On Tuesday, the EUR/USD currency pair saw a slight upward correction but has generally remained within a limited range for several weeks. This range cannot be classified as a clear horizontal channel or flat trend because the price occasionally moves outside it. For now, it looks more like a weak correction. The market finds it difficult to push the pair higher due to the lack of reasons to buy the euro. Even after two months of euro declines, any upward movement appears strained. As we have warned multiple times, the euro has been overbought and unjustifiably expensive, and a strong and prolonged decline was bound to happen eventually.

We have even pointed out September 18 as a potential date marking the start of a new downward trend. That day, the Federal Reserve decided to cut its key interest rate for the first time, signaling to the market that rate cuts had begun. This signal meant there was no longer any need to speculate about when the Fed would start reducing rates or by how much—it was happening, prompting investors to take profits on positions built during the anticipation of the Fed's monetary easing cycle.

This easing cycle lasted nearly two years. Recall that in the fall of 2022, inflation in the U.S. began to decline, sparking conversations about rate cuts. From that point, market-makers aggressively pushed the euro upward while selling off the dollar. Naturally, this movement was illogical, as the European Central Bank was also expected to start lowering rates. Today, the ECB is cutting rates even faster than the Fed. Thus, not only was the euro unjustifiably rising for two years, but the market also ignored everything except the Fed's future monetary easing.

We continue to believe that the euro is significantly overvalued. The persistent 16-year global downtrend adds to this, leaving little room for alternatives other than further declines. This week began with a strong ISM Manufacturing PMI in the U.S., providing additional support for the dollar. The overall correction against the two-month euro decline remains minimal and is not obliged to be strong or prolonged. Theoretically, the euro's downward movement could resume at any moment. We continue to expect the pair to reach the 1.00–1.02 range.

This week, much will depend on U.S. macroeconomic data, which could outperform forecasts rather than fall short. Regardless, any rise in the pair under current conditions should be treated as a correction and nothing more.

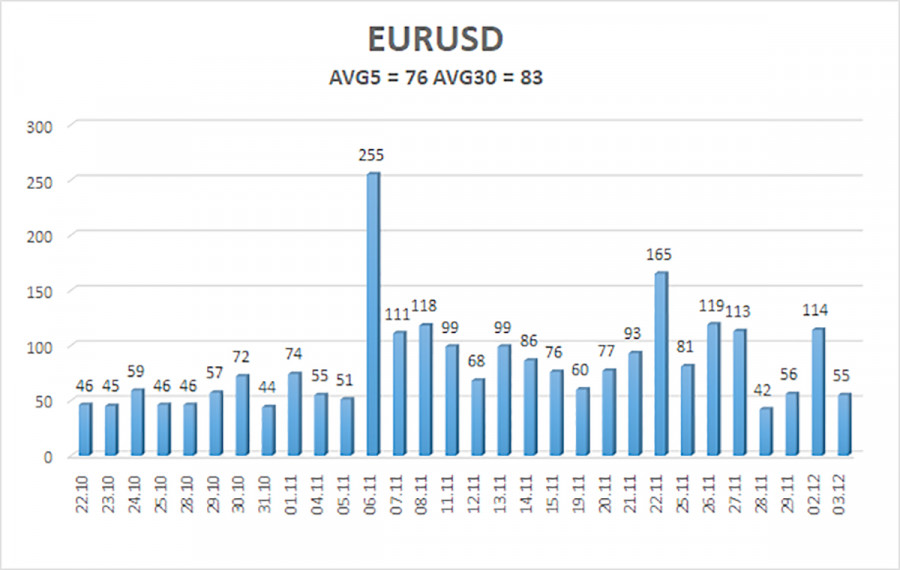

The average volatility of the EUR/USD currency pair over the last five trading days as of December 4 is 76 pips, which is considered "average." We expect the pair to move between the levels of 1.0457 and 1.0609 on Wednesday. The higher linear regression channel is directed downward, indicating that the global downtrend remains intact. The CCI indicator has entered the oversold zone several times, triggering an upward correction, which is still ongoing.

Nearest Support Levels:

- S1: 1.0498

- S2: 1.0376

- S3: 1.0254

Nearest Resistance Levels:

- R1: 1.0620

- R2: 1.0742

- R3: 1.0864

Trading Recommendations:

The EUR/USD pair could resume its downtrend. In recent months, we have consistently maintained that a medium-term decline in the euro is likely, and we continue to support the overall bearish trend direction. The market is highly likely to have already priced in most or all of the anticipated Fed rate cuts. If so, the dollar still lacks any substantial reasons for a medium-term decline, and there weren't many.

Short positions can be considered with targets at 1.0376 and 1.0254 if the price remains below the moving average. If you are trading based on "pure technicals," long positions can be considered if the price is above the moving average, with targets at 1.0620 and 1.0695. However, we do not currently recommend long positions to anyone.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.