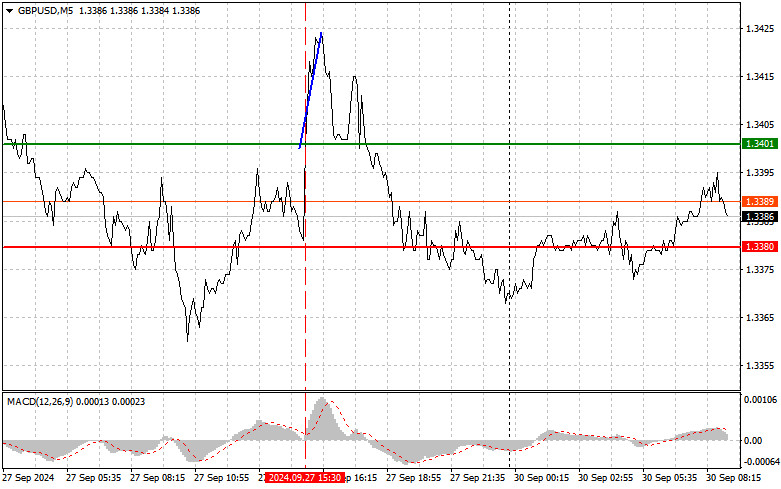

The test of the 1.3401 price occurred when the MACD indicator started to move up from the zero mark, confirming the correct entry point to buy the pound. As a result, the pair rose by more than 25 pips, but we didn't quite reach the target level. News of a decline in the Personal Consumption Expenditure Index – the Federal Reserve's preferred measure of inflation – led to a drop in the US dollar, supporting demand for the British pound in the second half of the day. Today, we have figures on changes in the UK's GDP, the current account balance, and the total change in investment, which could influence the GBP/USD outlook in the short term. Only very strong data will be able to continue the pound's rise at the end of the month. Otherwise, I'll trade within the channel. Regarding the intraday strategy, I will mostly rely on the implementation of scenarios #1 and #2.

Buy Signal

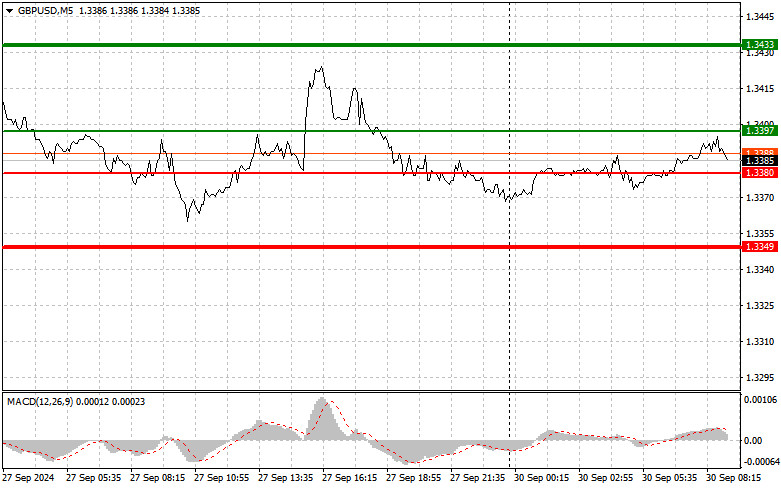

Scenario #1: Today, I plan to buy the pound when it reaches the entry point at 1.3397 (green line on the chart) with a target of rising to the 1.3433 level (thicker green line on the chart). Around the 1.3433 level, I intend to exit the buy positions and open sell positions in the opposite direction (expecting a movement of 30-35 pips in the opposite direction from this level). The pound's growth can be expected as part of the ongoing bullish market. Important! Before buying, ensure the MACD indicator is above the zero mark and is just beginning to rise.

Scenario #2: I also plan to buy the pound today in the case of two consecutive tests of the 1.3380 price when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. Growth to the opposite levels of 1.3397 and 1.3433 can be expected.

Sell Signal

Scenario #1: Today, I plan to sell the pound after the 1.3380 level is tested (red line on the chart), which will lead to a rapid decline of the pair. The key target for sellers will be the 1.3349 level, where I intend to exit the sell positions and immediately open buy positions in the opposite direction (expecting a movement of 20-25 pips in the opposite direction from this level). The pound can be sold after an unsuccessful attempt to break above the monthly high. Important! Before selling, ensure that the MACD indicator is below the zero mark and is just beginning to decline.

Scenario #2: I also plan to sell the pound today in the case of two consecutive tests of the 1.3397 price when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a downward market reversal. A decline to the opposite levels of 1.3380 and 1.3349 can be expected.

What's on the Chart:

Thin green line: Entry price at which you can buy the trading instrument.

Thick green line: The anticipated price where you can set Take Profit or manually lock in profits, as further growth above this level is unlikely.

Thin red line: Entry price at which you can sell the trading instrument.

Thick red line: The anticipated price where you can set Take Profit or manually lock in profits, as further decline below this level is unlikely.

MACD Indicator: When entering the market, it is important to be guided by overbought and oversold zones.

Important: Novice traders in the forex market should be cautious when making market entry decisions. It is best to stay out of the market before the release of important fundamental reports to avoid sudden exchange rate fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. You can quickly lose your entire deposit without stop orders, especially if you do not use money management and trade in large volumes.

And remember, for successful trading, you need to have a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are initially a losing strategy for an intraday trader.