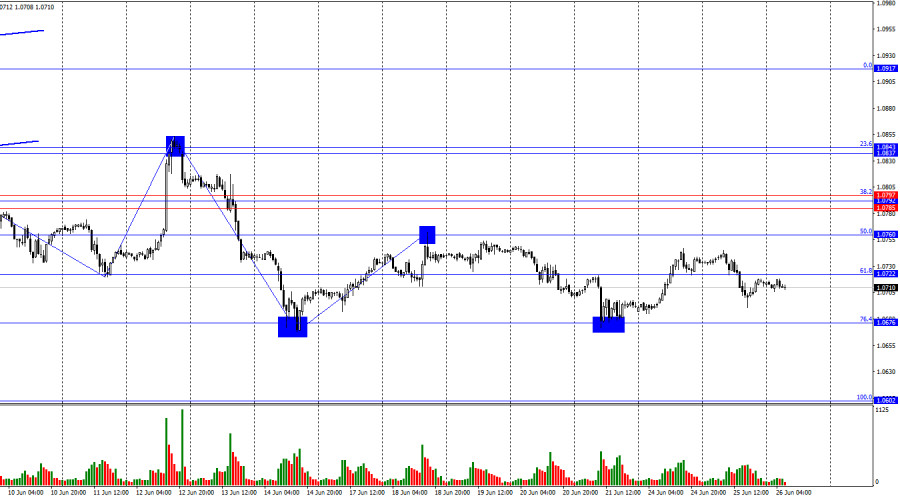

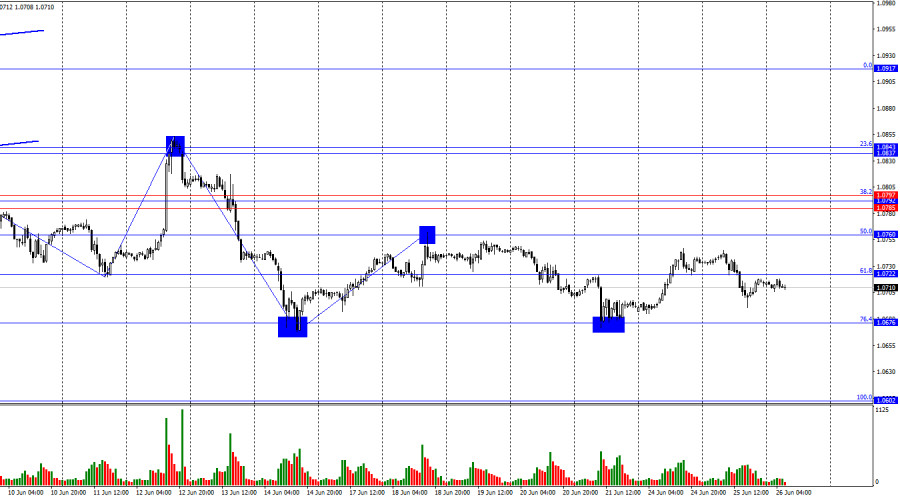

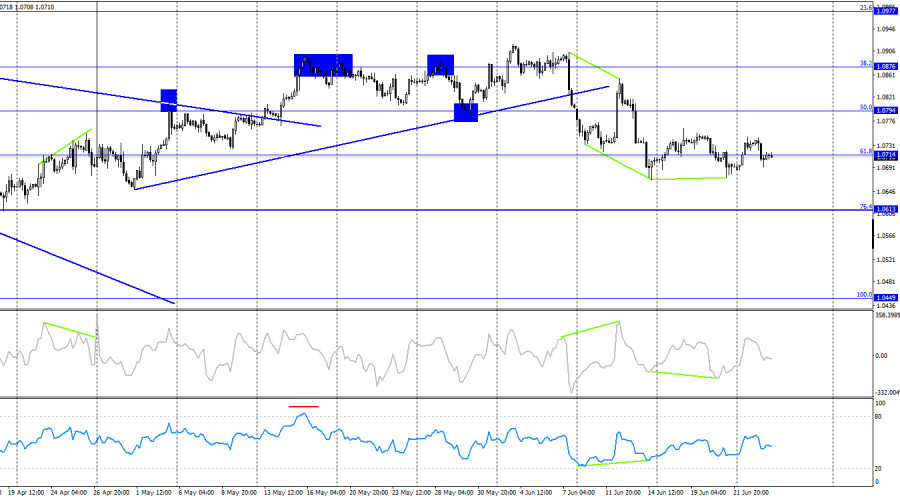

On Tuesday, the EUR/USD pair reversed in favor of the US dollar and consolidated below the 61.8% retracement level at 1.0722. Thus, the downward process may continue towards the next Fibonacci level of 76.4% at 1.0676. A rebound of the pair's rate from this level will be the third in a row and will allow for an expected new rise towards the 1.0722 level. Consolidation of the pair's rate below the 1.0676 level will indicate further decline towards the next corrective level of 100.0% at 1.0602.

The situation with waves remains clear. The latest completed upward wave was very weak and failed to break the peak of the previous wave. The last downward wave (which may not yet be complete) also failed to break the low of the previous wave. Thus, the "bearish" trend remains, but the first sign of a trend change to "bullish" could appear soon. This sign would be the break of the peak of the last upward wave from June 18. If this does not happen, I will expect a return to the level of 1.0676. At the same time, a break of the low from June 14 will maintain the "bearish" trend.

There was no informational background on Tuesday. The trend remains "bearish," and the peak from June 18 has not been updated. Everything indicates that the decline will continue, and it is only a matter of time before the bears consolidate below the 1.0676 level. This week, traders' activity is relatively weak, but now the bulls show no interest in attacks. Buyers could have used this week for a correction, but the correction occurred last Friday. As I mentioned, the peak from June 18 has not been broken, so the decline may continue. There are no significant events this week, as there are practically none. The only interesting report for me is the US GDP report, but even a weak value is unlikely to stop the bears. More significant factors are currently at play in the market.

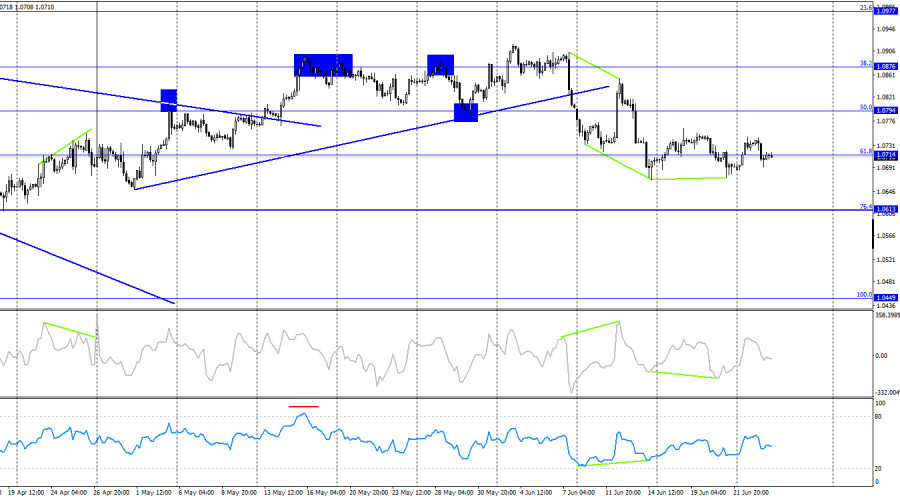

On the 4-hour chart, the pair made a new reversal in favor of the euro after forming a "bullish" divergence on the CCI indicator. Currently, the quotes have consolidated below the 61.8% Fibonacci level at 1.0714, which suggests further downside towards the corrective level of 76.4%-1.0613. Last week, on the 4-hour chart, there was a close below the trendline, shifting trader sentiment to "bearish."

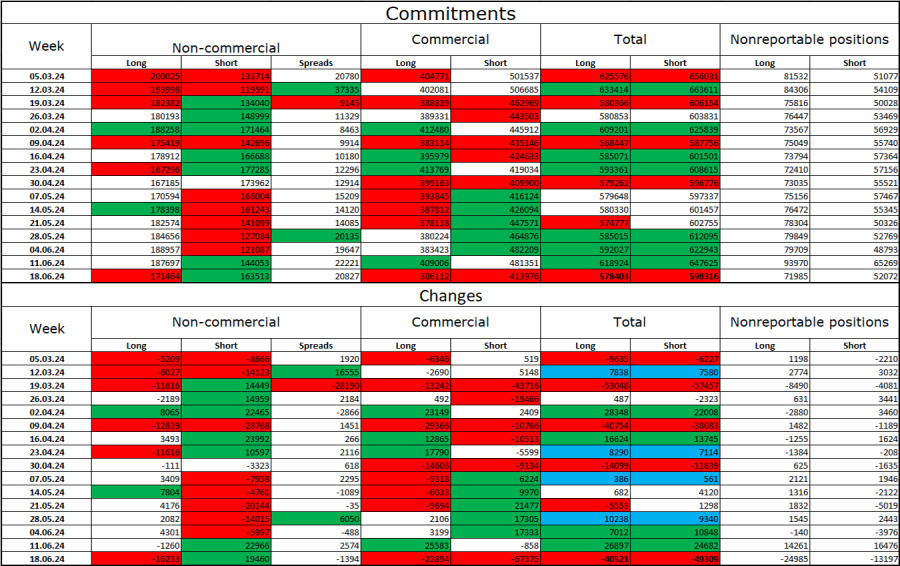

Commitments of Traders (COT) Report

During the last reporting week, speculators closed 16,233 long positions and opened 19,460 Short positions. The sentiment of the "Non-commercial" group shifted to "bearish" several weeks ago and is currently strengthening. The total number of Long positions held by speculators now stands at 171,000, while short positions amount to 163,000. The gap continues to narrow.

The situation will continue to favor the bears. I don't see long-term reasons to buy the euro, as the ECB has begun easing monetary policy, which will reduce the yields on bank deposits and government bonds. In America, on the other hand, they will remain high for several more months at least, making the dollar more attractive to investors. The potential for the euro to decline, even according to the COT reports, looks significant. If there is still bullish sentiment among major players now, and yet the euro is falling, where will the euro be when sentiment turns bearish?

Calendar of News for the USA and European Union:

USA – New Home Sales (14:00 UTC).

On June 26, the economic calendar includes only one minor event. The impact of the news background on traders' sentiment today will be very weak.

Forecast for EUR/USD and Trading Advice:

Sales of the pair were possible with consolidation below the level of 1.0722 on the hourly chart, targeting 1.0676. A consolidation below the level of 1.0676 will allow for continued selling with a target of 1.0602. Purchases of the euro were possible on the hourly chart on a rebound from the level of 1.0676 with targets at 1.0722 and 1.0760, but the pair did not reach the second target.

Fibonacci retracement levels are set at 1.0602–1.0917 on the hourly chart and at 1.0450–1.1139 on the 4-hour chart.