The EUR/USD currency pair was trading quite actively on Thursday. It cannot be said that the volatility was commensurate with the indicators after the ECB meeting, but still, after three days of "downtime", the pair finally moved. As expected, the markets could not ignore the US inflation report, which was the only important event of the day. Therefore, as soon as it became known that inflation rose from 7.0% to 7.5% in January, the pair collapsed, which meant the strengthening of the dollar. The markets regarded this information as a signal to increase the probability of tightening the Fed's monetary policy in March by 0.5% at once. However, we will still have time to talk about inflation. The most interesting now is the technical picture of the pair. We have already said earlier that the price twice worked out the Murray level of "4/8" - 1.1475 and twice bounced off it perfectly in accuracy. Thus, even a kind of "double top" pattern was formed. This pattern is quite formal and rarely found in reality. However, the very fact of two bounces from the same level indicates pending sell orders located just at this level. The European currency still does not have a fundamental basis for growth. We consider its rise in price last week to be groundless since the GDP report in the European Union turned out to be weak. Christine Lagarde did not give any specifics after the ECB meeting, her speech was not "hawkish", and the regulator itself refrained from making important decisions. Thus, we are surprised by the fact that the euro has grown by 350 points. Now justice can prevail, and the euro/dollar pair will go back to the 12th level.

The European Commission has worsened forecasts for the European economy.

Inflation will rise and economic growth will slow down. Here is the essence of the forecast on the economy from the EC. In the so-called "winter forecast", the European Commission increased the inflation forecast for 2022 to 3.9%. Last fall, the forecast was 2.5%. The GDP forecast for 2022 was also lowered, now it is 4%, and in the fall it was at 4.3%. The document says that the rise in energy prices is a key factor in the growth of inflation and will have an impact throughout the year. In addition, the European Commission expects gas prices to stabilize in the second half of 2022. But at the same time, the pandemic, supply problems, and disruptions of production chains will continue to harm the economy and inflation.

What follows from this? Nothing good for the European Union and the euro currency. Although traders did not work out this document very zealously yesterday, nevertheless, if the European Commission itself believes that the situation will worsen, this is a serious cause for concern. After all, the weaker the European economy, the less likely it is to tighten monetary policy. And if economic growth is close to zero or fundamentally small, then whatever the inflation, the ECB will not risk raising rates anyway. And if so, then the prospects for the growth of the European currency are even worse. While the Fed is considering at least 4 rate hikes in 2022, the ECB should be considering whether to extend the duration of the economic stimulus program. Of course, we exaggerate a little, but the European economy is not ready for normalization right now. The situation is also complicated by low GDP figures, as well as high unemployment (about 2 times higher than in the USA). In general, if we look exclusively at the fundamental background, we would expect a further fall in the European currency this year. However, we remember about the saturation factor of bears: the dollar has been growing for more than a year, but it still cannot grow forever. Therefore, it is quite possible that at certain levels, with any fundamental background, market participants will no longer buy the dollar and sell the euro. In principle, these levels could have already been reached last week, followed by a groundless growth of the pair by 350 points.

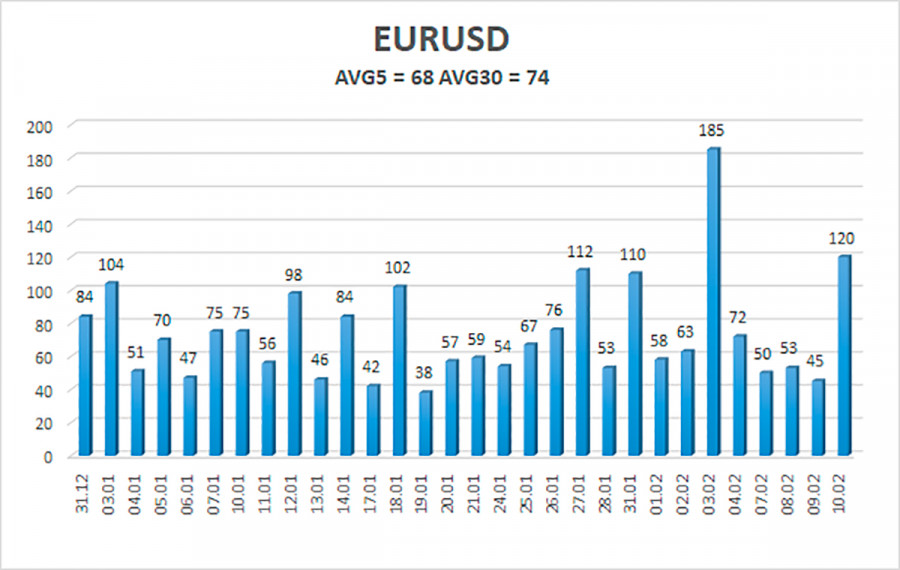

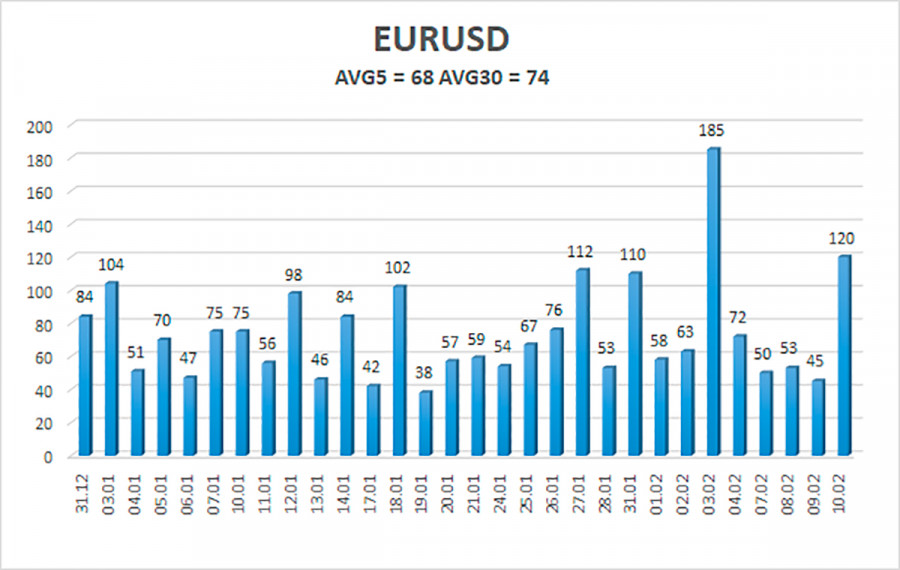

The volatility of the euro/dollar currency pair as of February 11 is 68 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1391 and 1.1527. The reversal of the Heiken Ashi indicator downwards signals a new round of corrective movement.

Nearest support levels:

S1 – 1.1414

S2 – 1.1353

S3 – 1.1292

Nearest resistance levels:

R1 – 1.1475

R2 – 1.1536

R3 – 1.1597

Trading recommendations:

The EUR/USD pair continues to be located above the moving average line. Thus, now you should stay in long positions with targets of 1.1527 and 1.1536 until the Heiken Ashi indicator turns down. Short positions should be opened no earlier than the price-fixing below the moving average line with targets of 1.1353 and 1.1292.

Explanations to the illustrations:

Linear regression channels - help to determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted now.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.