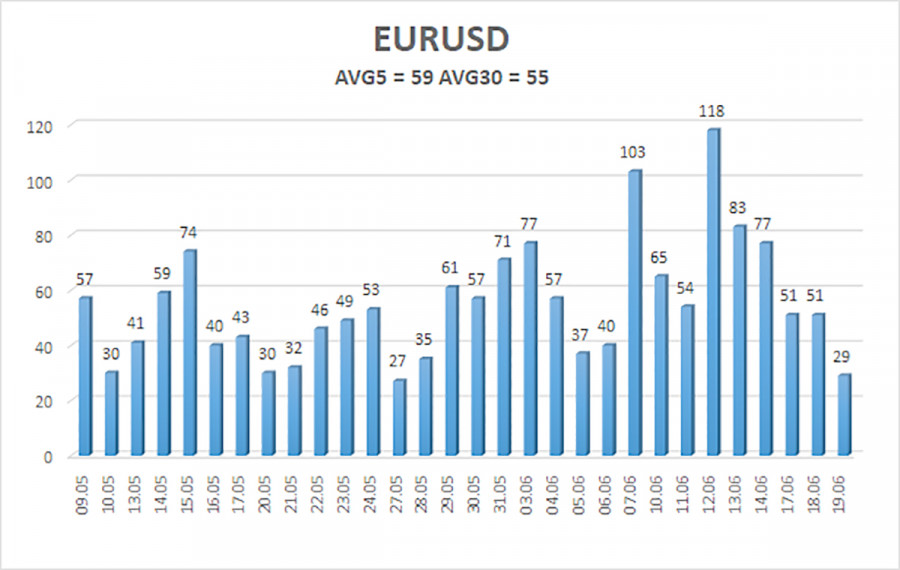

EUR/USD is gradually returning to the pattern it used to have two weeks ago and earlier. In the chart, we can see that the pair's volatility has been rising recently and currently stands at 76 pips, which is quite substantial for the euro. Prior to this period, we saw average volatility of about 50 pips over several months. However, the last few days have shown that everything is returning to its usual state, and the market is still not ready to become more active.

In general, the past two weeks can be considered pivotal for the EUR/USD pair. The price corrected higher for two months, leaving many questions unanswered. However, the global downward trend on the 24-hour timeframe has not changed. Moreover, the current fundamental backdrop does not suggest significant growth for the euro. There are undoubtedly many big players in the market who like to manipulate prices to gain profit. Therefore, from time to time, we observe movements that are very difficult to explain or even describe in words. However, the market cannot always move in an illogical manner; otherwise, technical and fundamental analysis would not be used at all.

Let's return to the pivotal moment. The European Central Bank became the first central bank among the "big three" to start its monetary easing cycle. At the beginning of the year, few believed in such an outcome. The market expected the Federal Reserve to start lowering rates first, but it was mistaken. We repeatedly said that without a slowdown in inflation, there would be no policy easing in the US, but the market (according to official analytics and forecasts) firmly believed in a rate cut in March. Perhaps it was just misinformation. Meanwhile, there is not even a hint of when the Fed might start lowering its rates. Some might think that it's finally in sight, considering that US inflation is not that high and has been slowing down over the past two months. However, let's recall that as recently as June 2023, inflation had dropped to 3%. Now it stands at 3.3%. So, over the course of a year, not only has it not decreased, but it has also accelerated.

Before dropping from 3.5% to 3.3%, it accelerated several times to 3.5% and 3.7%. In general, we are now seeing inflation flatlining within the 3.0-3.7% year-over-year range. Therefore, two months of a 0.1% inflation slowdown cannot imply a downward trend or signal an imminent Fed rate cut. That being so, the euro has no grounds for growth, just as it had none before.

Maybe some big market players don't want the dollar to rise. Perhaps someone doubts the American economy, which an army of analysts worldwide predicts will face a new financial crisis or default every year. However, we can't reject the fact that the dollar is still the world's reserve currency, and the US economy is the largest in the world. Therefore, the dollar simply cannot fall against the euro at this time if we are talking about logical and consistent movements, rather than market manipulation by big players.

The average volatility of the EUR/USD pair over the last five trading days as of June 20 is 59 pips, which is considered an average value. We expect the pair to move between the levels of 1.0688 and 1.0806 on Thursday. The higher linear regression channel has turned upwards, but the global downtrend remains intact. The CCI indicator entered the oversold area, but at this time we do not expect strong growth.

Nearest support levels:

S1 - 1.0681

S2 - 1.0620

S3 - 1.0559

Nearest resistance levels:

R1 - 1.0742

R2 - 1.0803

R3 - 1.0864

Trading Recommendations:

The EUR/USD pair maintains a global downtrend, and it continues to stay below the moving average on the 4-hour timeframe. In previous reviews, we said that we don't consider long positions and that we should wait for a continuation of the downtrend. At this time, short positions are still valid. The targets are 1.0620 and 1.0559. The rebound from 1.0681 triggered a bullish correction, but we expect it to end soon. We don't recommend buying the euro, as we believe that the global downtrend has resumed, and the single currency has no grounds for growth.

Explanation of the chart:

- Linear Regression Channels – Helps determine the current trend. If both are directed in the same direction, it means the trend is currently strong.

- Moving Average Line (settings 20.0, smoothed) – Determines the short-term trend and the direction in which trading should currently be conducted.

- Murray Levels – Target levels for movements and corrections.

- Volatility Levels (red lines) – The probable price channel in which the pair will spend the next day, based on current volatility indicators.

- CCI Indicator – Its entry into the oversold area (below -250) or the overbought area (above +250) means that a trend reversal in the opposite direction is imminent.