Analysis of GBP/USD 5M

GBP/USD traded positively on Wednesday. Volatility was low but comparatively higher than in the last few days. The pair managed to break through the range of 1.2691-1.2701, increasing the likelihood of moving towards the upper boundary of the sideways channel at 1.2786. The flat phase is still intact, but the way the British currency has been rising recently suggests that it is ready to start an upward trend.

We believe that the market has no particular reason to justify this movement. We have analyzed the fundamental and macroeconomic background in detail, and none of the factors supports the pound more than the dollar. Even yesterday, the U.S. released two relatively important reports. The ADP report showed that American businesses added 140,000 new jobs in February falling within the range of forecasts between 90,000 and 150,000. The value of the previous month was revised upwards. Job openings slipped to 8.863 million on the last day of January, against a forecast of 8.9 million. As we can see, the deviation is minimal, but the December value was revised downwards.

Let's say the data wasn't the best, but certainly not bad enough for the dollar to fall further. As for Federal Reserve Chief Jerome Powell, he told Congress that the U.S. central bank may keep the rate at its peak for longer, as there is no guarantee that inflation will return to 2%.

There was only one trading signal for the pound, but it was a very good one. At the beginning of the European session, the price bounced off the 1.2691-1.2701 range, so traders could open long positions. By the end of the day, the pair was up by 40 pips, which traders could earn by manually closing the trade. The pound may continue to rise up to the level of 1.2786

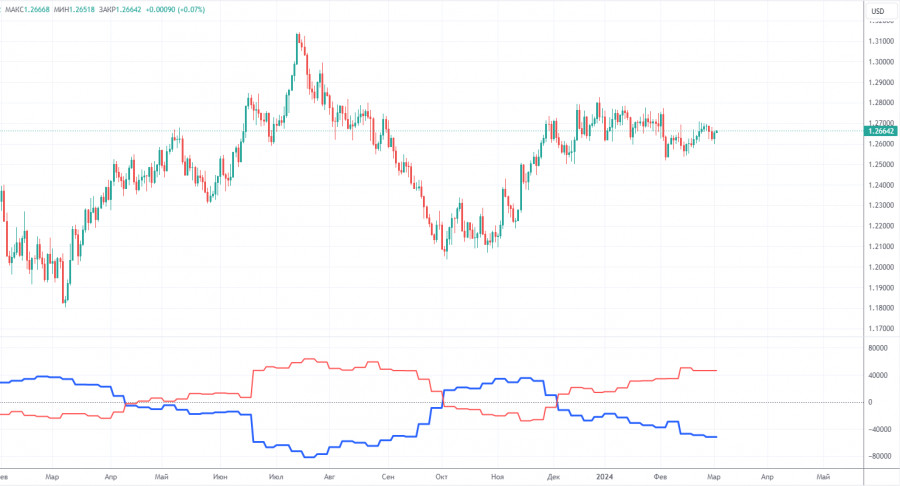

COT report:

COT reports on the British pound show that the sentiment of commercial traders has frequently changed in recent months. The red and blue lines, which represent the net positions of commercial and non-commercial traders, constantly intersect and, in most cases, remain close to the zero mark. According to the latest report on the British pound, the non-commercial group opened 4,400 buy contracts and 4,300 short ones. As a result, the net position of non-commercial traders increased by 100 contracts in a week. Despite the fact that the net position of speculators is growing, the fundamental background still does not provide a basis for long-term purchases of the pound sterling.

The non-commercial group currently has a total of 92,000 buy contracts and 45,600 sell contracts. The bulls have a big advantage. However, in recent months, we have repeatedly encountered the same situation: the net position either increases or decreases, the bulls or the bears either have the advantage. Since the COT reports do not provide an accurate forecast of the market's behavior at the moment, we have to scrutinize the technical picture and economic reports. The technical analysis suggests that there's a possibility that the pound could show a pronounced downward movement. The economic reports have also been significantly stronger in the United States than in the United Kingdom, but this has not benefited the dollar.

Analysis of GBP/USD 1H

On the 1H chart, GBP/USD left the sideways channel of 1.2611-1.2787 but is now trading within another sideways channel of 1.2605-1.2701. And despite all that, the flat remains intact, and market participants feel quite comfortable in this phase. The British pound is still a currency that tends to move sideways, trading in a somewhat illogical and confusing manner. If this week's U.S. macro data turns out to be even slightly weaker than expected, the pound may rise further.

As of March 7, we highlight the following important levels: 1.2215, 1.2269, 1.2349, 1.2429-1.2445, 1.2516, 1.2605-1.2620, 1.2691, 1.2786, 1.2863, 1.2981-1.2987. Senkou Span B (1.2643) and Kijun-sen (1.2680) lines can also serve as sources of signals. Don't forget to set a Stop Loss to breakeven if the price has moved in the intended direction by 20 pips. The Ichimoku indicator lines may move during the day, so this should be taken into account when determining trading signals.

There are no significant events or reports lined up in the UK. The U.S. docket will feature another speech from Powell and a secondary report on unemployment benefit claims. However, don't forget to take note of the European Central Bank meeting, which may trigger a reaction in the euro, and this could influence the British pound.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.