Details of the economic calendar on February 1

Preliminary data on inflation in the EU was better than forecasts. The rate was expected to fall from 9.2% to 8.7%, but slowed down to 8.5%. Such positive results once again indicated that the ECB is likely to ease its monetary policy, which will lead to the end of the interest rate hike cycle.

The main event was the outcome of the Federal Open Market Committee meeting, where the regulator raised the base rate to its highest level in 16 years.

The Fed raised the base rate by 25 basis points—from 4.25–4.5% to 4.5–4.75% per annum. This decision was expected in the market. In an accompanying press release, the Fed stressed the need for further increases in the base rate to bring inflation back to its 2% target.

However, despite such a hawkish stance, Federal Reserve Chairman Jerome Powell still hopes to avoid a strong economic slowdown. He believes that "a soft landing is possible."

The main theses from Powell's conference:

- The Fed is considering a couple more rate hikes to move to an appropriate restrictive stance

- The Fed don't have a final interest rate decision yet

- The March meeting will update estimates on the path of interest rate hikes

- The final interest rate could certainly be higher than we expected in December

- Pausing between meetings is not what the committee is discussing; we don't plan to raise the rate at every two meetings

- My prediction, and that of my colleagues, is that a rate cut this year is not advisable

- If inflation falls faster, we will notice it and include it in our policy.

Financial markets' reaction to this year's first Fed meeting:

NASDAQ100 +3.22%

S&P500 +1.5%

EURUSD +1.17%

GBPUSD +0.60%

GOLD +1.14%

BTCUSD +2.6%

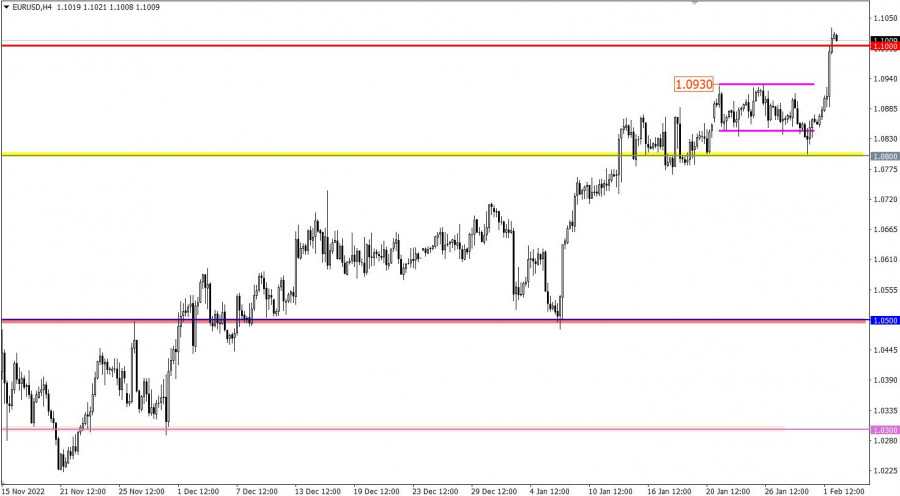

Analysis of trading charts from February 1

The EURUSD currency pair not only managed to show an upward interest, but has undergone drastic changes. Initially, the local high of the upward trend was updated, and then the 1.1000 psychological level was broken. In fact, there was a full-blown inertial move amid market speculation.

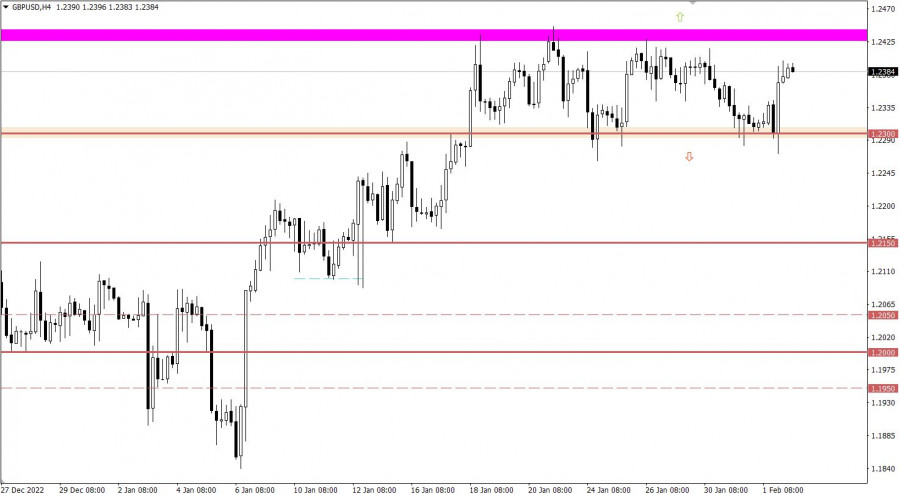

The GBPUSD currency pair managed to show upward activity by about 80 points during the past day. However, this movement did not lead to anything cardinal. The quote is still moving within the side channel 1.2300/1.2440.

Economic calendar for February 2

Today, the Bank of England and the European Central Bank will hold its meetings at once. In both cases the interest rate is expected to rise by 50 basis points. This is slightly more than in the U.S. thus, locally, the euro and pound sterling may get support from the market.

It is worth noting that traders will pay special attention to the subsequent press conference of ECB President Christine Lagarde. During which, Lagarde can put everything in its place regarding the prospects for monetary policy.

The market may experience the strongest volatility during the press conference.

Time targeting:

Bank of England meeting result – 12:00 UTC

ECB meeting result – 13:15 UTC

ECB press conference – 13:45 UTC

EUR/USD trading plan for February 2

Such strong price movements in a short period of time have led to a technical signal that the euro is overbought in the short term. This allows the upward cycle to slow down with the formation of a pullback.

It is worth noting that subsequent speculation will arise in the market during the outcome of the ECB meeting and the subsequent press conference.

From a technical analysis point of view, a stable holding of the price above the level of 1.1000 allows the further growth of the euro.

GBP/USD trading plan for February 2

As long as there is no breakdown of one or another flat border, a price rebound scenario is allowed, which, in the theory of technical analysis, can lead to a reduction in the volume of long positions in the pound sterling around 1.2400/1.2440.

The breakdown method is rightfully considered the main tactic, because only it will lead to drastic changes relative to the current stagnation.

Based on the breakdown tactics, we concretize the above:

A downward movement will be relevant if the price holds below the level of 1.2300 in a four-hour period. This step can lead to the formation of a full-blown correction.

An upward movement is taken into account in case of a stable holding of the price above the value of 1.2450 in a four-hour period. This move will indicate a continuation of the upward trend.

What's on the charts

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed in history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.