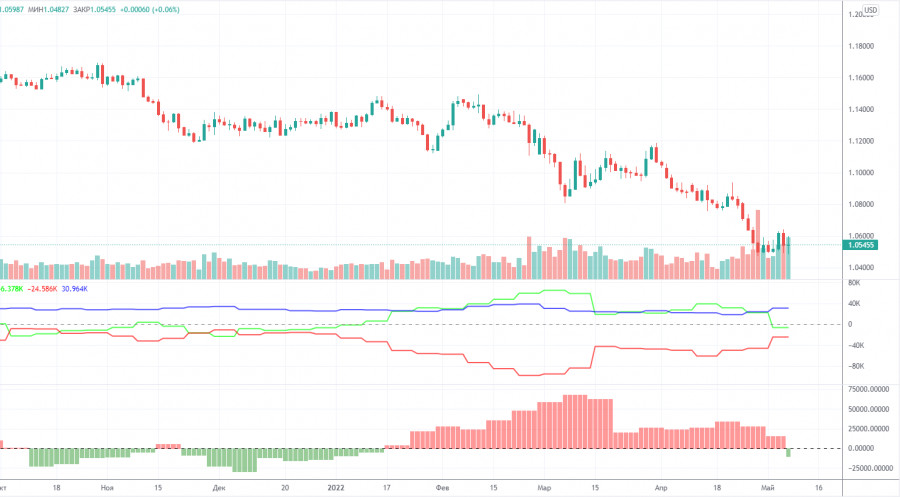

EUR/USD 5M

Yesterday, the EUR/USD pair resumed its downward trend and managed to lose about 140 points during the day. 140 points! Almost out of the blue, since important statistics were not published on Thursday either in the United States or in the European Union. There were no important speeches or events. But at a certain moment the euro settled below the horizontal channel and began a new round of its own depreciation against the dollar. We have already said earlier that the euro's decline now simply raises questions, since there are no such weighty and serious reasons for such a strong fall. But if the market continues to sell out, then what else is left for the euro? Now the pair has reached the 1.0369 level, and the 1.0340 level is the low for the last 20 years... That's how easy and simple the pair dropped to such values...

Despite the sad picture for the euro, the trading signals were very good yesterday. Once again, we remind you that a trend movement is always good. You can make very good money on the trend. The first trading signal for short positions was formed when the pair settled below the extreme level of 1.0471. A little later, it formed a second sell signal in the form of a rebound from the same level from below. Thus, the pair should have been sold 100%. By evening, the quotes dropped to the level of 1.0369, where they should have taken profits. It amounted to at least 80 points. The rebound from the level of 1.0369 was a signal to buy, but it formed too late in time, so it was not worth working out already. Like the next sell signal.

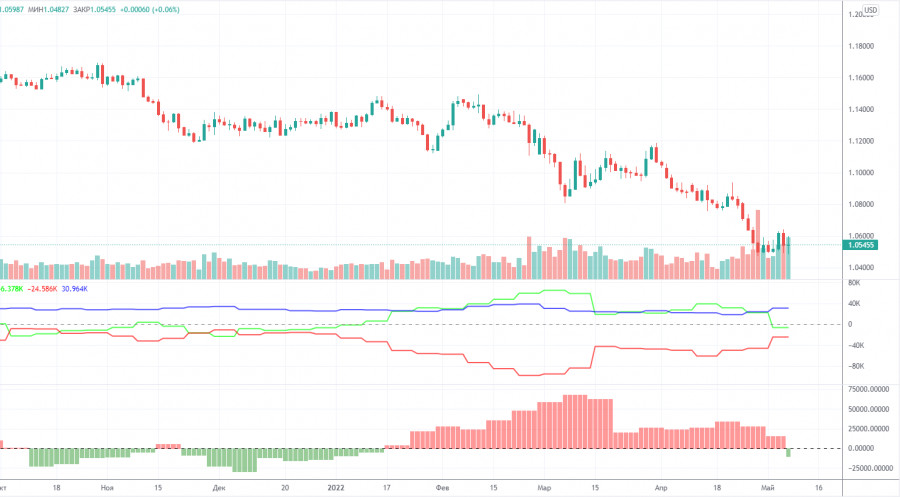

COT report:

The latest Commitment of Traders (COT) reports on the euro raised more questions than they answered! But finally the situation began to change and now the COT reports more or less reflect the real picture of what is happening on the market, as the mood of the non-commercial group has become bearish. The number of long positions decreased by 14,500 during the reporting week, while the number of shorts in the non-commercial group increased by 14,000. Thus, the net position decreased by 28,500 contracts per week. This means that the bullish mood has changed to bearish, as the number of short positions now exceeds the number of non-commercial traders' long positions by 6,000. However, what happened in the last reporting week is a double-edged sword. On the one hand, COT reports now reflect what is happening on the market. On the other hand, if now the demand for the euro has also begun to fall, then we can expect another new fall in this currency. Recall that in recent weeks, professional traders, oddly enough, maintained a bullish mood and bought the euro more than sold. And even in this scenario, the euro fell like a stone. What will happen now, when the major players have begun to sell the euro? Demand for the dollar remains high, demand for the euro falls. Thus, it is quite reasonable now to expect a new decline in the euro/dollar pair. Moreover, the reaction to the Federal Reserve's hawkish meeting was not quite adequate.

We recommend to familiarize yourself with:

Overview of the EUR/USD pair. May 13. Finland and Sweden will apply for NATO membership within a week.

Overview of the GBP/USD pair. May 13. New absolutely groundless fall of the pound. Even despite the weak GDP.

Forecast and trading signals for GBP/USD on May 13. Detailed analysis of the movement of the pair and trading transactions.

EUR/USD 1H

You can clearly see on the hourly timeframe that the pair has left the horizontal channel. Guess which border it is? Naturally, through the bottom. Thus, the downward trend continues, and the euro can theoretically fall anywhere. The market continues to actively sell this currency, so it has no choice but to fall. We highlight the following levels for trading on Friday - 1.0340-1.0369, 1.0471, 1.0579, as well as Senkou Span B (1.0556) and Kijun-sen (1.0475) lines. Ichimoku indicator lines can move during the day, which should be taken into account when determining trading signals. There are also secondary support and resistance levels, but no signals are formed near them. Signals can be "rebounds" and "breakthrough" extreme levels and lines. Do not forget about placing a Stop Loss order at breakeven if the price has gone in the right direction for 15 points. This will protect you against possible losses if the signal turns out to be false. The release of a report on industrial production is scheduled for May 13 in the European Union. Only the consumer sentiment index from the University of Michigan will be published in the US today. It is also far from the most important indicator of the state of the economy. Therefore, we do not expect the market to significantly react to today's macroeconomic reports.

Explanations for the chart:

Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels.

Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one.Support and resistance areas are areas from which the price has repeatedly rebounded off.

Yellow lines are trend lines, trend channels and any other technical patterns.

Indicator 1 on the COT charts is the size of the net position of each category of traders.

Indicator 2 on the COT charts is the size of the net position for the non-commercial group.