Análise dos relatórios macroeconômicos

Muito poucos eventos macroeconômicos estão agendados para terça-feira. O único relatório notável diz respeito à produção industrial na Alemanha, mas esse não é um dado significativo, o que pode resultar em uma reação fraca ou até inexistente do mercado. No geral, o euro e a libra caíram na semana passada, e, nesta semana, especialmente em dias sem um contexto macroeconômico ou fundamental relevante, o mercado pode se inclinar para uma correção ascendente. Isso é particularmente verdadeiro para a libra esterlina, que, em 2024, teve uma queda em relação ao dólar com muito menos frequência do que o euro.

Análise de eventos fundamentais:

Os principais eventos fundamentais na segunda-feira incluem discursos dos representantes da Reserva Federal, Raphael Bostic, Susan Collins e Philip Jefferson. Esses discursos podem ser interessantes, já que esses oficiais podem comentar sobre os relatórios de desemprego e de folha de pagamento não agrícola da última sexta-feira. Provavelmente, ouviremos declarações sugerindo que um afrouxamento agressivo da política monetária pelo Fed na próxima reunião não será necessário. No entanto, o mercado provavelmente aguardará o relatório de inflação dos EUA antes de tirar conclusões definitivas sobre a decisão do Fed em novembro. Na Zona do Euro, o vice-presidente do Banco Central Europeu, Luis de Guindos, também fará uma apresentação, o que pode ser notável, uma vez que recentemente houve comentários regularmente dovish dentro do BCE.

Conclusões gerais:

No segundo dia de negociação da nova semana, o euro e a libra podem começar uma correção. Se ontem o mercado continuou a reagir aos dados do mercado de trabalho e do desemprego dos EUA de sexta-feira, essa influência pode diminuir hoje. Os investidores terão vários dias "vazios" antes do relatório de inflação norte-americana. A expectativa é de que o dólar suba no médio prazo, mas isso não significa que ele evitará correções ou diminuirá diariamente.

Regras básicas do sistema de negociação:

- A força de um sinal é determinada pelo tempo necessário para que o sinal se forme (salte ou ultrapasse o nível). Quanto menos tempo levar, mais forte será o sinal.

- Se duas ou mais negociações forem abertas em torno de um determinado nível com base em sinais falsos, todos os sinais subsequentes a partir desse nível deverão ser ignorados.

- Em um mercado plano, qualquer par pode gerar muitos sinais falsos ou nenhum. Em qualquer caso, aos primeiros sinais de um mercado estável, é melhor parar de negociar.

- As posições de negociação devem ser abertas durante o período do início da sessão europeia até o meio da sessão americana, após o qual todas as negociações devem ser fechadas manualmente.

- No período de uma hora, recomenda-se negociar com base nos sinais do indicador MACD somente quando houver boa volatilidade e uma tendência confirmada por uma linha de tendência ou canal de tendência.

- Se dois níveis estiverem muito próximos um do outro (entre 5 e 20 pips), eles devem ser considerados como uma zona de suporte ou resistência.

- Ao passar de 15 a 20 pips na direção pretendida, um Stop Loss deve ser definido no ponto de equilíbrio.

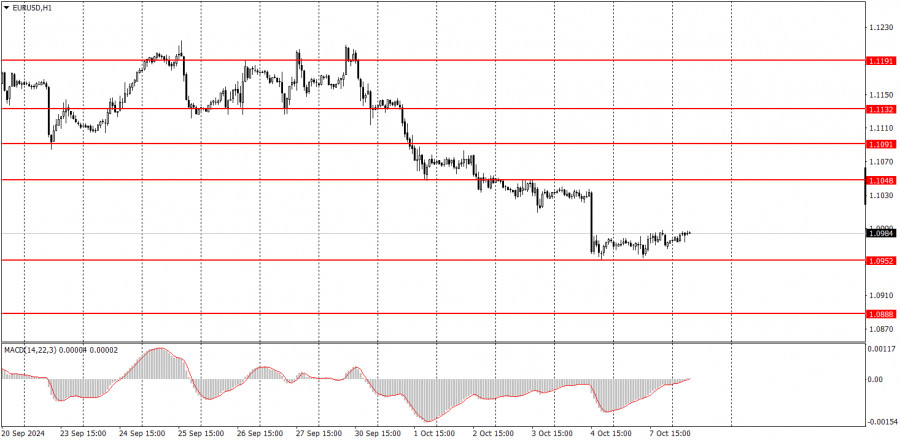

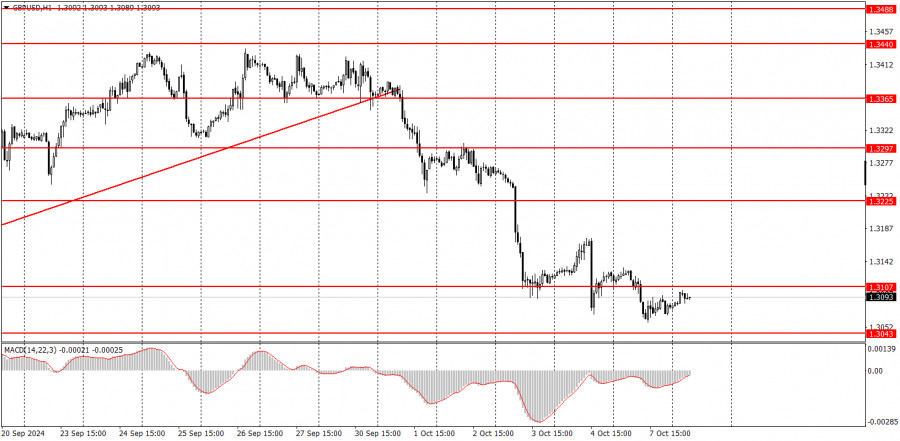

O que o gráfico nos mostra:

Níveis de preço de suporte e resistência: Esses níveis servem como alvos ao abrir posições de compra ou venda. Eles também podem ser usados como pontos para definir níveis de Take Profit.

Linhas vermelhas: Representam canais ou linhas de tendência que exibem a tendência atual e indicam a direção de negociação preferida.

Indicador MACD (14,22,3): O histograma e a linha de sinal servem como um indicador suplementar que também pode ser usado como fonte de sinais de negociação.

Discursos e relatórios importantes (sempre encontrados no calendário de notícias) podem afetar significativamente o movimento de um par de moedas. Portanto, a negociação deve ser feita com o máximo de cautela durante sua divulgação, ou você pode optar por sair do mercado para evitar uma forte reversão de preço contra o movimento anterior.

Para iniciantes em negociações no mercado Forex: É essencial lembrar que nem toda negociação será lucrativa. O desenvolvimento de uma estratégia clara e a prática de gerenciamento de dinheiro são fundamentais para obter sucesso de longo prazo nas negociações.