On the hourly chart, the GBP/USD pair on Tuesday managed to consolidate above the resistance zone of 1.2690–1.2705 once again. Thus, the upward movement may continue towards the next resistance zone of 1.2788–1.2801. The bears showed their weakness again this week. Even with a favorable informational background, they had no desire to build on their success after closing below the zone of 1.2690–1.2705.

The wave situation changed on Friday. The last upward wave broke the peak of June 4, and the new downward wave managed to break the low of the wave from June 10. Thus, the trend for the GBP/USD pair has shifted to "bearish." I am cautious about concluding that a "bearish" trend has started, as the bulls are still very strong. The emerging advantage of the bears can be easily nullified. The current upward wave may turn out to be corrective, after which a new downward wave will form, maintaining the "bearish" trend. However, the bears' advantage in the market at this time (if it exists at all) is very weak.

The informational background on Tuesday was weak. There were two reports in the US, one of which supported the dollar, and the other worked against it. This morning, a fairly important consumer price index for May was released in the UK. Despite the fact that the report's value matched traders' expectations and inflation fell to the Bank of England's target level, the bulls began to attack again. Everything should have been the opposite. A decrease in inflation to 2% allows the Bank of England to start easing monetary policy in the near future. Thus, the interest rate in Britain will begin to fall earlier than in the US, which should support the dollar. However, we still need to see the growth of the American currency. The bears cannot use even the positive informational background to their advantage.

On the 4-hour chart, the pair reversed in favor of the American currency and consolidated below the ascending trendline. Thus, the decline in quotes may continue towards the next level of 1.2620. A rebound from this level will allow the bears to take a small pause, while a consolidation below it will allow them to expect a further decline towards the next level of 1.2450. There are no emerging divergences in any indicator today.

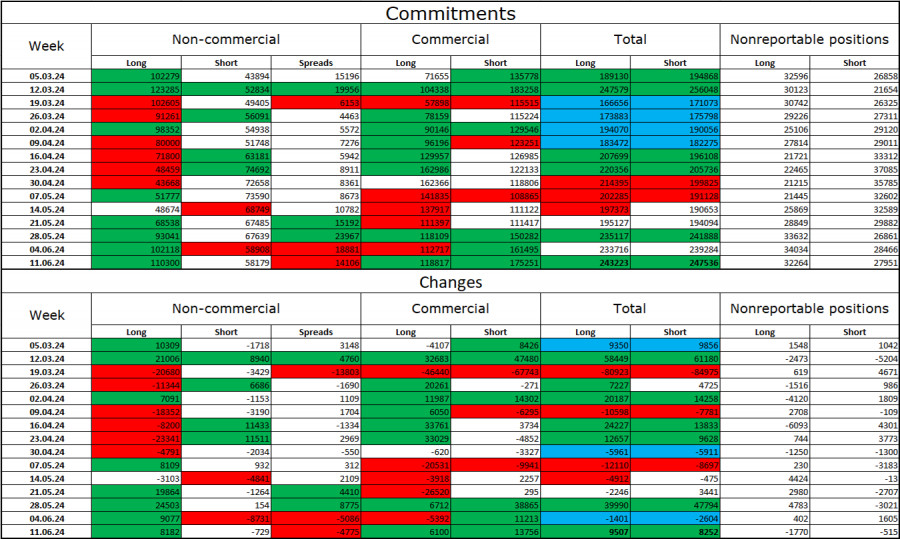

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category of traders became even more "bullish" over the last reporting week. The number of Long contracts held by speculators increased by 8,182 units, while the number of Short contracts decreased by 729 units. The bulls have a solid advantage again. The gap between the number of Long and Short contracts is 52,000: 110,000 versus 58,000.

However, the British pound still has excellent prospects for decline. Graphical analysis has issued several signals of a "bullish" trend breakdown, and the bulls cannot attack forever. Over the past three months, the number of Long contracts has increased from 102,000 to 110,000, while the number of Short contracts has grown from 44,000 to 58,000. Over time, major players will continue to shed Buy positions or increase Sell positions, as all possible factors for buying the British pound have already been worked out. However, the key factor this week will be the news background from the UK.

News Calendar for the US and UK:

UK – Consumer Price Index (06-00 UTC).

On Wednesday, the economic events calendar contains only one entry, which is already available to traders. The impact of the informational background on market sentiment may be moderate until the end of the day.

Forecast for GBP/USD and trading advice:

Selling the British pound will be possible again upon closing below the zone of 1.2788–1.2801 with a target of 1.2690–1.2705. Purchases could be made upon consolidation above the zone of 1.2690–1.2705 with the target zone of 1.2788–1.2801. Caution: the Bank of England meeting is tomorrow, and the pair's direction may change sharply.