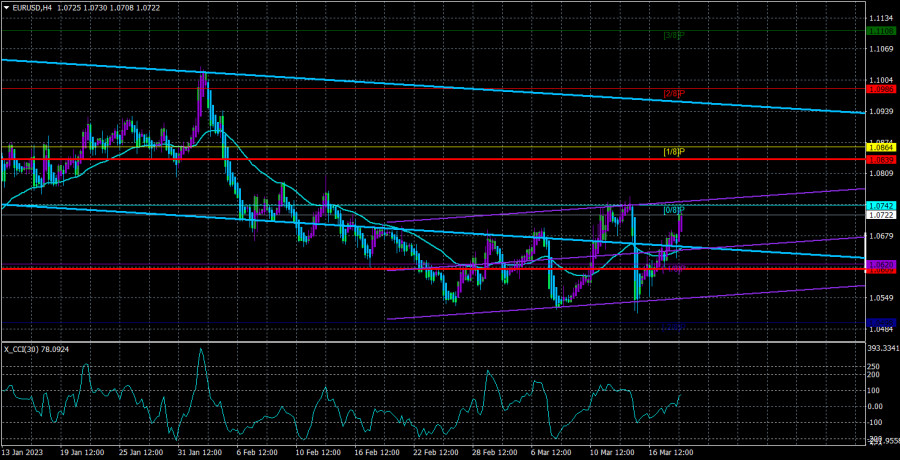

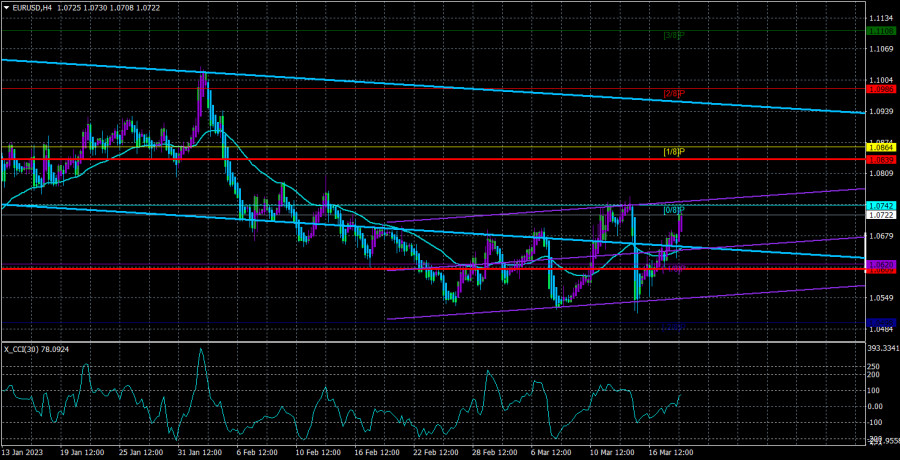

On Monday, the EUR/USD currency pair was trading higher once more, which makes sense but only takes into account one factor. "Technique" is this factor. The fact is that the euro currency has been showing what is known as "swings" for several weeks now, which are characterized by alternating movements in various directions that are roughly the same size. As a result, the European currency might show development in this mode even when all other growth causes are absent. That is exactly what we saw on Monday. A downward reversal may occur today or tomorrow, and an equally strong turn of movement to the south may follow, even if there are no fundamental or macroeconomic reasons for this. The pair has approached its most recent local maximum. A rebound from the Murray level of "0/8"-1.0742 might also occur at the same time as the reversal. Hence, it is currently unable to draw any new conclusions about the technical picture. The pair is still very challenging to trade on the 4-hour TF because reversals happen far too frequently. We often have a flat on a 24-hour TF. Only the lowest TF remains, and a 200-300 point movement is a pattern.

It should be highlighted that, in our opinion, neither the inflation report nor the ECB meeting at the end of last week is to blame for the recent increase in the value of the euro. The meeting's results were as dull as possible; Christine Lagarde hinted at a potential slowdown in the pace of tightening monetary policy; and the inflation report demonstrated the necessity for further rate increases, for which the ECB might not be prepared. Hence, there is no justification for the European currency's current growth.

Markets are being prepared by Christine Lagarde for a long period of high inflation.

The ECB president addressed the Committee on Economic and Monetary Affairs on Monday in the European Parliament. One of the key points raised was the long-term persistence of high inflation. Although Lagarde has stated this previously, it is crucial to comprehend the precise meaning of her comments. We believe as follows. Such pronouncements wouldn't exist if Lagarde and the company were prepared for a rate increase just to achieve price stability. Because they would be meaningless. The opposite is true, and the ECB is not prepared to raise interest rates as far as necessary to follow the Fed's lead. As a result, we fully anticipate that the rate will only rise by 0.25% in May and a maximum of 0.75% overall. This is insufficient to bring inflation back to 2% even over the medium term. Remember that even in the United States, where the Fed has disproportionately vast resources, a rapid return of inflation to 2% is not anticipated. If the aforementioned statements are accurate, the European currency will not strengthen even in 2023 since the ECB rate will not rise above the Fed rate. As a result, the Fed rate won't just stay far higher than the ECB rate; it won't even start to go close to it. How, therefore, can we anticipate the growth of the euro against such a fundamental backdrop?

The last turn of the upward movement was accompanied by a modest downward correction, as shown by the 24-hour TF. This indicates that the euro has not changed sufficiently to resume the upward trend. Even while there are currently "swings," this does not indicate that sooner or later the bulls will activate and rush to purchase euros once again. And what occurs? The "technique" predicts a further decline; the euro currency has no drivers of growth. The euro was strengthened by Credit Suisse's rescue, but how much will the pair's growth depend only on one factor? This week, the Fed will meet, and it is impossible to predict in advance whether there won't be any surprises. If the Fed doesn't raise rates in March or Jerome Powell adopts an overly "dovish" stance, the dollar may well continue to decline. Nobody is safe from this. The dollar should not, however, continue its local and global decline if we assume that the meeting's outcomes will be neutral.

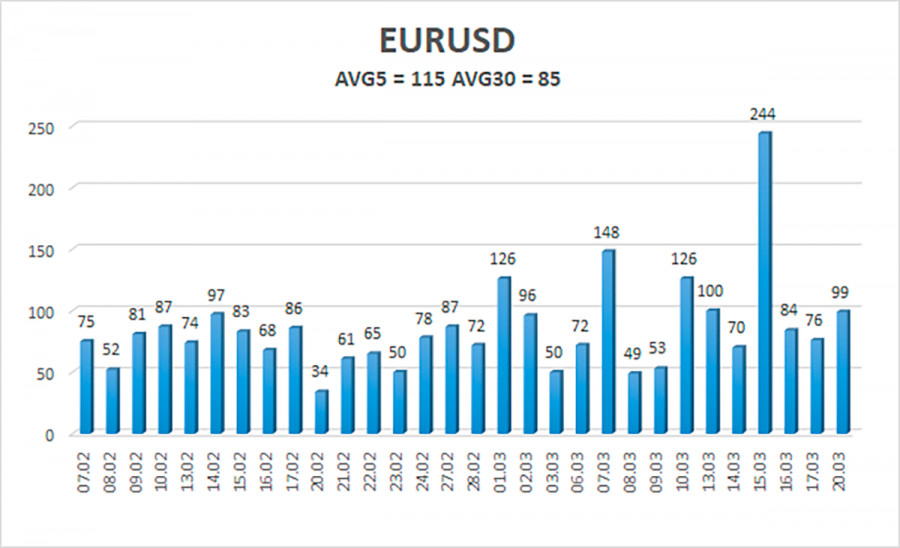

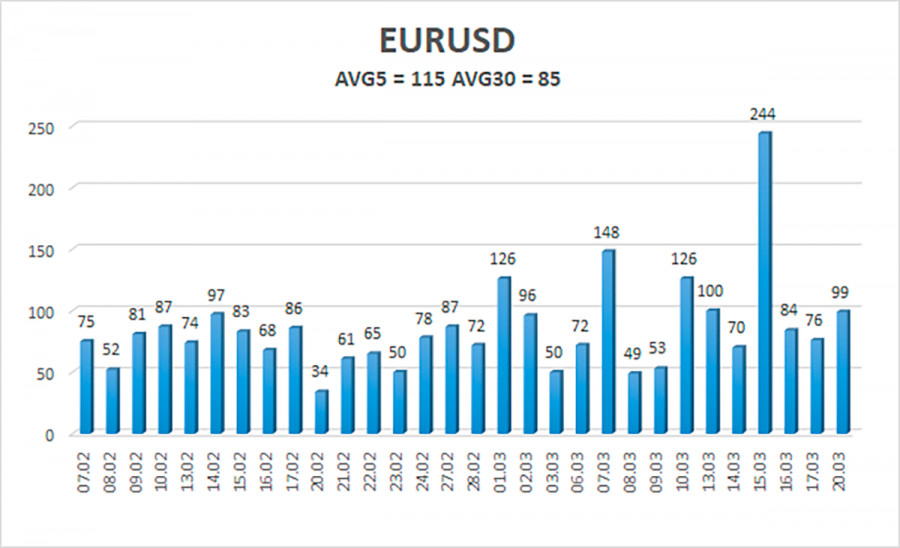

As of March 21, the euro/dollar currency pair's average volatility over the previous five trading days was 115 points, which is considered "high." Hence, on Tuesday, we anticipate the pair to move between 1.0609 and 1.0839. A new round of downward movement within the "swing" will be indicated by the Heiken Ashi indicator turning back down.

Nearest levels of support

S1 – 1.0620

S2 – 1.0498

Nearest levels of resistance

R1 – 1.0742

R2 – 1.0864

R3 – 1.0986

Trade Suggestions:

The EUR/USD pair is presently above the moving average after once more changing its direction of movement. Until the Heiken Ashi indicator turns down, you can continue holding long positions with targets of 1.0742 and 1.0839. After the price is fixed below the moving average line, short positions can be opened with a target of 1.0498.

Explanations for the illustrations:

Determine the present trend with the use of linear regression channels. The trend is now strong if they are both moving in the same direction.

Moving average line (settings 20.0, smoothed): This indicator identifies the current short-term trend and the trading direction.

Murray levels serve as the starting point for adjustments and movements.

Based on current volatility indicators, volatility levels (red lines) represent the expected price channel in which the pair will trade the following day.

A trend reversal in the opposite direction is imminent when the CCI indicator crosses into the overbought (above +250) or oversold (below -250) zones.